Small caps and the U.S. election: How investors can win in the home stretch

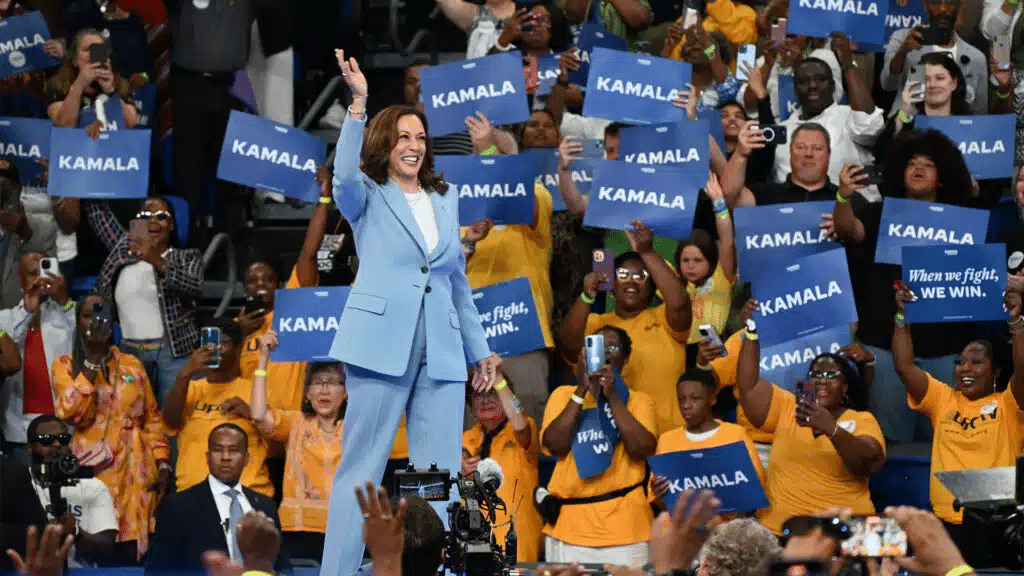

The unexpected entry of Kamala Harris into the presidential race on July 21 drove a 5.7% rise in the shares of AdvisorShares Pure US Cannabis ETF, which provides investors with access to U.S. cannabis companies, with a 19% increase in the number of shares changing hands. More than half of the ETF’s portfolio consists of small- and micro-cap stocks.

Harris, an advocate of marijuana legalization, urged the U.S. Department of Health and Human Services and the Department of Justice in March 2024 to hasten the reclassification of marijuana as a Schedule I drug, alongside, for example, heroin, to a Schedule III substance — including the likes of ketamine and codeine. This prompted investors to see her entry into the presidential race as positive for cannabis producers.

What other small companies might benefit in the next administration, and what should investors be on the lookout for?

Perfect environment

Stocks do not rise and fall solely on statements by presidential candidates. Other important factors include past performance, the economic backdrop, and access to funding.

The next presidential term will coincide with a period of quantitative easing in the U.S. The Fed is expected to cut rates at its next meeting in September. Small companies benefit from lower rates, as they reduce the cost of loans for them and their clients.

Historically, in presidential election years, the Russell 2000 index, which comprises 2,000 small-cap stocks, outperforms the Russell 1000, made up of 1,000 large-cap stocks, points out Francis Gannon, co-CIO at Royce Investment Partners, which specializes in small-cap investing. Macquarie notes that since 1980, U.S. small caps have outperformed U.S. large caps in seven of the 11 presidential election years, even in the months following the elections. Small companies that generate a greater percentage of their revenue in the U.S. may benefit more from policy and economic changes.

Small-cap stocks are likely to rally if Donald Trump wins, as happened in 2016, say Goldman Sachs analysts cited in MarketWatch: “Many investors view small-cap stocks as a potential ‘Trump trade.'” Trump’s “America First” approach, together with plans to raise tariffs on Chinese imports, could boost U.S. small- and mid-cap companies, agrees James Yardley, senior research analyst at Chelsea Financial Services.

Against this backdrop, investors have the opportunity before the election to rebalance their portfolios and add small caps.

Traditional and clean energy

Republicans are pushing to boost fossil fuel production. For example, Trump told Bloomberg in an interview that he could bring down prices by opening up the U.S. to more oil and gas drilling. Meanwhile, a Democratic win might further promote the development of renewable energy, said Rob Haworth, a senior investment strategist at U.S. Bank Wealth Management. Ironically, he added, renewable energy stocks performed better under the Trump administration, while traditional energy stocks have done better under the Biden administration.

For instance, Beam Global is a small company that provides infrastructure solutions for the electrification of transportation and energy security, including batteries, EV ARC systems (solar-powered, off-grid EV charging systems), and transport trailers. Its clients include both commercial and government entities. In the second quarter of 2024, it reported orders of $10.6 million, up 128% year over year. Five analysts recommend buying Beam Global, while one has it as a hold. The average target price is $14.60 per share, indicating upside of almost 200%.

