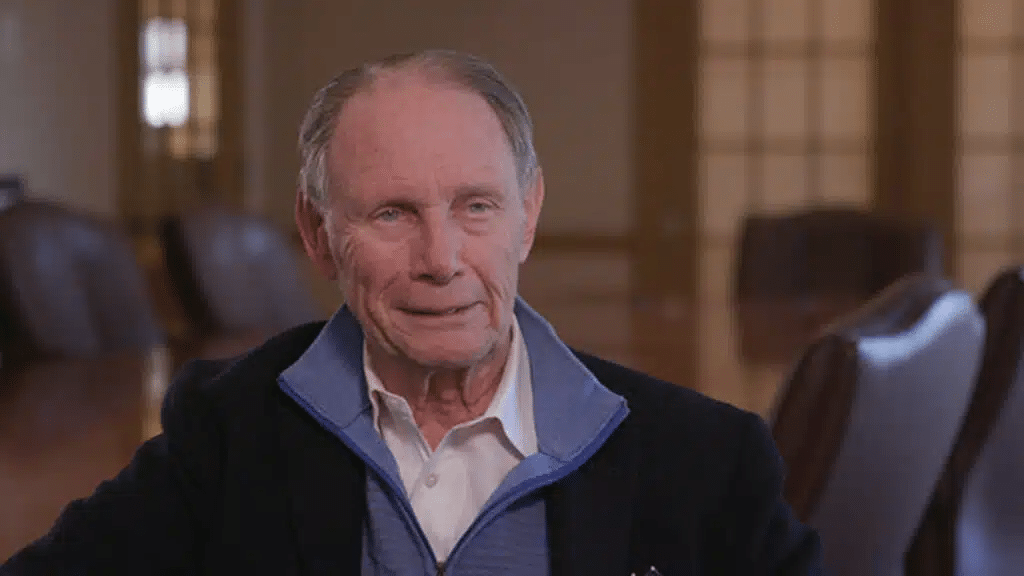

How to invest in small caps: Five tips from Wall Street legend Chuck Royce

“Essentially, we are interested in three things — a strong balance sheet, a record of success as a business, and the potential for a profitable future,” says Chuck Royce, the long-time portfolio manager and the namesake of Royce Investment Partners. Over half a century ago, Royce was one of the first on Wall Street to focus on small-cap stocks. What principles underpin his investing?

Small-cap pioneer

In September 2024, after more than 60 years on Wall Street, Chuck Royce will step away from day-to-day portfolio management at Royce Investment Partners, remaining a senior advisor to the firm.

Royce Investment Partners manages $11.8 billion in assets, with 98% of that invested in small-cap stocks, according to a Business Insider feature in 2023. The company manages 11 open-end funds, three closed-end funds, and an ETF that has outperformed the small-cap Russell 2000 index by 2.83% on market-price return over the last five years (as of July 31).

Warren Buffett began investing before the S&P 500 index was created in 1957. Chuck Royce was also ahead of his time — he started investing in small caps (typically with market capitalizations ranging from $250 million to $2 billion) a decade before the Russell 2000 was created to track their performance. “We were early in identifying this as a category for investing,” Royce told Business Insider.

Royce is a “small-company stock pioneer,” says Consuelo Mack, host of the news program WealthTrack, who previously spent over a decade at the Wall Street Journal. Royce is called a “legend” in the small-cap space and “one of the last of the generation of star managers” by Dan Culloton, Morningstar’s editorial director for manager research, as quoted by the FT.

Royce began his career in finance in the 1960s as an equities analyst. In 1972, he took over management of the Pennsylvania Mutual Fund, later renamed the Royce Small-Cap Fund. The next year, his first one managing the fund, Royce lost 40%, but the year after he notched a 120% return, according to Forbes. In 2001, Royce’s company was acquired by Legg Mason (which itself was later acquired by Franklin Templeton). Forbes noted the “spectacular” success of the management company: Royce acquired Pennsylvania Mutual for next to nothing and sold it for $115 million (with another $100 million on the table if the fund under his management met certain return goals).

Despite the change in ownership, the fund retained its name, strategy, and team.

