13 waves of research: Key trends and factors related to consumer confidence in Kazakhstan

Kursiv Research researches customer confidence (CCI) regularly and publishes its surveys every month. The surveys are based on the methodology of United Research Technologies Group (URTG) and advanced methods of leading indicators.

We use telephone inquiry (CATI) to collect necessary data. In each monthly wave of CCI research, we interviewed 3,600 respondents aged above 18 in different regions and cities throughout the country. Our sampling represents different sexes, ages and regions.

This year, in addition to traditional monthly surveys, Kursiv Research summarized the results of 13 research waves identifying key trends and factors that affected customer sentiments among Kazakhstanis over the period from November 2022 to November 2023. We have also compared our results with official data.

How strong is the trend

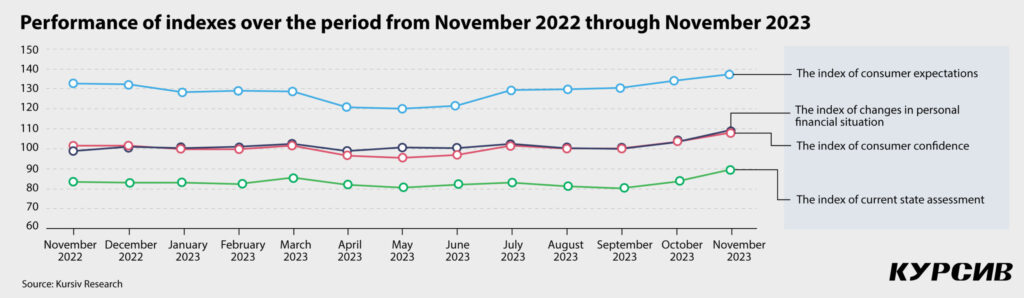

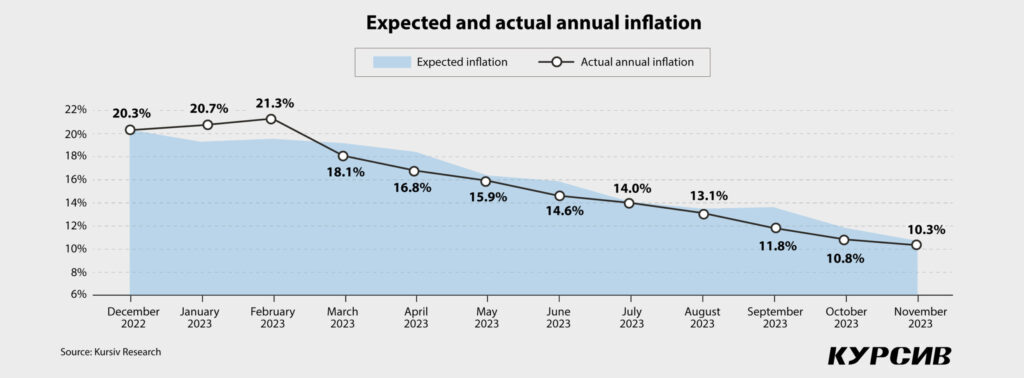

The customer confidence index was volatile in the reviewed period in reaction to the symptoms of inflation. For instance, during the first half of the period, the CCI declined from 95.7 points in May to 89.7 points. However, the index continuously grew after reaching that low point. In November, the CCI reached its highest point of 108.2 (100.5 points throughout the past 13 months on average). This means that in November, the index was 12.6 points higher than in May and 4.9 higher than in October. On the other hand, inflation was also rapidly growing during this period, showing in February 2023 the second highest growth rate (21.3%) since the turbulent 1990s, although that rate declined twofold in November (10.3%).

More generally, the rebounding of the index during the past six months correlated with the relatively positive macroeconomic situation in the country. For instance, the base rate and the volatility rate of the national currency were both declining along with the inflationary pressure. The statistical data also shows that the labor market is doing quite well, even though structural problems such as a decline in earnings and gradually increasing poverty are still there. This indicates that the vast majority of people in Kazakhstan still either depend on debt or switch to more frugal lifestyles. Although inflation has declined, according to official data, it is still indirectly affecting consumer sentiments, because an average citizen in Kazakhstan considers purchasing many goods and services less necessary than food staples and continues going by a different trajectory compared to expected inflation. In addition, the monthly inflation rate in November was the highest over the past nine months (1% versus 0.6% to 0.9%) driven by utility price increases (+16.1% for heat and +8.1% for hot water).

It is worth noting that despite quite a positive dynamic of the CCI over the past months, during 13 waves of our research, we noticed that respondents showed concern over some economic factors. This means that sometimes the correlation between statistics and the CCI itself isn’t obvious all the time. See details below.

The trend of postponed optimism

The subindexes of current state assessment and future expectations have shown positive dynamics at the expense of nearly all of their constituents. However, the current state assessment is traditionally in the red zone (below 100 points), although it hit the maximum of 89.7 points (+6.3). The subindex has experienced pressure from factors such as «favorable conditions for major purchases» (74.3 points) and perception of «the current economic situation in the country» (85.4 points). Both factors were quite low throughout the year. At the same time, expectations were positive as usual with the maximum rate in November 2023 (137.2 points or +3.1 month-on-month). This optimism is likely driven by the economic situation in the country both long-term (139.6) and short-term (136.2). Expectations concerning «personal financial situation» are a bit lower (135.9).

