Stock of emoji encyclopedia creator jumps after new buyback announced

Shares of Zedge, which owns an emoji encyclopedia and makes ringtones and wallpapers for mobile phones, rose over 5% on Monday, September 16, buoyed by the announcement of a new share repurchase program for up to $5 million.

Details

On Monday, Zedge stock added 5.35% to $3.15 per share on the NYSE. It is up 34% since the beginning of the year and almost 46% over the last 12 months.

Before the opening bell on Monday, the company announced a new $5 million share repurchase program, which follows the completion of its prior $3 million buyback at the end of August.

“Our new stock repurchase program highlights our strong belief that the market is significantly undervaluing Zedge,” CEO Jonathan Reich was quoted as saying in the press release.

The company plans to buy shares in the open market and through privately negotiated transactions at prices and times it deems appropriate.

About Zedge

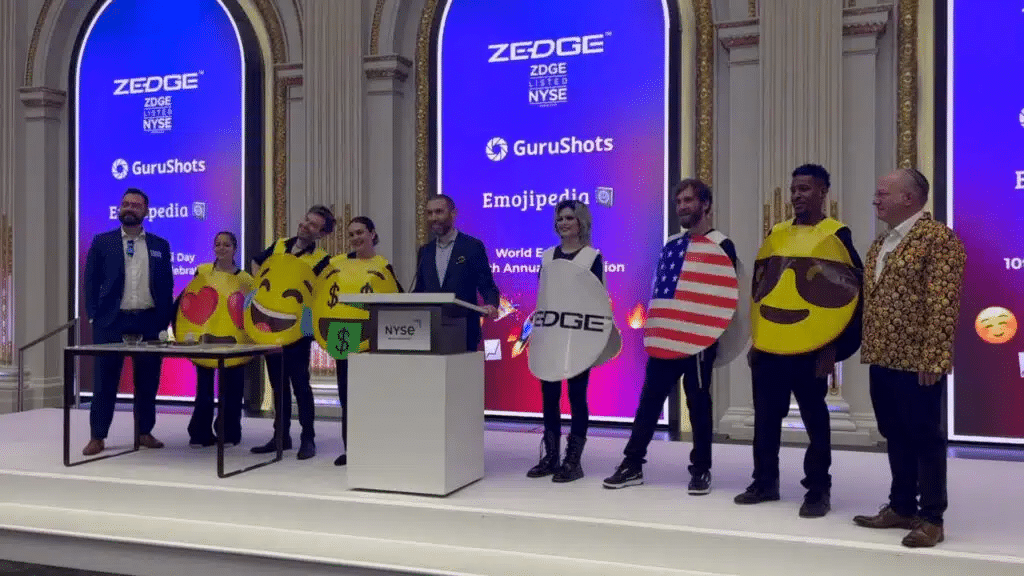

Zedge is the creator of a namesake app that offers phone personalization. Its products include wallpapers, ringtones, and notification sounds, all available for purchase through its marketplace. Zedge also develops games and owns Emojipedia, an emoji encyclopedia.

Zedge generates revenue through ads, digital goods and services, and subscriptions. For example, it offers both free and paid content, which can be purchased with its own NFTs or by viewing ads. The company claims that both the marketplace and Emojipedia are seeing “impressive” double-digit revenue growth.

In the fiscal-2024 third quarter (ended April 30), Zedge posted revenue of $7.7 million, up 13.8% year over year. Net earnings per share under GAAP for the same period came in at $0.10, compared to a loss of $0.55 a year earlier. The company continues to invest in paid user acquisition and plans to introduce new features and services on Emojipedia, including emoji-based minigames, which, according to Zedge CEO Reich, will boost engagement and enable monetization growth.

According to MarketWatch, Zedge is covered by one analyst, who recommends buying the stock, with a target price of $7 per share.