Shares of insurer Universal rise 12% after Hurricane Milton weaker than expected

Quotes on Universal Insurance Holdings, Florida’s largest private insurer, closed nearly 12% higher on Thursday, October 10, as Hurricane Milton, which hit the state’s Gulf of Mexico coast on Wednesday-Thursday, turned out to be less destructive than anticipated. Experts had estimated that the hurricane could cause up to $10 billion in insured losses, with the worst-case scenario at $100 billion.

Details

On Thursday, Universal Insurance Holdings stock surged 11.8% to $18.96 per share, marking the highest closing price of the week. It thus pared much of the loss from Monday, October 7, when Universal gave up almost a fifth of its market value.

Investors snapped up Universal shares after it became clear that Hurricane Milton, which made landfall on Florida’s Gulf coast in the wee hours on Thursday, had proven significantly less destructive than expected, as the Wall Street Journal (WSJ) notes. Still, according to the New York Times, 12 people died in the hurricane.

Expectations around Milton

On Saturday, October 5, Milton formed as a tropical depression (an area with winds of up to 61 km per hour) before growing into a tropical storm and then, by Sunday afternoon, a Category 1 hurricane. It picked up strength at near-record pace, turning into “one of the most intense hurricanes on record in the Atlantic basin,” according to the U.S. National Oceanic and Atmospheric Administration.

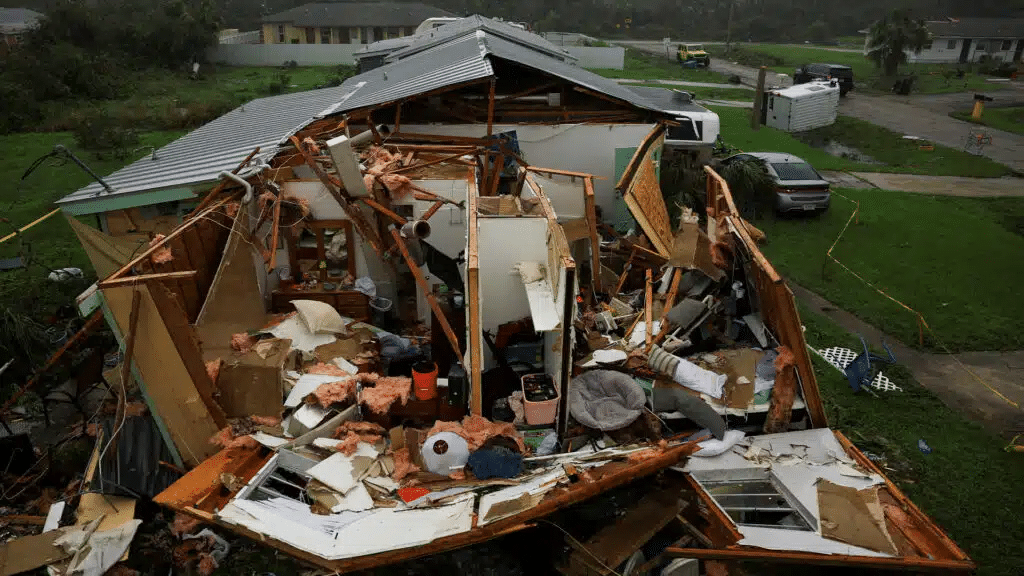

The hurricane was eventually classified as a Category 5 storm, the highest on the Saffir-Simpson hurricane wind scale. This indicates winds of at least 252 km per hour, which can destroy buildings or blow off their roofs and shut down transport infrastructure. An insurance analyst for the firm Keefe, Bruyette & Woods, Inc., Meyer Shields, predicted that Milton could cause over $10 billion in insured losses, reported Barron’s. In a worst-case scenario, Shields believed, they could reach up to $100 billion. More than 5.5 million people were forced to leave Florida’s Gulf coast ahead of the storm, making it one of the largest evacuations in state history.

However, as it approached Florida early on Thursday, the hurricane significantly weakened, making landfall as a Category 3 storm (which entails major damage to even well-built structures) before diminishing further to Category 1 (some damage and power outages).

Recall that in late September, Florida was hit by Hurricane Helene, which destroyed many homes and claimed more than 200 lives as it made its way through the state and beyond.

Context

Due to the high hurricane risk in Florida, many U.S. national insurers have refused to operate there, notes the WSJ. The largest player in the local market is a state-created nonprofit called Citizens Property Insurance Corp. Universal Insurance, the largest private insurer in the state, is number two.