In other words, we can say that the monitoring of consumer sentiments over the past 13 months has identified the presence of deferred optimism, although assessments of the current situation were quite pessimistic (below 100). This dynamic may indicate a sort of psychological aspect and even cognitive dissonance in the perception of information, which is also common for many other markets all over the world, according to similar surveys by global research groups.

СCI from the perspectives of gender, age and regions

In terms of gender, women showed a little bit less optimism than men: 100.2 points of the CCI for females versus 100.9 for males. Women were also more concerned about the current economic situation (81.3 vs 85.1 for men). At the same time, women are more prone to believe in a better future (the subindex of consumer expectations: 130.9 vs 126.5 for men). Another trend is a rapid rebounding of confidence among women starting from November 2022 (CCI: +8.3 to 108.2 vs +4.7 to 108.3 for men). In other words, despite being more sensitive in terms of customer behavior, women turned out to be more resilient to economic shocks and shocks to personal financial status.

Men are probably more optimistic due to historically higher median wages compared to women. According to the Bureau of National Statistics (BNS), this rate was 9% and 17% higher for men in 2022 and over the first six months of 2023, respectively. This disproportion in wages also correlated with men being less concerned about unemployment throughout the year. For instance, the unemployment index for men declined from just 80.4 to 76.1 (-4.3 points) over the 13 months of research, while women reported a decline from 79.3 to 74.1 (-5.2 points).

In terms of different ages, people aged between 18 to 29 demonstrated the highest rate of confidence at 116.8 points. People aged 30 to 40 were also quite confident despite the gap (102.1). On the other hand, people aged 60 and above are much more skeptical about what is going on in the economy now, although their confidence has grown by 9 points and reached 95.2. Even though it is still below the critical mark of 100 points, the increase in confidence for the elderly is higher than in other age groups (+5.9 points on average).

Different regions have also shown different performances over the reviewed period. From April to June, most regions reported a sharp decline in optimism. The most optimistic regions in terms of the CCI (105.9 to 109.8 points) over the reviewed 13 months were the Atyrau region, the Turkestan region, the city of Shymkent and the Kyzylorda region.

On the other hand, residents of the East Kazakhstan, Karaganda, Pavlodar, North Kazakhstan and Kostanay regions reported the highest level of pessimism (89 to 96 points). The region of Atyrau was quite interesting because of the highest monthly volatility in the rate (-15.3 points in November 2023 year-on-year) and the highest average CCI rate among all regions (109.8). The Jetisu region demonstrated the best performance (+18.4 points) with an average rate of 100.1 points.

Interestingly, macroeconomic indicators such as gross regional product (GRP) and average wage (AW) could explain just half of the respondent’s answers with a subtle dominance of positive correlation between CCI and GRP rather than CCI and AW. Of course, there are some exceptions. For example, the Atyrau region has proven its leadership in terms of all three indicators (GRP, AW and CCI), followed by the Abay and Akmola regions.

Residents of urban and rural areas reported different perceptions of the economic situation in the country. For example, residents of big cities turned out to be more pessimistic compared to residents of rural areas (CCI: 98.9 vs 103 for people in rural areas over 13 waves of research on average). Also, they reported a negative impact of the current economic situation earlier (in April, -5.9 points month-on-month to 93.9), while people in rural areas did so in May (-5.1 points to 95.4). Moreover, villagers were faster in terms of rebounding from that decline. In November, their CCI reached 110.6 (+15.2 points compared to the decline in May) versus 106.6 for townspeople (+12.7 points compared to April).

Being desperate for money

Even though many respondents surveyed in the second half of 2023 often said that nothing was worrying them (26% of respondents on average), both economic (29%) and non-economic problems (31%) bothered Kazakhstanis. For instance, the vast majority of respondents said that financial difficulties such as «lack of money, debt, credits and low wages and scholarships» were the key factors affecting their consumer confidence (19%). Inflation, price and tariff increase were ranked second (8.4%). At the same time, the correlation between the answers «nothing worried» and «financial difficulties» was a bit stronger than the correlation with «inflation.» By the end of 2023, the financial and inflationary pressure on consumer confidence was a bit lower. Among other topics important for respondents were: family and health (15% combined) and job, business and study (6% combined).

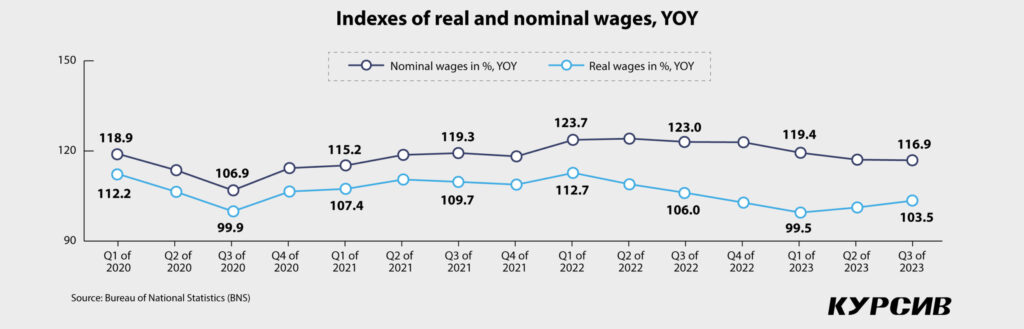

Official data has also confirmed these sentiments. For instance, over the reviewed period (November 2022 to November 2023), the nominal wage index was declining and by the end of the period was lower than in Q1 of 2021. The situation was worsened by inflation, causing a big difference between the nominal and real earnings of the people in Q4 of 2022 and Q1 of 2023. Despite lowering inflationary pressure, this difference is still above the longstanding historic rate.

