Nuclear energy stocks soar after Amazon backs advanced reactor technology

Shares of three nuclear energy companies soared on Wednesday, October 16, following Amazon’s announcement of investments to build new nuclear reactors. The retail and tech giant thus joined Microsoft and Alphabet in turning to nuclear to meet its growing power needs, driven by cloud services and AI.

Details

- Shares of U.S.-based Oklo Inc., which is building advanced nuclear reactors, surged around 42% on Wednesday to $16.54 per share — their highest closing price since the company’s public debut about six months ago, after it merged with a SPAC, AltC Acquisition Corp. Oklo’s market capitalization now exceeds $2 billion. Its board of directors is chaired by Sam Altman, CEO of OpenAI, the company behind ChatGPT.

- NuScale Power Corporation, another U.S. company developing so-called small modular reactors (SMRs), saw its stock hit a record high on Wednesday. Its shares closed at $19.07 per share, having gained 40% for the day. Currently, NuScale is trading 5.8 times higher than it was at the beginning of 2024, for a market capitalization of $4.75 billion.

- Nano Nuclear Energy Inc., which focuses on microreactors, ended Wednesday with a 38% gain at $21.45 per share — its highest mark since July 17. The company’s market capitalization is now $646.2 million.

Where Amazon is investing

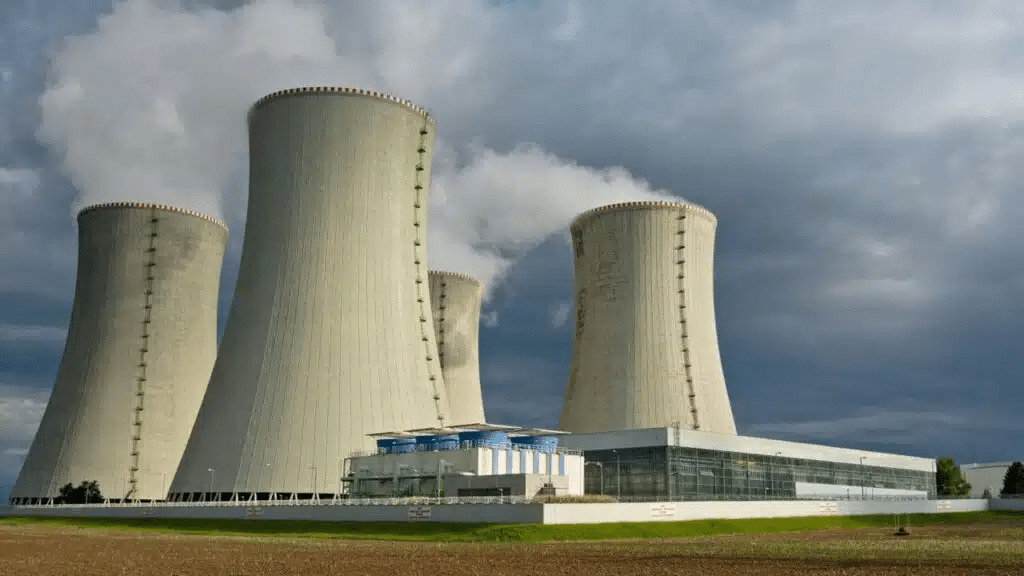

On Wednesday, Amazon announced agreements to develop and build SMRs, which have about one third the capacity of traditional reactors and enjoy the advantages of flexibility and size. Amazon is investing in this advanced technology to meet its growing energy demands.

Amazon’s agreement with Dominion Energy includes exploring the possibility of building an SMR near Dominion’s North Anna nuclear power plant in Virginia. Another investment is in next-generation reactor and fuel developer X-energy, whose technology will be used to build four SMRs in Washington state alongside a consortium of public utilities led by Energy Northwest. Additionally, Amazon has agreed to locate a data center near a Talen Energy nuclear plant in Pennsylvania.

Of these four firms, two are publicly traded. Dominion Energy shares rose 5.1% on Wednesday to $60.55 per share, their highest level since mid-February 2023. The other public stock, Talen Energy, added 5.53% to $171.05 per share. Dominion’s market capitalization neared $50.8 billion, while Talen Energy’s is now just over $8.7 billion.

Overall, Amazon is investing more than $500 million in nuclear energy, CNBC reports. The announced projects, according to financial news site Seeking Alpha, are expected to produce at least 5,000 MW of power by the late 2030s.

Context

“Technology giants want to secure clean, uninterrupted nuclear-based electricity to power their power-hungry AI data centers,” Barron’s explains. By signing up for nuclear energy investments, Amazon joins other major tech companies seeking alternative energy sources to meet growing electricity needs, noted Investing.com.

Recall that on Monday, October 14, Google announced a deal with Kairos Power to purchase energy from SMRs. The first reactor is expected to come online by 2030, with a total capacity of up to 500 MW expected from the deal.

Back in September, Microsoft inked an agreement with Constellation Energy to restart a reactor at the Three Mile Island nuclear power plant. Constellation called it the largest power purchase agreement in its history.