Shares of SpaceX’s small competitor now up over 1,300% since April

Shares of telecom company AST SpaceMobile, which aims to compete with Elon Musk‘s SpaceX, have skyrocketed over 1,300% since April, when they hit an all-time low. The growth makes AST SpaceMobile the top-performing stock in the small-cap Russell 2000 index over the last six months, Bloomberg reports. The latest gains are attributable to the launch of the company’s first satellites today, Thursday, September 12.

Details

AST SpaceMobile stock has gained over 1,300% since April. At the close on Wednesday, September 11, it was quoted at $27.90 per share, having risen from the trough of $1.97 reached on April 2.

Bloomberg notes that AST SpaceMobile has delivered the best performance in the Russell 2000 index over the last six months, calling it “one of the hottest stocks in the world this year.” Nevertheless, traders remain somewhat skeptical about the company: around 20% of its float is sold short. So far, short sellers have been losing money, racking up paper losses in excess of $600 million over the last six months, according to S3 Partners LLC data cited by Bloomberg.

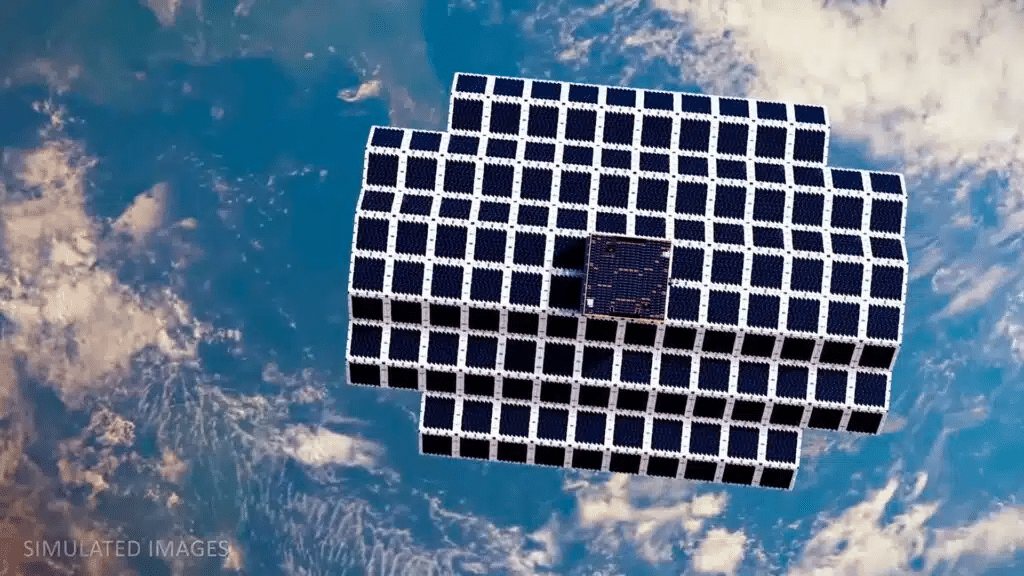

In the early hours of Thursday, September 12, AST SpaceMobile launched its first five BlueBird satellites into low Earth orbit as part of SpaceX’s Transporter rideshare mission. AST SpaceMobile stock is rising in premarket trading as we write.

What is AST SpaceMobile?

AST SpaceMobile is a small telecom company with a market capitalization of $7.7 billion. It claims to be building the first space-based broadband network to operate directly with standard mobile devices. Usually, signals are transmitted by cell towers. Similar solutions already exist, such as Israel’s Gilat Satellite Networks, which provides satellite-based connectivity for remote areas.

In May, AST partnered with telecoms operator AT&T to provide wireless service from space. As Bloomberg notes, this put AST in competition with SpaceX, which has a similar deal with T-Mobile US. The day after the partnership with AT&T was announced, AST stock surged close to 70%.

The next spike in the share price — almost 51% — happened in mid-August, following AST’s 2024 second-quarter earnings. At the same time, the company announced plans to launch its first five satellites in September and revealed that telecoms giant Verizon had joined as a strategic investor, committing to invest $100 million. “Part of the recent rally was simply recognition of the work the company has been doing for years,” Bloomberg quoted Scotiabank analyst André Coelho as saying.

AST plans to send dozens of satellites into orbit. “It offers an amazing technology that is incredibly wide in coverage, highly scalable, and extremely important,” said Kevin Mack of Stanford’s Graduate School of Business. “This is the equivalent of flying cars.”

Analyst insights

According to MarketWatch, all six analysts who cover AST SpaceMobile recommend buying the stock, with an average target price of $37.98 per share. This implies upside of 36% from the last closing price.