The past and future 12 months: inflation sentiment

Perception of inflation by the population followed the decline in inflation reported by official statistics. In September, the gap between these two trends was the biggest before decreasing over October and November.

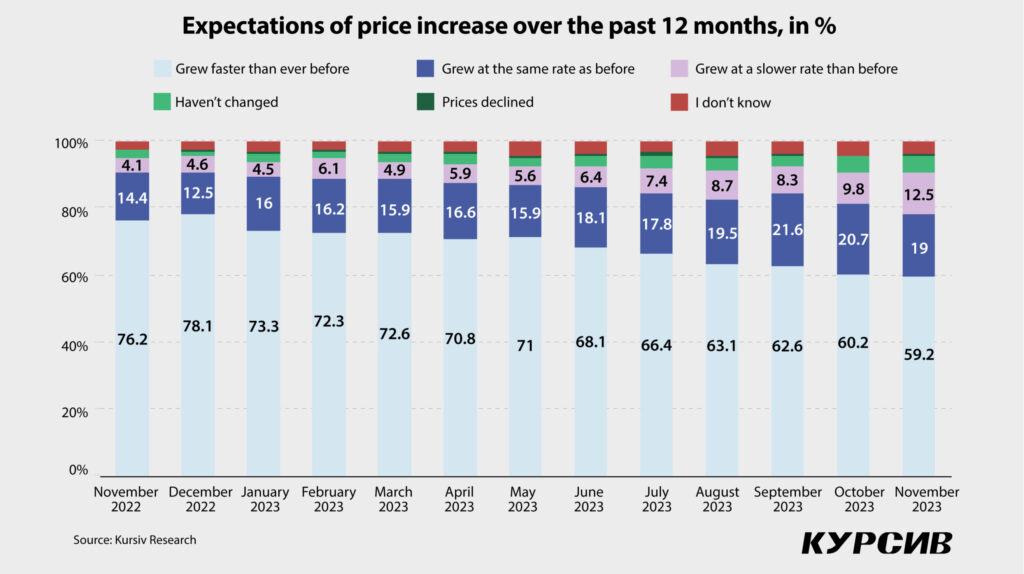

Over the reported period, most respondents (+/-93%) reported a price surge. By November, their perception slightly improved (91%). Even the very structure of their answers improved. For instance, there was a decline in the share of those who believed that prices increased faster than before (by -17.1 p.p. per year to 59.2%), while the number of those who believe that «price increase was as usual» has grown (19%, +4.6 p.p.), along with «price increase was slower than before» (12.5%, +8.4 p.p.) and prices «haven’t changed» (4.8%, +2.1 p.p.). The share of those who said that prices declined has changed (0.8%). At the same time, December 2022 was when the respondents were sensitive to fast price surges the most (78% of respondents).

Women (72.6% over 13 waves of research on average), people aged 30 to 59 (70.9%), townspeople (70.9%), mostly in the East Kazakhstan (75.1%), Pavlodar (74.1%) and Karaganda (72.8%) regions as well as residents of Astana (73.3%) and Almaty (72.7%) were the most sensitive to the rapid price surge.

In terms of assessment of their financial situation, almost all categories of respondents reported less pressure from fast price surges, excluding those who already had higher earnings. For instance, in the category of those who can easily purchase expensive goods (car, apartment, summer cottage, etc.) the number of respondents who noticed a price surge increased by November 2022 by +7 p.p. YOY to 49.1%. On the other hand, people with lower income reported a weakening of such pressure (-16.5 p.p. on average), although their share is still big: 68.4% reported difficulties with buying food products, 64.1% with clothes, 61.2% with durable goods and 54% with major purchases. In other words, we are observing a bit higher sensitivity at two endpoints: purchasing food products (the majority of answers) and expensive goods (noticeable annual increase).

In the third quarter of this year, the share of the population with income below the poverty level amounted to 5.6% (1.11 million people), according to the BNS. This is one of the historical records over the past almost 13 years, with the greatest comparability to Q2 to Q3 of 2020 (5.7% or 1.06 million people).

