Wildberries continues expanding its market share in Kazakhstan despite problems in Russia, its home country

The number of pick-up points for Russian marketplaces has rapidly grown in Kazakhstan. To better understand if this dynamic is stable and whether opening a pick-up point for Wildberries or Ozon is worth it, Kursiv.media discussed the topic with market participants.

When walking down the streets of almost any Kazakhstani city, you can see the logos of Wildberries and Ozon as frequently as those of regular grocery stores. This surge has mainly occurred over the past 12 to 18 months. There are so many pick-up points that customers can choose one within a range of 200 to 300 meters. However, it is not uncommon for a customer, after two months of joy about being so close to a pick-up point, to receive a message saying, «Sorry, this pick-up point has closed, so you have to pick up your delivery somewhere else…» The app will show the address of a new pick-up point.

How many pick-up points do Russian marketplaces have in Kazakhstan?

To properly assess the dynamics of the increase in pick-up points, Kursiv.media requested this information directly from the marketplaces. However, they refused to reveal absolute figures, calling them sensitive information for competitors. Ozon reported that its number of pick-up points grew by 15 times year-on-year in the second quarter of 2024.

Wildberries has reported a 150% increase in its pick-up points since January 2024.

According to the Infoline consulting agency, by the end of 2023, Wildberries and Ozon had roughly the same number of pick-up points, although Ozon was slightly ahead of its competitor.

«In 2023, the infrastructure of Russian marketplaces in Kazakhstan underwent dramatic changes. The number of pick-up points sharply rose. For instance, both marketplaces expanded their presence in the market from several dozen pick-up points at the beginning of the year to 900 for Wildberries and more than 1,000 for Ozon by the end of the year. Furthermore, this infrastructure has continued to grow,» said Ivan Fedyakov, head of Infoline.

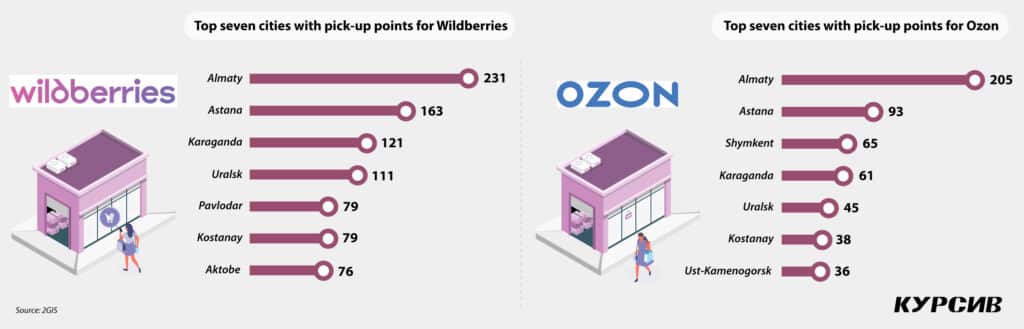

Even though the companies prefer to keep data about their retail networks hidden, you can easily find this information in 2gis, a navigation app. Based on the list of pick-up points in 2gis.kz, Wildberries operates more than 1,230 pick-up points in regional capitals, while Ozon has 790 points. (Sometimes the latter service considers regional capitals to include some small towns and villages.) There are many more pick-up points when considering district centers and villages.

The top seven cities with the largest number of pick-up points for Wildberries include Almaty, Astana, Karaganda, Uralsk, Pavlodar, Kostanay and Aktobe. This slightly differs from the top seven cities for Ozon, which includes Ust-Kamenogorsk instead of Aktobe (see infographics).

However, these indicators constantly change. For example, several weeks ago, Wildberries had ten pick-up points more than today, while Ozon had 12 points more than now, according to 2gis.kz. The issue is that marketplaces frequently open and close their pick-up points, and the navigation app shows that this happens more often for Ozon than for Wildberries. All those closed pick-up points are also indicated in the 2gis.kz app. It is no surprise that Almaty and Astana lead in this trend: Ozon closed 17 and 14 pick-up points in those cities, respectively, while Wildberries closed just five and two. (It is unclear what period that statistic covers, though.)

The marketplaces themselves explain this dynamic quite philosophically: Kazakhstani entrepreneurs are eager to open new pick-up points because it is relatively easy and beneficial, but they close them when they face challenges or see a lack of revenue.

According to Ozon, 8 out of 10 buyers prefer to collect their orders from pick-up points, which is why many entrepreneurs consider these points a good business opportunity given the low entry threshold, financial support within the first six months for up to $7,560 depending on the location, and assistance in deploying the necessary IT infrastructure.

«First-time entrepreneurs often miscalculate the risks associated with operating a pick-up point. As a result, these points might be closed. Usually, this happens due to poor location choices without analyzing demand and accessibility, a lack of financial planning, and not paying attention to the quality of service, which is crucial in a highly competitive market,» Ozon representatives said.

Wildberries believes that Kazakhstani entrepreneurs are interested in opening pick-up points due to several factors, such as the low market entry threshold (which requires less than $2,000 in investments), not-so-strict requirements for point opening and the chance to launch the business quickly. The company stated that it will continue expanding its network of pick-up points, offering local entrepreneurs all the necessary conditions for development and growth.