An example of a traditional energy small cap is Matador Resources, which engages in oil and gas exploration in the U.S., with operations focused on New Mexico and West Texas. In July, it was on a Morningstar-compiled list of the 10 most popular stocks with small-cap funds. According to MarketWatch, the average target price among the 20 analysts covering the stock is $80.25 per share, indicating about 40% upside. Eighteen of the analysts have a buy recommendation, while two rate it a hold.

AI and tech

One of the big questions for investors remains whether the policies of the next U.S. president will help or hurt tech. Wall Street and Silicon Valley still wonder whether to fear or welcome a Trump or Harris administration, according to Investors.com. Artificial intelligence companies fear that a new president might impose regulations that put the brakes on the sector’s growth. Chipmakers fret over the future of U.S. relations with Taiwan, home to TSMC, the largest contract semiconductor manufacturer in the world, as well as a possible tightening of restrictions on tech exports to China. Another question is how much the next president will try to tax corporations.

Trump advocates corporate tax cuts, while Harris proposes raising the corporate rate from 21% to 28%. There is a theory that Trump will be good for tech companies and Harris will not, but that’s not necessarily true, argues Alex Morris, president and CEO of F/m Investments. He notes that Republican vice presidential candidate JD Vance is “striking an ‘isolationist, anti-tech’ arc” in his speeches.” For example, Vance has stated that the U.S. needs “a leader who won’t sell out to multinational corporations, but will stand up for American companies and American industry.” In contrast, Harris reaches out to tech companies on core issues, adds Morris.

Artificial intelligence is likely to become a “political combat zone,” writes Investors.com. Though Washington is expected to put in place a regulatory framework for AI, it is believed that a Trump administration would impose fewer restrictions than a Harris-led one, according to Ivana Delevska, founder and chief investment officer at Spear Invest.

Below are examples of small-cap AI and tech companies:

Inuvo, a provider of AI-driven advertising technology, claims that it will benefit from stricter regulations on data privacy and user rights, areas that Harris says she will prioritize, notes Investors.com. The company says that its product IntentKey can target audiences without using cookies, focusing on «why» rather than «who.» As such, the platform does not use confidential data, increasingly regulated by governments. The three analysts who cover the company have a target price of $0.95 per share, indicating upside of more than 250%.

Sidus Space has joint projects with U.S.-based Nvidia. It plans to equip its FeatherEdge AI delivery platform with Nvidia accelerators, resulting in the “highest performance edge computing capability on orbit.” The single analyst following the company recommends buying Sidus stock, with a target price of $10.00 per share, for upside of about 200%.

SoundHound AI develops speech and sound recognition technologies. In partnership with Nvidia, it is working on an in-vehicle voice assistant. Of the seven analysts who cover the stock, six recommend buying it, while one has it as a hold, with an average target price of $7.79 per share, indicating upside of more than 60%.

Innodata, an IT services and enterprise software company, develops large language models for Big Tech companies, which has driven double-digit growth in its financial metrics this year. A recent new contract is expected to generate about $87.5 million in annualized run rate revenue. Two analysts recommend buying Innodata stock, with an average target price of $34.00 per share. On Wednesday, August 28, it finished the day at $17.72 per share.

Weapons manufacturers will win

Gun stocks could benefit from a Trump victory, Reuters writes. If elected, the Republican nominee has promised to “roll back every Biden attack” on gun owners’ rights.

Byrna Technologies, which makes so-called less-lethal weapons, wants to be ready for what could be an increase in demand due to possible unrest in the wake of the US presidential election, said CEO Bryan Ganz. In its report for the fiscal-2024 second quarter (ended May 31), the company reported expanding its production of weapons. The two analysts who cover the company rate the stock a buy, with a target price of $18.13 per share. On Wednesday, August 28, Byrna closed at $11.20 per share.

Military spending

Chelsea Financial Services’ Yardley notes that a potential Trump administration could push for increased military spending, both at home and by NATO allies, creating a strong tailwind for the defense sector.

Sidus Space has secured three contracts to be a subcontractor for U.S. Navy equipment. Under the most recent one, it will manufacture, test, and deliver pre-production panels for interactive display equipment for a program to maintain nuclear power plants on submarines.

Israel’s Gilat Satellite, which trades on the Nasdaq, also works with military and defense companies. Its products include VSATs (very-small-aperture terminals), which can be quickly deployed anywhere on the planet and are widely used for maritime navigation and by the military. Two analysts recommend buying the stock, with an average target price of $7.90 per share, versus the current $4.53 per share price.

Crypto poised for gains

Investors.com writes that the outlook for crypto, already a high-risk, volatile sector, is unlikely to change no matter who wins the election. That said, Trump has repeatedly voiced a pro-crypto stance. Meanwhile, Brian Nelson, a senior Harris campaign advisor on policy, has said that the Democratic nominee would back measures to help grow digital assets.

Many small-cap companies operate in the crypto sector. Gryphon Digital Mining aims to use only renewable energy to mine Bitcoin. The single analyst covering the company has a hold recommendation on the stock, with a target price of $16.00 per share, almost 22 times current levels.

DeFi Technologies has a subsidiary, Valour, that issues exchange-traded products that enable investors to access digital assets like Bitcoin via their traditional bank accounts. As of June 30, Valour had approximately CAD730.1 million ($533.4 million) in assets under management.