Royce announced his retirement in July, which coincided with the start of the “great rotation” on Wall Street. Upbeat inflation data in the U.S., which heightened expectations of an imminent Fed rate cut, along with rising investor concerns about a bubble in big tech, led traders to move into small-cap stocks. Against this backdrop, in July the Russell 2000 outperformed the Nasdaq Composite, which is dominated by tech stocks. “I timed my retirement to be the beginning of this small-cap takeoff — that was part of our plan 10 years ago,” Royce joked in a conversation with the FT.

He said that he plans to continue studying small-cap stocks even after he stops managing funds. “I love doing it,” he said, “and I’m probably going to do it forever.”

What is his strategy?

- Avoid big names

His approach entails eschewing the biggest names in the S&P 500 in favor of lesser-known companies with above-average earnings and attractive valuations, as the FT noted.

Royce’s portfolio does not include Microsoft, IBM, or Walmart; instead, he has invested in what Forbes calls “unsexy” companies like knit fabric maker Fab Industries, exhaust manifold producer Wescast Industries, and milk cooler manufacturer Paul Mueller.

Business Insider listed some of the firm’s “favorite investments” held across multiple portfolios. One is Air Lease, an aircraft leasing company, as Royce believes that airline demand for planes is growing and manufacturers cannot always keep up with it, according to the Royce Investment Partners website. In addition, the firm sees growth potential in the aviation industry, especially in the international travel segment. Another top pick for Royce is Simpson Manufacturing, which makes building materials. Its growth outlook is linked to housing demand in the U.S.

- Look for companies with strong balance sheets

Forbes described Royce’s strategy as not “going with glamor” but rather betting on companies where most funds are not looking. In the 1970s, Royce watched Wall Street pump up the Nifty Fifty — an unofficial term for about 50 of the largest-cap, blue-chip stocks, such as Polaroid and Kodak — and then saw the bubble burst. “I realized it wasn’t about a compelling story,” he says. “A company had to have a strong balance sheet also.”

Francis Gannon, cochief investment officer at Royce Investment Partners, explained to Business Insider: “We tend to focus on companies that have high return on invested capital, low leverage, strong balance sheets, and don’t necessarily need access to capital.”

- Risk and diversification are as important as reward

Royce himself did not always have a specific interest in small companies. After some early struggles, however, he found that buying high-quality smaller companies, combined with maintaining diversified portfolios, is a good way to limit losses. “I came to the realization that risk is as important as reward,” he told Business Insider.

There are several “vastly different” types of small-cap investing, Royce told the FT. For example, one Royce fund mainly invests in dividend-paying companies, another in small caps, and a third in micro-cap stocks. “People say low-priced stocks are worthless, but there are as many fabulous small-cap companies with great earnings [as large ones],” Royce told Forbes.

- Pick stocks as if you are buying the entire company

In an interview with WealthTrack, Royce said he invests in each stock as if he is buying the entire company — because he invests for the long run. And while numbers are crucial, understanding the company’s ecosystem is just as important, which is why it is necessary to connect with its customers, suppliers, and even competitors.

- Invest for the long run

Royce likes to invest in companies whose management has been in place for at least five years, buying them cheaply and holding them, Forbes wrote. He told the publication that most of the stocks currently performing well are the ones his funds have owned for years.

What’s next for small-cap stocks?

Morningstar’s Dan Culloton has calculated that if a wise five-year-old had entrusted Royce’s flagship fund with $10,000 in 1975, they would have about $9.5 million today. By comparison, the same investment in the S&P 500 index over the same period would have returned around $3.1 million.

If recent performance continues amid the “great rotation,” a small-cap boom could benefit from a “phenomenal shift in psychology,” Royce said in July.

However, August began with a panic-driven selloff in global markets. And now, not all analysts are so optimistic about the outlook for small caps.

Defensive stocks will shine and small caps will fade, predicted Mike Wilson, chief U.S. equity strategist at Morgan Stanley. “While we don’t necessarily expect small caps to underperform large caps as much as they have over the past few years, we still see relative downside for the Russell 2000 ahead given the deteriorating consumer and labor environment and the fact that smaller cap stocks are generally much more economically sensitive,” he believes.

Meanwhile, Luke Barrs, managing director of fundamental equity at Goldman Sachs Asset Management, reported that his firm is “considering” the possibility of buying tech and small-cap stocks. In his view, the recent U.S. equity selloff “has removed a lot of the froth,” making these assets attractive.