E-commerce experts confirm that the marketplaces have been actively investing in expanding their networks in Kazakhstan, promoting the opening of new pick-up points without the expectation of immediate strong results. In turn, entrepreneurs open pick-up points to gain the promised benefits. However, sometimes, the number of pick-up points exceeds the overall level of business development, as highlighted by Ivan Fedyakov. Not all entrepreneurs see enough turnover to cover rent and labor costs, resulting in some pick-up points closing within just a couple of months after opening due to low profitability.

«For the vast majority of entrepreneurs and marketplaces, this is the chicken-or-egg problem as they try to determine whether to boost turnover to make pick-up points more profitable or to continue opening new pick-up points to make it convenient for customers and give momentum for turnover growth,» Fedyakov says.

Is opening new pick-up points worth it?

According to Evgeniya Sowyers, who is responsible for working with key clients in IBC Real Estate, opening warehouses was a pivotal moment for both Wildberries and Ozon in Kazakhstan. «A warehouse is a key driver for sales, as its presence simplifies deliveries, which in turn boosts sales. To make sales happen, we need smoothly operating pick-up points and a massive advertising campaign. We’ve been observing this over the past 12 to 18 months, particularly in the extensive number of ads on the streets and TV,» she said.

The expert believes that both companies are actively competing with each other in logistics, opening new warehouses not only in logistical hubs but also in regions. «We believe that after opening fulfillment centers in Astana and Almaty, the companies will focus on smaller warehouses with a floor size of less than 10,000 square meters in regions,» Sowyers said, adding that it is impossible to predict who will win this race.

There is another reason for the geographical expansion by Wildberries and Ozon: nearly all economically attractive regions of Russia have already been conquered by the marketplaces. «The European part of Russia has been fully covered, while the Far East, with its seven million population, isn’t that interesting for these companies,» the head of Infoline said.

«That is why Central Asia — Kazakhstan, Kyrgyzstan and Uzbekistan —along with the UAE and Georgia, are the new development vectors,» Sowyers emphasized.

Is investing in new pick-up points worth it?

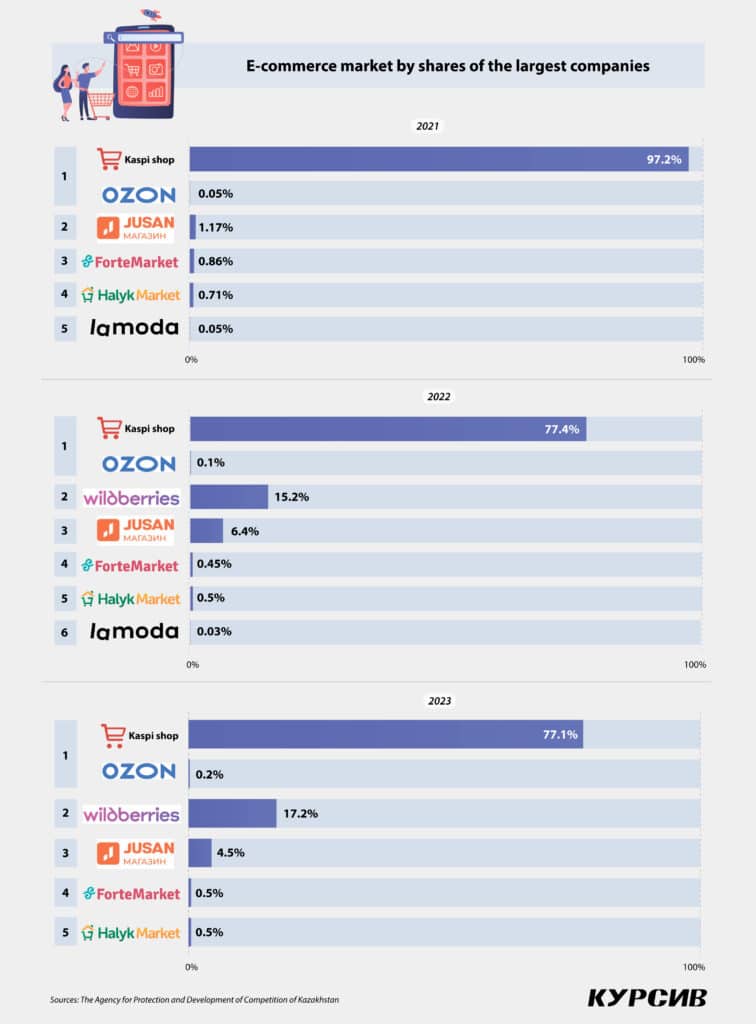

As Fedyakov pointed out, for the majority of consumers in Central Asia, purchasing items through pick-up points is still exotic, as many prefer to pick up their deliveries themselves or via courier. Another factor fueling doubts is competition with Kaspi, whose infrastructure includes thousands of automated pick-up points, making delivery costs even lower. Even though Kaspi’s share has been declining (dropping from 97.2% in 2021 to 77.1% in 2023, according to the Antimonopoly Agency) due to tough competition with Russian marketplaces, its turnover is still higher.

«Of course, Kaspi won’t sit on its hands. It will do everything possible to maintain its market share. From this perspective, competition on the Kazakhstani market is even stiffer than in Russia,» says Fedyakov. The expert is convinced that Kaspi will take some «interesting steps» to support its sales by the end of the year. The upcoming New Year’s holiday will be a pivotal moment for many e-commerce market participants. «I believe many pick-up points are awaiting a surge in turnover during the holidays. If they manage to turn a profit for the entire year in December alone, they will remain. Otherwise, we may see a large-scale closure of these pick-up points,» Fedyakov said.