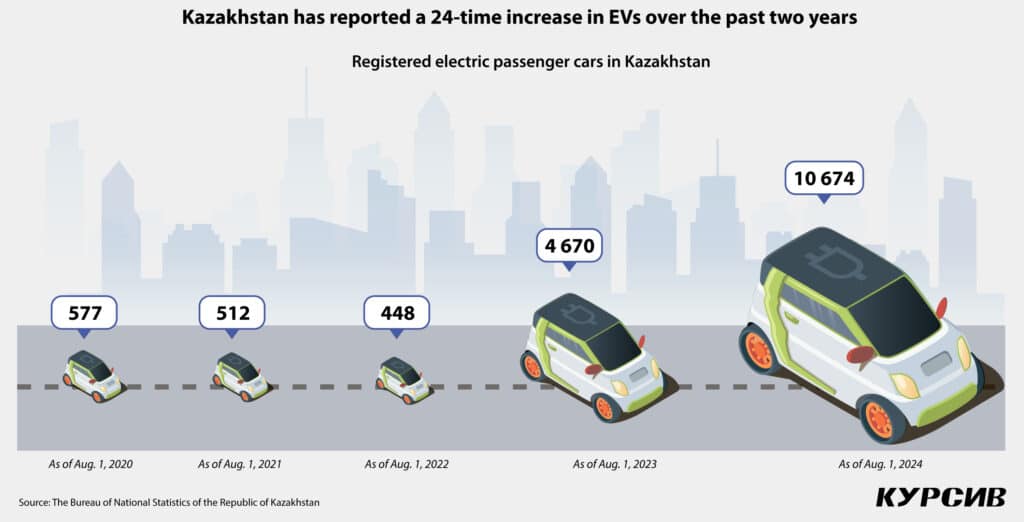

Kazakhstan’s authorities reported a more than twofold increase in the number of registered EVs — from 4,700 to 10,700 year-on-year. For some insurance companies, this means new opportunities as they launch new products specially designed for EVs, while for others this is unchartered territory, leading them to avoid optional insurance for EVs altogether.

There are several key challenges Kazakhstani insurers consider when insuring electric vehicles, including their faster acceleration compared to gasoline cars, higher repair costs (especially for battery issues), complex electronics and limited availability of diagnostic tools. The legislation prohibits insurance companies from refusing to issue compulsory civil liability insurance for electric vehicle owners, but comprehensive and collision insurance is optional both for a driver and for an insurer. For instance, Victoria Insurance Company doesn’t provide a comprehensive insurance option yet, citing a lack of data on electric vehicle operation.

Risks to assess

The companies who are ready to insure EVs include additional premiums covering risk for uncertainty.

«Electric vehicles are a relatively new type of transportation for the market, and insurance companies lack comprehensive data on the frequency and severity of losses compared to traditional gasoline cars. Hence, insurers tend to charge higher premiums for EVs,» commented Laura Utekova, manager of the underwriting department at Jusan Garant.

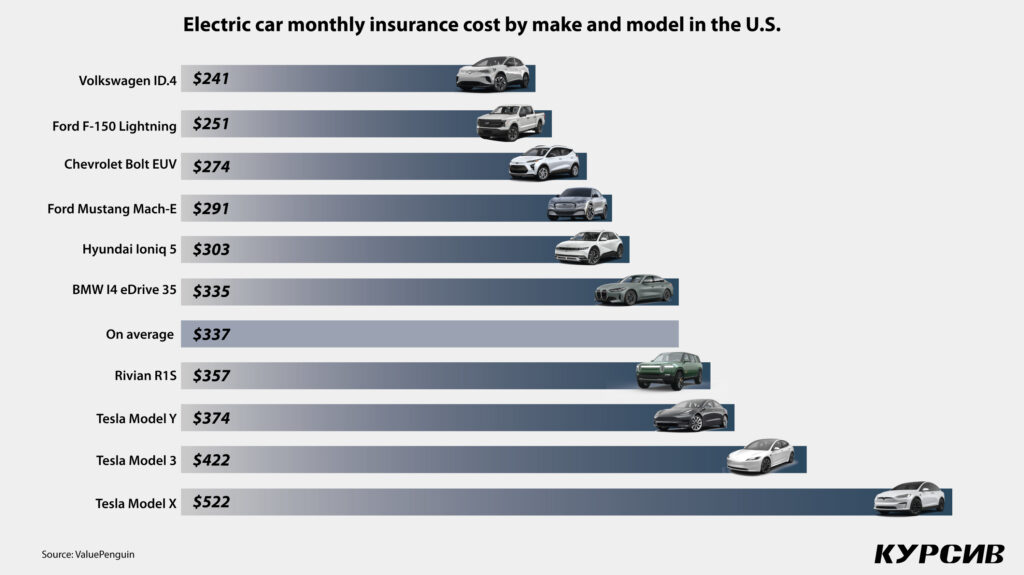

The comprehensive and collision insurance for an electric vehicle would cost 10%-35% more than for a traditional gasoline vehicle. In addition to the aforementioned factors, there are some other reasons for higher premiums, such as the higher price for EVs, their complex design and high-end components (autopilot, sensors, electric motors and batteries), all of which are more expensive to repair.