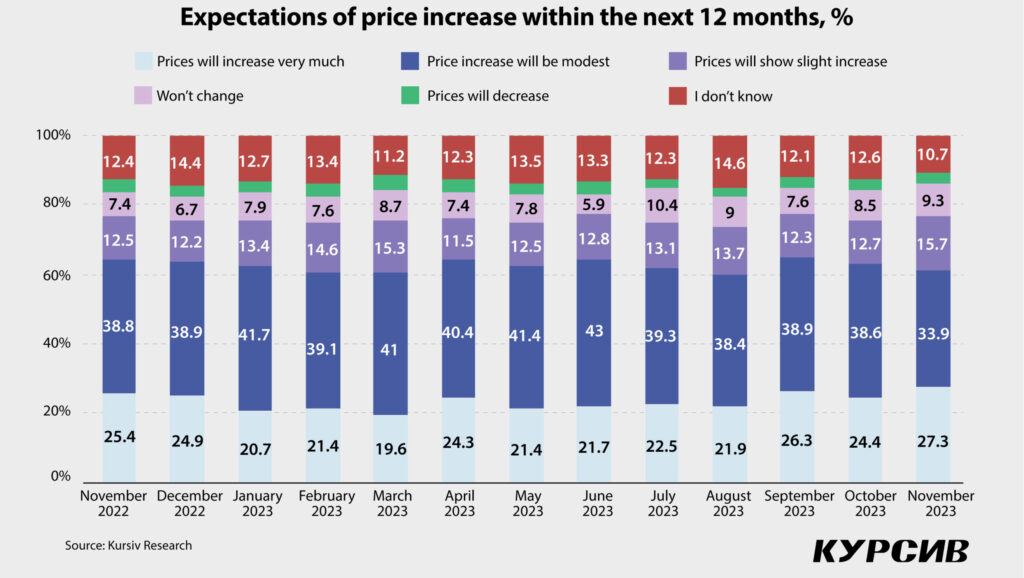

Despite the unfavorable perception of the current situation, expectations for the next 12 months look better: about 76% expect some kind of price increase versus 91% who already reported a price increase in the previous 12 months. Three variants of answers were most popular: growth will be the same as now (November 2023: 33.9% with a 4.9 p.p. decrease over 13 periods); the growth will be faster (27.3% or +1.8 p.p.) and the growth will be slower (15.7% or +3.3 p.p.).

Interestingly, the opinions of the respondents were more optimistic than the outlook for inflation by the National Bank of Kazakhstan published in November. The regulator expected 9.3% to 10.3% inflation for 2023 and 7.5% to 9.5% for 2024.

Customers’ perceptions

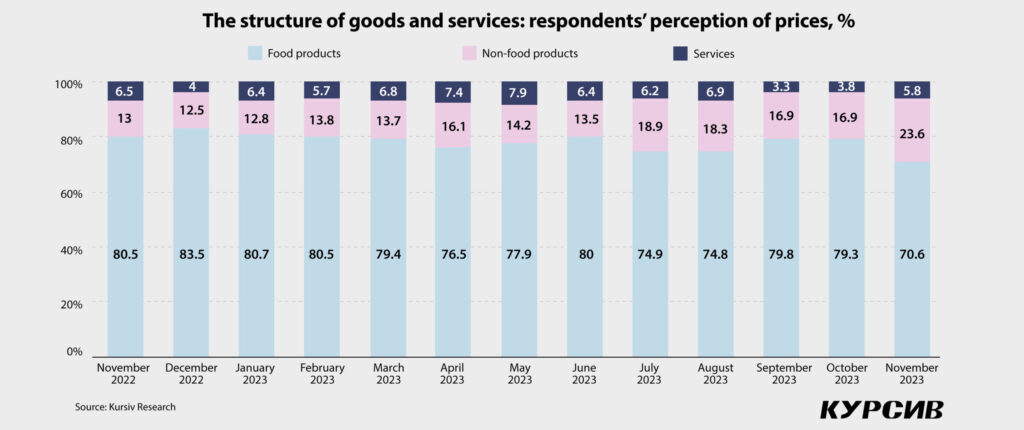

Customers’ perception of price increases for specific goods and services hasn’t changed dramatically throughout all 13 waves of research. More often, people talked about food products (in 78% of cases on average), non-food products (16%) and services (6%). At the same time, while shares of food products and services declined (-10 p.p. and -1 p.p., respectively) in November year-on-year, the share of non-food products increased by 11 p.p.

Please note that unlike official statistics, the survey covers goods and services, which became expensive faster.

