Longboard Pharma soars after announcing acquisition by Danish peer

On Monday, October 14, shares of Longboard Pharmaceuticals, which is developing medicines for neurological diseases, surged more than 50% after the company announced a deal to be acquired by its Danish peer Lundbeck. The transaction is valued at $2.6 billion, almost 14% above Longboard’s current market capitalization.

Details

On Monday, Longboard Pharmaceuticals stock skyrocketed 52% to almost $59.00 per share. According to MarketWatch, it was a top trending ticker on Stocktwits, a social media platform for investors and traders, at the open. Over the last 12 months, Longboard shares are now up over 1,000%.

Before the opening bell on Monday, the pharmaceutical company announced a proposed agreement whereby it would be acquired by Denmark’s Lundbeck for $2.6 billion. Lundbeck plans to offer Longboard shareholders $60.00 per share in cash. The deal is expected to close before the year end.

About the deal and the companies

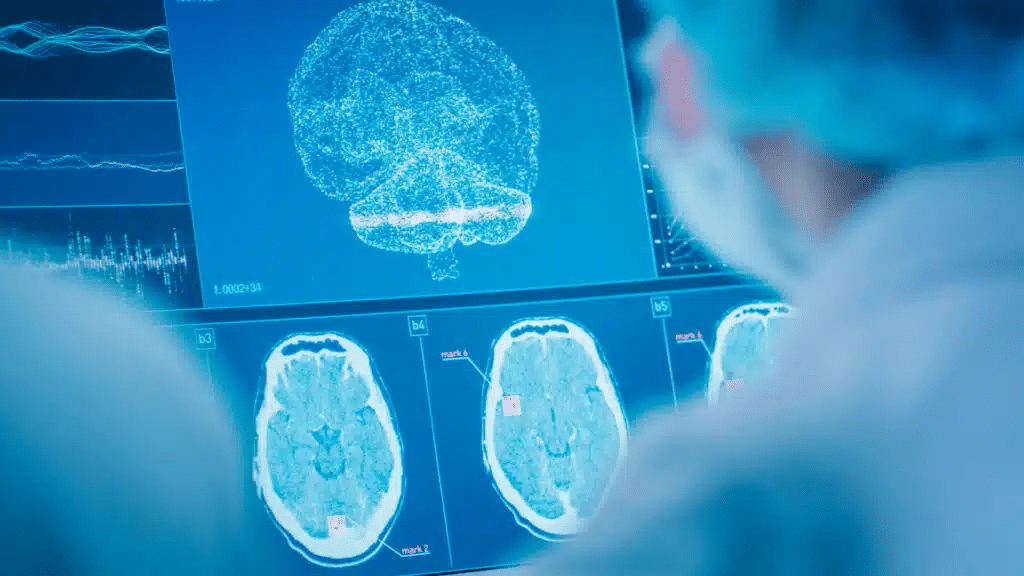

Founded over 100 years ago by Hans Lundbeck, H. Lundbeck initially sold a variety of things, ranging “from machinery to biscuits,” besides renting out vacuum cleaners. In the 1920s, the company added pharmaceuticals to its range of products. Today, Lundbeck focuses exclusively on developing treatments for brain health. In particular, it has brought to market chlorprothixene (Truxal) for psychosis and citalopram (Cipramil and others) for depression. About 70% of Lundbeck shares are owned by the Lundbeck Foundation, with the remaining 30% publicly traded. On Monday, Lundbeck stock dipped a little but has bounced back today, Tuesday, October 15.

The acquisition of Longboard is expected to “enhance and complement Lundbeck’s capabilities and presence within neuro-rare conditions,” according to the companies’ joint statement. The Danish drugmaker believes that Longboard’s lead asset, bexicaserin, has blockbuster potential. Note that the drug entered final, phase III clinical trials in September. It is designed to treat seizures caused by epileptic disorders such as Dravet syndrome and Lennox-Gastaut syndrome. Patients suffering from rare and severe epilepsies have “very few good treatment options available,” pointed out Lundbeck President and CEO Charl van Zyl. He added that the deal has the potential to drive Lundbeck’s growth into the next decade.

Longboard, a former subsidiary of Arena Pharma, was spun off in October 2020 after a $56 million funding round from a syndicate of investors. The following year, the company went public at $16.00 per share, while in January 2024, it was valued at $21.00 per share in a secondary offering. Since then, its market value has nearly tripled.

Analyst recommendations

According to MarketWatch, seven analysts cover Longboard. Two recommend buying the stock, while five rate it a “hold.” The average target price is $68.30 per share. On Monday, two analysts downgraded their ratings.