Sidus Space sells off after new stock offering announced

Shares of Sidus Space, a space services company, plummeted around 16% in trading on Tuesday, October 15, following the announcement of the company’s third stock offering this year. The latest is expected to nearly double the company’s outstanding shares.

Details

Sidus Space stock lost almost 16% on Tuesday, closing at $2.21 per share. The company plans to offer 3.7 million shares, along with an equal number of warrants, at a price of $2.67 per share, according to a filing submitted to the U.S. SEC. The warrants are available to investors whose stake would exceed 4.99% or 9.99% of Sidus Space’s capital if they purchased common shares. For each warrant sold, the number of common shares on offer will be decreased on a one-for-one basis.

Following the offering (assuming no exercise of the warrants and the underwriters’ option), Sidus Space outstanding shares will nearly double to 7.8 million shares. The company aims to raise a net $8.9 million (assuming the underwriters exercise their option to purchase additional shares and before expenses).

Sidus Space will use the proceeds for product development, manufacturing expansion, sales and marketing, and working capital. In the second quarter of 2024, the company reported general and administrative expenses of $3.1 million, versus only $930,000 in revenue.

About Sidus Space

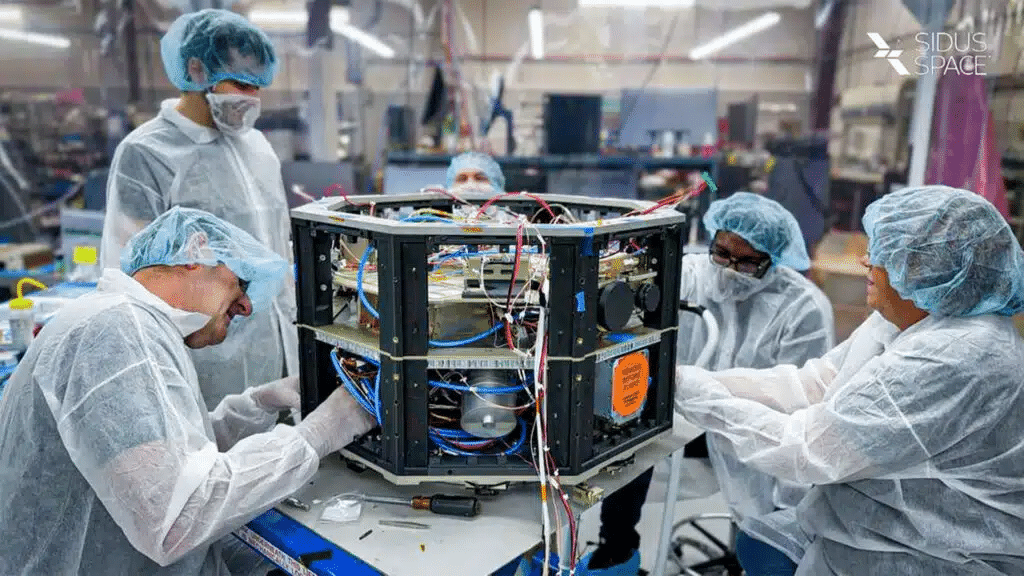

Sidus Space, a space-as-a-service company, was founded by Carol Craig, one of the first women authorized to fly U.S. Navy combat aircraft. The company is building a constellation of 100 LizzieSat satellites, with its clients able to integrate their own sensors and technologies to obtain space-born data.

The first satellite was launched into space in March as part of the Transporter small satellite rideshare mission of Elon Musk’s SpaceX . The second satellite is ready for launch and is expected to reach orbit by the end of the year. Also on Tuesday, October 15, the company announced that the U.S. Federal Communications Commission (FCC) had granted permission to operate a micro constellation of remote sensing, multi-mission satellites in low Earth orbit. The approval covers the next four LizzieSat missions.

This marks the third stock offering for Sidus Space this year. In January, the company sold 1.18 million shares at $4.50 per share, while in March, following the launch of its first satellite, it sold another 1.3 million shares at $6.00 per share. Since the start of the year, Sidus Space stock is off nearly 75%. According to MarketWatch, one analyst covers the stock, rating it a “buy” with a target price of $10 per share.