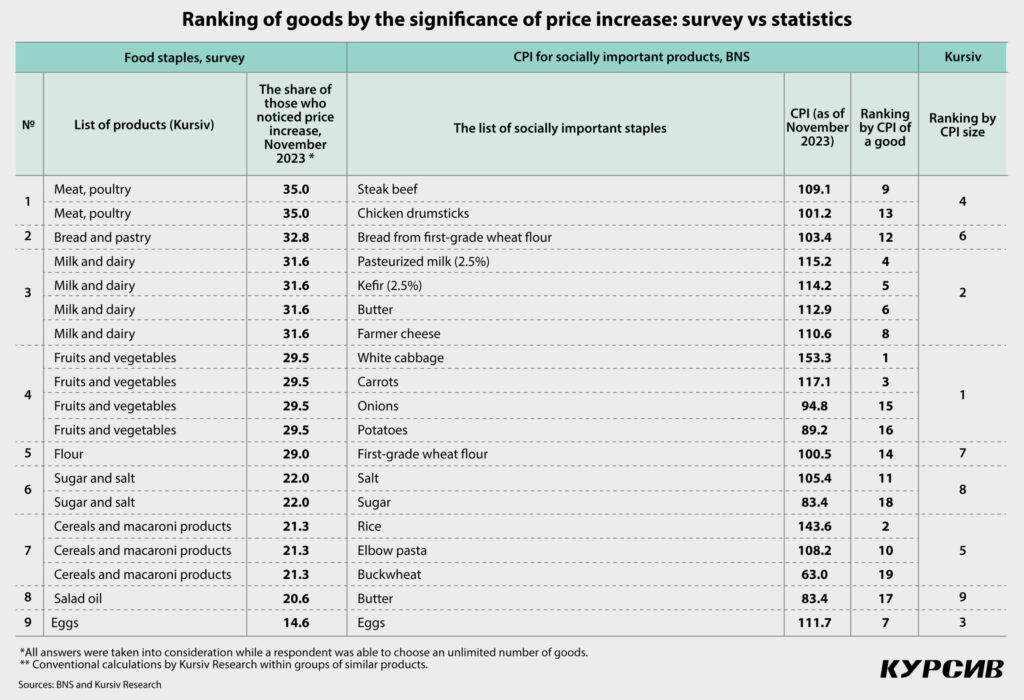

Thus, although the data formats aren’t comparable, it is still possible to conduct a comparative analysis of which products were among the «leaders» in terms of price increase by statistics and public opinion. At the same time, in the context of food products, respondents more often talked about products that are one way or another included in the list of socially important staples, while others (such as alcoholic and non-alcoholic beverages, fish and seafood) were mentioned less frequently. Also, survey data most likely represents a combination of prices and consumption volumes (the importance of expenses relative to income), while the list of socially important staples we use for comparison shows only prices without indicating the importance of an item in people’s diet.

The socially important food products were grouped and ranked according to the average value in the group (the last column of the corresponding table). Thus, we observe the similarity in terms of the significance of price increases only in dairy products in Group No. 3. At the same time, the difference between «meat and poultry» and «vegetables» (especially cabbage and carrots) is quite noticeable, according to the statistics.

Respondents’ sensitivity to prices for sugar and salt dropped significantly by the end of the year (-27 p.p. in November 2023 to November 2022), as well as for vegetable oil, bread/bakery products, cereals/pasta and eggs (-12 p.p. on average). Also, respondents reported slightly less price pressure for dairy and meat products and flour (-7 p.p. each on average), although these staples still play a crucial role in purchases. The smallest change was observed in the segment of fruits and vegetables.

Concerning non-food products, respondents were most concerned about household chemicals, cleaning agents and detergents (12.5% per annum on average), clothing and footwear (9.6%), as well as gasoline, fuel and lubricants (9.5%). The latter indicator rose in April by 18.2%, a more than 3.5-fold increase in sensitivity of price growth and then dropped again, showing an almost two-fold reduction. In terms of services, respondents noted housing and communal services (9.7%), which rose to their highest levels in August (up to 12.8%), followed by internet/mobile communications and household services (3.7% each).

Reflecting on the dollar exchange rate

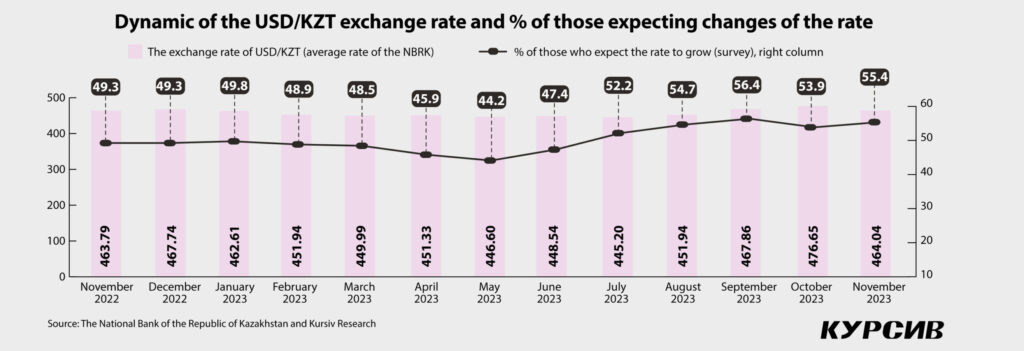

Various economic factors badly affected people’s expectations regarding changes in the USD/KZT exchange rate over 12 months of 2023. Respondents’ concerns outpaced actual changes in the exchange rate. Thus, the share of respondents expecting the depreciation of the national currency increased by November 2023 to 55.4% (+6.2 p.p. YOY), while an average annual rate was at 50.4%. The maximum rate was reported in September (56.4%) when the official USD/KZT exchange rate (monthly average for the National Bank of Kazakhstan) showed the largest increase for the entire year (+3.5% month-on-month). At the same time, the October depreciation of the national currency (+1.8% month-on-month), which led to an increase in the exchange rate to an annual maximum (476.65 USD/KZT) didn’t have such a significant impact on the population’s perception, since depreciation shocks had already occurred.

The shares of those who believe that the exchange rate will remain at the same level and those who found it difficult to answer were distributed almost equally (20% to 21% each). Only 9% said that they expected the national currency to become stronger.

The most sensitive to unfavorable fluctuations in exchange rates were men, young people, urban residents and those who found it difficult to make major purchases, such as a car and/or an apartment. This information has been confirmed by the higher positive correlation between the expected depreciation of the national currency and the sensitivity of respondents to changes in prices specifically for non-food products, which in the survey include major purchases (0.66 coefficient). At the same time, the relationship with the actual change in the national currency exchange rate looks more moderate (0.51). The average between them is the correlation with the real income index (0.62).

