Morningstar names 10 most popular stocks with small-cap funds

Barron’s has published a Morningstar-compiled list of the most popular stocks with small-cap funds. The past month has been great for small-cap stocks, the publication notes, but navigating them can be quite challenging given the lack of media attention and Wall Street analyst coverage. Barron’s sought to find out what professional investors are buying.

Onto Innovation

Onto Innovation is a semiconductor company with a market capitalization of $9.32 billion, formed in 2019 through the merger of Rudolph Technologies and Nanometrics Incorporated. Propelled by the tech boom, its stock price surged 30% in 2024, Barron’s notes. The stock is held by 77 of the 227 funds surveyed by Morningstar.

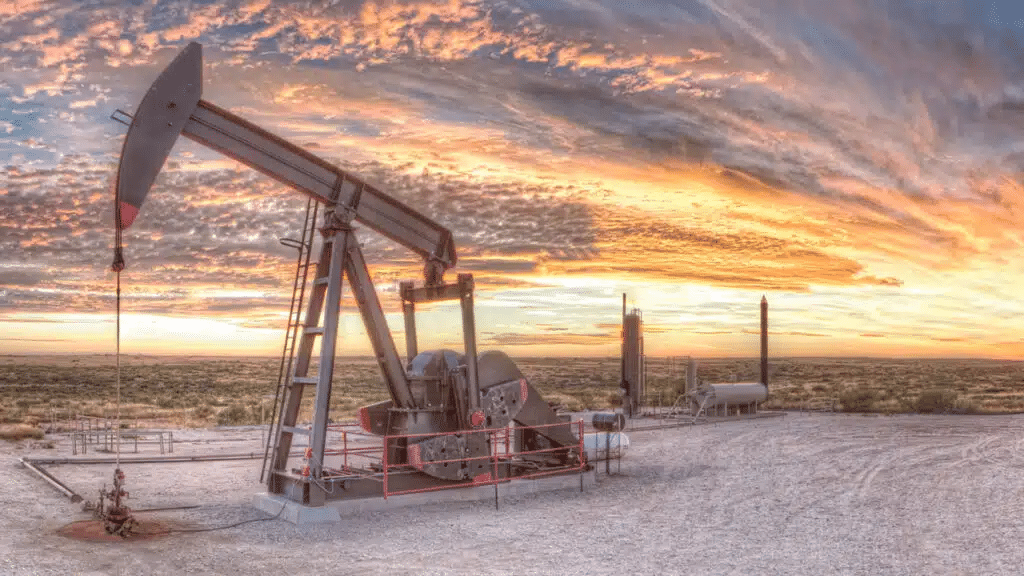

Matador Resources

Matador Resources is an energy company engaged in oil and gas exploration in the U.S., with operations focused on New Mexico and West Texas. It has a market capitalization of $7.51 billion. The company’s stock is up about 5% this year and held by 77 funds.

Modine Manufacturing

Modine Manufacturing, with a market capitalization of $5.36 billion, is a supplier of heating and cooling management systems and solutions across different segments, including building construction, electric vehicles, and data centers. Having soared 70% this year, the stock is held by 66 funds.

HealthEquity

HealthEquity is a provider of services for healthcare savings and spending decisions with a market capitalization of $6.93 billion. Since the beginning of the year, quotes on HealthEquity shares, held in 60 small-cap fund portfolios, have risen more than 20%.

Lantheus Holdings

The company develops and sells solutions that help doctors diagnose diseases and monitor their progression, including AI-based software for assessing PET/CT scans to detect prostate cancer. Since the beginning of the year, Lantheus Holdings stock has jumped almost 77%, with its market capitalization reaching $7.73 billion. It is held by 60 funds.

Rush Enterprises

Rush Enterprises is a commercial vehicle dealer with a market capitalization of $3.9 billion that operates the Rush Truck Centers dealership network in the U.S. and Canada. For the year to date, the stock, held by 58 small-cap funds, has added less than 3%.

Fabrinet

The company started with disk drive manufacturing but has expanded to produce a variety of optical products, including lenses, prisms, and polarizers. Since the beginning of the year, Fabrinet stock has gained more than 17%, for a market capitalization of slightly below $8 billion. The stock is held by 57 funds.

Comfort Systems USA

With a market capitalization of $11.2 billion, Comfort Systems USA provides installation, maintenance, repair, and replacement services for heating, ventilation, and air conditioning systems in the U.S. The stock, held by 56 funds, has climbed 55% this year.

The AZEK Co.

This building materials manufacturer has a market capitalization of $6.62 billion. Since the beginning of the year, quotes on its shares are up more than 22%, with AZEK held by 56 small-cap funds.

Atkore

Atkore, with a market capitalization of $5 billion, chiefly sells cables and installation accessories. Held by 56 funds, the stock is off more than 15% this year.