According to Alexander Tuleshov, deputy chair of Freedom Insurance, several insurance companies provide individualized underwriting options for electric vehicle owners, as standard packages are unsuitable for less common and high-value vehicles, particularly those produced by Tesla, Lotus and BYD. The comprehensive and collision policies for EVs cover the same risks as those for traditional gasoline cars, including accidents, fire, explosion, lightning strikes, damage to plumbing or heating systems, and falling through ice. Additionally, insurance companies may offer battery replacement or repair coverage.

For instance, Eurasia Insurance Company offers EV owners standard options similar to those for gasoline vehicles, which cover risks such as fire, battery damage in traffic accidents and mechanical impact.

«Problems with wiring, charging station malfunctions and any other incidents caused by manufacturing defects are not covered by the insurance contract,» clarified Nurzhan Jantureyev, deputy chair of the Eurasia Insurance Company.

At the same time, the company reported paying $26,647 to the owner of an almost new Tesla Model 3 due to damage from spontaneous combustion affecting the front of the car and battery. An investigation by the insurance company revealed that a dent in the battery was the alleged cause of the incident. The event was considered insurable because the cause of the self-combustion could be identified; mere evidence of combustion alone would not suffice for a payout.

As Jantureyev noted, Eurasia is going to introduce a new insurance package specifically designed for electric vehicles, which will consider unique risks related to EVs and employ a different calculation method. He also highlighted the risk of recurring battery fires that may happen two or three weeks after being extinguished. Additionally, he talked about an incident that took place in a residential compound in Almaty, where several electric cars were charging simultaneously in the parking lot. This led to a short circuit that caused damage to multiple appliances working from the power grid at the time in the building. The insurance company is still working on data collection.

«We don’t have enough data yet to develop a loss calculation model,» Jantureyev said.

Among those insurance companies offering specialized packages is Nomad Insurance, which has launched a comprehensive and collision insurance policy specifically for electric vehicles. This policy differs from those for gasoline cars by including battery insurance. Due to the complexity of battery repair and replacement, the premium cost is increased by 15% to 20%, according to Shakir Iminov, who is responsible for the company’s public relations.

Repair issue

Arranging repairs for an insured electric vehicle presents another challenge for companies. Most manufacturers, with few exceptions, are not represented by official or authorized repair shops. The battery condition is one main reason for the high costs, as it requires specialized equipment and technicians who are qualified enough to execute complex repair work.

«If the battery is severely damaged, the insurance company may consider the repair work unreasonable, which enhances the likelihood of recognizing this event as a total loss,» Utekova added.

Jusan Garant insurance company prescribes in its comprehensive and collision insurance agreements that if the loss is evaluated at more than 80% of the insurance coverage, the company repays the whole amount of loss, excluding deductibles and the value of the salvage ready-for-sale parts.

Alexander Tuleshov from Freedom Finance acknowledged that the company faces difficulties in recommending a repair shop if the insured car is not on a warranty service provided at a Kazakhstani dealership. In contrast, Eurasia offers its clients the option to send their insured vehicle to the nearest specialized repair shop, which could be in China or Germany, if no official or authorized shops are available in Kazakhstan. «If the agreement implies repairs at the specialized repair shop, the client ships the insured vehicle outside Kazakhstan at their own expense,» Jantureyev clarified.

Future of EV

«Future development of the EV comprehensive and collision insurance market is obvious. The growing number of electric vehicles will boost the demand for their repairs, including those following accidents. Hence, the infrastructure for the EV maintenance and haulage will develop. As the insurers accumulate statistics of losses on such cars, various insurance packages will be introduced specifically for electric cars,» Tuleshov highlighted.

Although insurance companies are gathering more data on electric vehicle incidents — especially as many EVs are «connected cars» with wireless access to various systems, including data storage — ongoing technological advancements in these vehicles may not only drive InsurTech (insurance technologies) forward but also introduce new challenges.

«How do we accurately assess the risks if a car is driven in autopilot mode on Kazakhstani roads, many of which lack the surface markings necessary for AI to function properly? For instance, what happens if an accident occurs while the AI is in control and the driver — who may be intoxicated — is not actively driving? Should the insurance contract deny coverage in such cases, or should we investigate why the AI caused the accident?» Tuleshov wondered while commenting on the future of the EV insurance market.