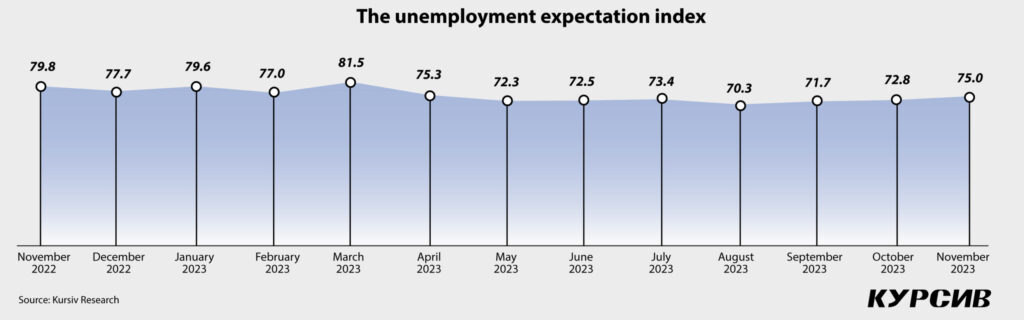

Unemployment expectation index

Over the year, concerns about unemployment increased, which shifted the index to 75% (-4.8 points) by the end of the reviewed period with an average of 75.3% over 13 waves of research. At the same time, November was marked by the restoration of public confidence in economic conditions after six months of decline, bringing the index closer to the level of April (+2.2 points month-on-month). Please note, the lower the index value, the higher the respondents’ concerns about employment.

The majority of respondents expected an increase in the unemployment rate throughout the study with an increase of +1.9 percentage points over the 13 study periods to 40.3% in November. The number of those who believe that the unemployment rate will remain at the same level increased by +2.1 p.p. to 37.2%. The number of those expecting a reduction and those who found it difficult to answer declined to 15.3% (-2.8 p.p.) and 7.2% (-1.3 p.p.), respectively.

Respondents most concerned about unemployment issues and the actual registered unemployed were mainly urban residents and people aged 45 to 49 years. In particular, the survey revealed (based on dominant features observed throughout 13 waves of research) that these are city residents aged 45 to 49 years. The gender ratio was approximately equal, although women demonstrated greater anxiety throughout the year. The Atyrau and West Kazakhstan regions as well as the city of Almaty reported the highest rate of anxiety. For comparison: a conditional portrait of the officially unemployed (also based on the dominant feature in each category) is a woman aged 35 to 44 living in a city.

Please note that the respondents’ concern about unemployment doesn’t indicate the fact of unemployment. In other words, respondents could either lose their jobs or continue to work while being concerned about the future. Nevertheless, the unemployment index is an important barometer indicating a possible decline in the standards of living in the country that can further weaken effective demand in the short and medium term.

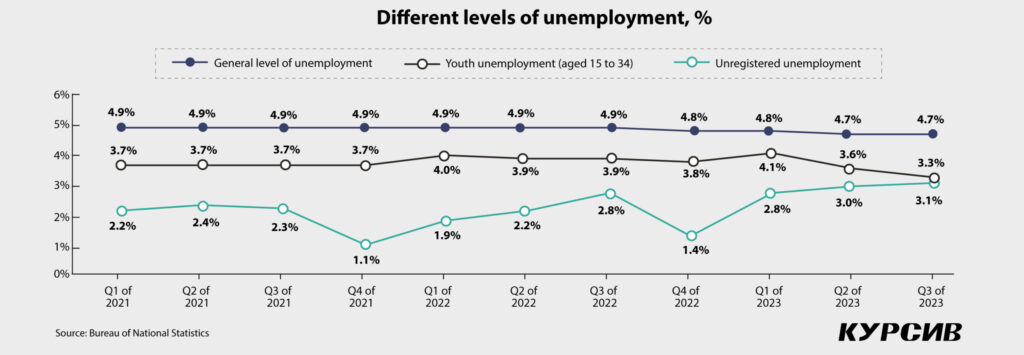

The country’s overall unemployment rate hasn’t changed much over the past few years. Since January 2018, it’s been at 4.8%. However, starting from the end of 2022, a downward trend has been observed. For instance, the rate dropped from 4.9%, a level established during the COVID pandemic, to 4.8% and then to 4.7% after Q2 of 2023. At the same time, the official unemployment rate (based on the number of people applying for jobs at employment agencies) increased, which correlates with increased anxiety among Kursiv respondents: by the end of September, the rate reached 3.1%. It is worth noting that the level of youth (15 to 34 years old) unemployment dropped to the lowest level over the past three years (3.6%), according to official statistics. This survey also revealed that older respondents (aged 45 to 59 years old) experienced more anxiety.

The multidirectional dynamics of statistical data may indicate an increase in the official registration of self-employed and micro-business workers, which affects the decrease in the overall unemployment rate. On the other hand, there is an increasing tendency among the unemployed population to obtain official unemployed status, which leads to an increase in the level of registered unemployment.

