The Motley Fool spotlights three small caps to buy ahead of expected Fed rate cuts

Ahead of expected rate cuts, small-cap stocks have started to “show signs of life,” notes the Motley Fool. It suggests that if the Fed achieves a “soft landing” — that is, lowering rates while avoiding a recession — small caps could outperform large caps and offers three of the best small-cap stocks to gain exposure to the potential outperformance.

Magnite

Magnite is a company with a market capitalization of about $1.8 billion that specializes in digital advertising. In particular, the Motley Fool calls it a leader in video and internet-connected TV (CTV) advertising, with clients including Walt Disney, Fox, and Warner Bros. Discovery.

Even though the company’s growth has slowed amid the weakness in the streaming sector, it still has great potential, the Motley Fool argues. Since the beginning of the year, quotes on Magnite have risen more than 36%.

ACM Research

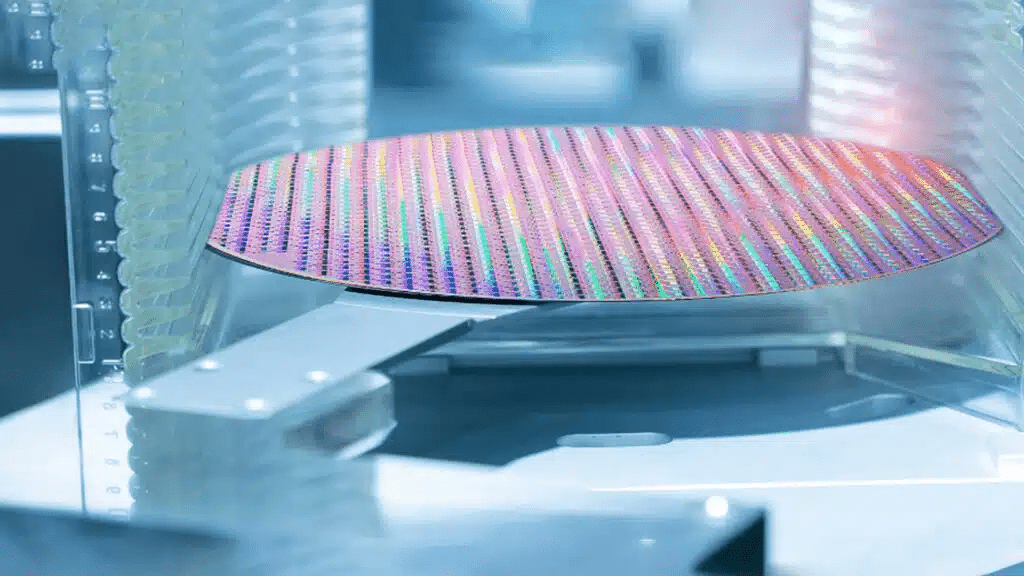

ACM Research, with a market capitalization of $1.25 billion, develops products that support multiple semiconductor processing steps, such as single-wafer cleaning, electroplating, and thermal deposition, among others. The Motley Fool argues that investing in ACM Research provides exposure to a high-growth industry without exposure to the risk of commodity chip prices declining. Additionally, most of the company’s business is concentrated in China, which the Motley Fool believes is a “relatively safe” way to gain exposure to the Chinese market.

ACM is a rare small cap with both high growth potential and solid profitability, adds the Motley Fool. Since the beginning of the year, the stock is up more than 7%.

Consolidated Water

Consolidated Water, with a market capitalization of almost $436 million, develops and operates water supply, water treatment and reuse plants, and water distribution systems. In recent years, it has outperformed industry peers, and the Motley Fool sees this continuing, arguing that the company’s specialization in desalination could become a “big trend” in coming years as global water supplies are stretched. Since the beginning of the year, Consolidated Water stock is off more than 22%.