Sidus Space stock soars following news of joint venture in the Middle East

Satellite company Sidus Space saw its stock rise by nearly 6% on Tuesday, June 25th, after announcing its entry into the Middle East market and the formation of a joint venture with local service company NamaSys Bahrain.

Details

Sidus Space’s shares increased by 5.72% on Nasdaq on Tuesday, June 25th, closing at $2.59. After-hours trading saw an additional 7.8% rise to $2.63 per share, with continued growth in pre-market trading on Wednesday. Year-to-date, the company’s stock is down nearly 71%.

On Tuesday, Sidus Space announced it signed a memorandum of understanding with service company NamaSys Bahrain. According to the memorandum, a joint venture, Sidus Arabia, will be established in Saudi Arabia to develop and manufacture satellites using 3D printing technology.

The joint venture aims to serve government and private companies from the Middle East and North Africa (MENA) region. Initially, the partners will explore the possibility of providing «sustainable access» to space for Arab Gulf states, establishing satellite production in the region, and gathering space data.

Partner activities

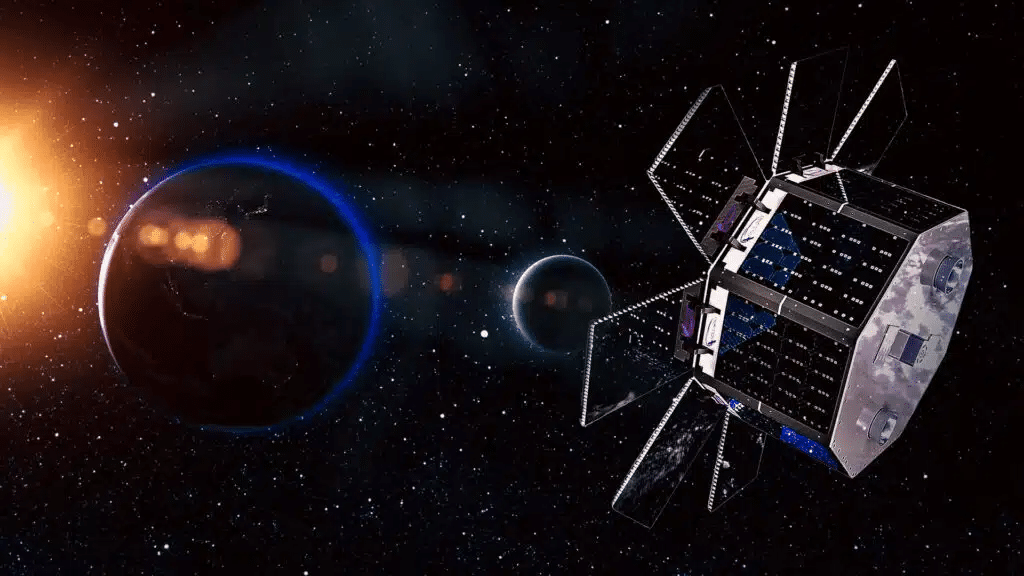

Sidus Space provides space services and is developing the LizzieSat satellite constellation, which will become the platform for Sidus’s space infrastructure, offering space data to the company’s clients, stated company founder Carol Craig in an interview with Forbes. Carol Craig is one of the first women to receive the right to operate combat aircraft for the Navy.

Sidus plans to launch a total of 100 satellites, allowing its clients to integrate their sensors and technologies. The first satellite was launched into space in March 2024 as part of SpaceX’s 10th Transporter Rideshare mission (SpaceX’s rideshare mission by Elon Musk).

Sidus reported revenue of around $1.1 million for the first quarter of 2024, which fell by more than half year-over-year. The company attributed the decline to client payment delays and expects growth in the second quarter.

NamaSys is a service company that develops various data collection models, such as space observation. Sidus also notes that NamaSys possesses «legal tracking and interception technologies.»

Analyst insights

According to MarketWatch, Sidus Space stock is monitored by one analyst, who recommends buying with a target price of $10, implying a potential growth of 286% from the last closing price.