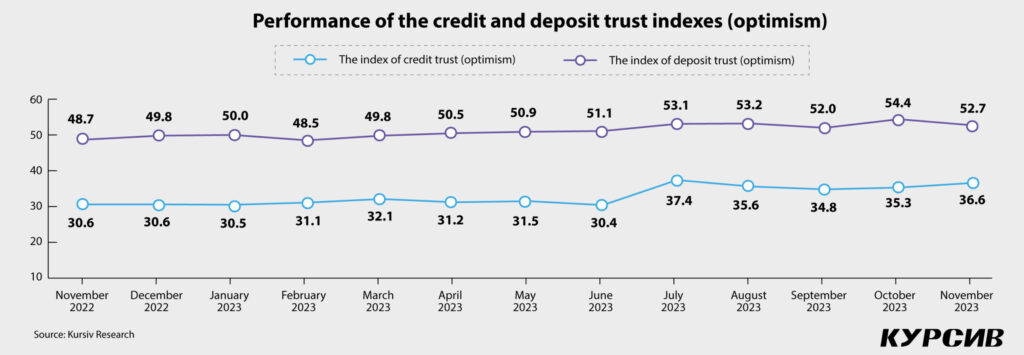

Making the right decisions: loans vs deposits

The methodology for calculating credit and deposit trust indexes was updated in July 2023. A neutral answer option was added, which accounted for 25% in terms of confidence in loans and 29% in terms of deposits. Given that many of those who had previously chosen the answer «rather bad» switched to neutral sentiment, this shifted the value of the indexes toward a positive trend, as can be seen in the corresponding chart.

Over the period from July to November 2023, when the methodology was updated, both indexes demonstrated multidirectional dynamics with an overall slight decline. At the same time, in November, credit confidence was slightly above the average for the period (36.6% versus 35.9%). Deposit confidence, on the contrary, was below average (52.7% versus 53%).

In terms of the credit confidence index, 50.2% of respondents were negative toward loans, while only 15% were positive and 10% found it difficult to answer.

This picture was quite different for the deposit trust index. The difference between positive, neutral and negative responses over the reviewed period wasn’t big: 33.5%, 29% and 26%, respectively. This data may indicate a fairly high need for living money at a certain point in time or a lack of extra money for savings.

Also, starting in July, the study included measuring plans for the next 12 months regarding purchases on credit or obtaining a loan. These results demonstrate a constant dominance of a negative answer: more than 78% on average over the period. There were less than 20% of respondents who planned to take a loan. The share of those who were unsure about loans reached 2.5%. At the same time, over the past two months, the share of those who didn’t plan to take a loan declined to 75.8%.

Respondents with the highest credit confidence within each sample category (over five waves of research on average: 35.9 points) are women, youth, rural residents and those who can easily buy quite expensive things. In terms of regions, these are the Turkestan, North Kazakhstan and West Kazakhstan regions. Categories with the least credit trust are men, the elderly and urban residents mainly in the Abay and Zhetysu regions and the city of Almaty.

Among those who have no plans for loans and purchases on credit in the next 12 months (77.8% on average) are women, the elderly, urban residents and those who most often answer that «there is not enough money even for food.» In terms of regions, these are the Kostanay, Akmola and Abay regions.

Those wishing to take a loan or buy something on credit (19.7% on average) are men, people aged 30 to 44 years, rural residents and those who can purchase durable goods but find it difficult to purchase expensive items. In terms of regions, these are the Turkestan, Kyzylorda and Jambyl regions.

Among those who have the highest deposit trust (53 on average) are women, young people, urban residents and those who can easily buy expensive things. In terms of regions, these are the Atyrau, Mangistau and Ulytau regions. The group of people with the least trust includes men, people aged 45 to 59 years and rural residents. In terms of regions, these are the Zhetysu, Turkestan and Abay regions.

Please note that the very fact of trust does not confirm that people took out loans or opened deposits, although it indicates a high probability that this happened in the past, with a high proportion of positive experiences. It also indicates a certain tendency to do this in the future.

Thus, throughout the study, respondents have shown a greater tendency (including believing that this is more rational) to save money rather than obtain loans. However, despite a slight strengthening of the trend associated with a favorable attitude toward saving money, the number of those eager to take out a loan started increasing in mid-autumn, driven by the seasonal factor and deferred purchases (related to durable goods), including customers’ expectations of prices increasing in January 2024.

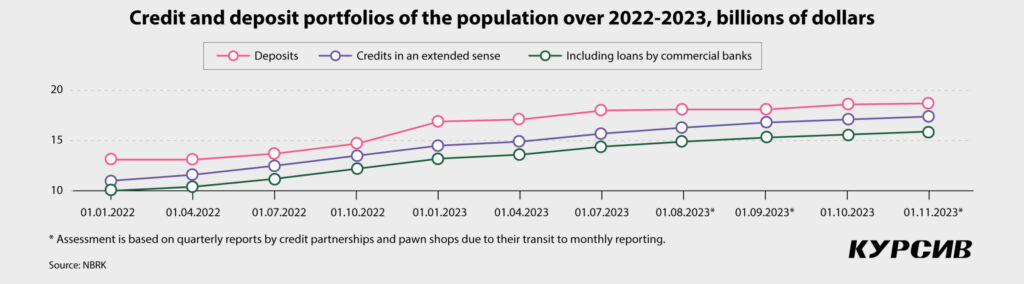

According to the National Bank, both indicators showed quite active dynamics. As of November 1, 2023, in terms of loans (banks, microfinance organizations, credit partnerships and pawn shops), the indicator grew by 29% and reached $38 billion and by 28% to $40.9 billion for deposits. Even though another increase in the base rate at the end of 2022 slowed down the pace of loan issuance in subsequent months, their pace still outpaced deposits throughout 2023. When comparing the average quarterly dynamics between 2022 and 2023, we observe a relatively similar change in loans ($1.9 billion in 2022 versus $1.8 billion in Q3 of 2023), including an increase in the number of loans issued by commercial banks ($1.709 billion vs $1.775 billion), with a simultaneous decrease in deposits ($2.1 billion vs $1.2 billion). Household savings grew significantly in Q4 of 2022 (+15.3%) and then began to increase moderately, with surges at the end of each quarter.

According to the Agency for Regulation and Development of the Financial Market, about 1.5 million Kazakhstanis have overdue debt (over 90 days) to banks, microfinance organizations and collection agencies. In turn, the National Bank of Kazakhstan estimated overdue debt at 2.5%, a slight decline compared to previous months with the 2.8% rate on average. At the same time, publicly available reports by financial organizations do not reveal all the details, including the debt transferred by banks and microfinance organizations to collectors, as well as the results of collection agencies’ work.

Thus, we observe a similarity in the ratio in each pair (within confidence indexes and portfolios): deposits exceed loans. However, actual statistics indicate an acceleration in lending compared to savings, which correlates with the answers of respondents, noting an increase in the need for borrowed funds.

Under the pressure of anxiety

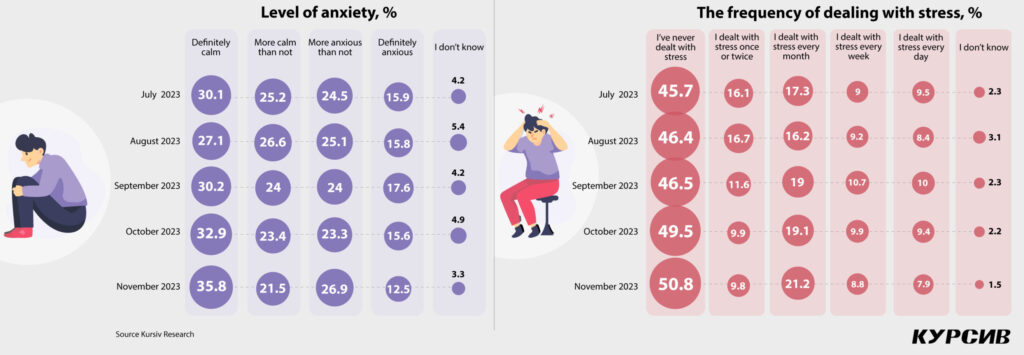

We started to measure anxiety and the frequency of encounters with stress in July 2023. Since then, the share of respondents assessing their mood as «definitely calm» has increased significantly (+5.7 p.p. to 35.8% in November), although this group was initially dominant. On the other hand, the number of those who said that they were «rather annoyed» has also increased (+2.3 p.p. to 26.9%), and this is the second largest group.

Despite these dynamics, which generally look positive, please note that the measurements were carried out in the second half of the year. As we mentioned before, this was a period when consumer confidence was rebounding after a decline over April-June, following shocks of the COVID-19 pandemic and geopolitical events that occurred in 2022. Against the backdrop of these events, price increases weren’t as depressing. However, since inflationary pressures and financial difficulties are important elements of living standards, respondents often cited them as the most unfavorable factors reducing their consumer confidence.

Interestingly, the most anxious group of respondents were those who experienced the least amount of stress, namely women and the elderly. At the same time, city dwellers are more anxious and stressed, just like residents of the Ulytau and East Kazakhstan regions. The most stress-resistant people live in the Atyrau and Kyzylorda regions.

Conclusions

An analysis of 13 waves of research demonstrates that the consumer confidence index (CCI) turned out to be quite sensitive to events occurring in the economy. As a result, this indicator turned out to be one of the most important tools for monitoring the macroeconomic situation in the country. At the same time, external events worried respondents less and didn’t influence their daily decision-making. (We do not consider the indirect impact of imported inflation through food and non-food products, since these factors are not directly related to the CCI survey.)

A detailed examination of the respondents’ answers has placed a spotlight on existing problems related to income, the availability of sufficient free funds at their disposal, concerns about employment and unemployment, the weakening of the tenge exchange rate and the deterioration of the quality of life. Other topics of concern to citizens include personal and household issues, including education and health, which also have an indirect impact on the economic efficiency of consumers.

The dynamics of responses also demonstrate that respondents from a certain point, namely after the shock of late 2022 and early 2023, began to get used to higher prices and generally turbulent realities in the economy, politics, ecology and infrastructure, without lowering their assessment of «no worries» and «definitely calm» below a certain level (30% to 45%).

However, the picture of statistically significant figures is overshadowed by the negative dynamics shown by the most vulnerable segments of the population (the elderly, people with low incomes and economically underdeveloped regions). And this negative trend affected almost all the factors that shape their consumer confidence.

Keeping the aforementioned factors in mind, we can’t give any positive assessment of economic events in the past 12 months. The period from November 2022 to November 2023 turned out to be truly turbulent with all the ensuing consequences, which likely will still appear in 2024. In addition, the situation is expected to worsen when state policy toward socially important products changes. Starting from July 2024, prices for nine goods out of 19 will change upward, while the remaining products will get more expensive later. Prices for utility services, fuel and lubricants will also go up, not to mention inflation of other goods and services against the backdrop of falling household incomes.

This means that the transition to a new year is accompanied by a high risk of worsening structural issues related to the standard of living within the country. The situation can only be improved by a set of measures associated with competent government regulation and effective actions of the economic entities themselves (financial institutions, businesses and consumers). However, even with the simultaneous implementation of the most successful measures by all subjects, it will happen only in the mid-term future, taking into account the structural imbalances existing in the country’s economy.