Freedom Broker spotlights Archer Aviation as small cap poised to rally on Trump win

Archer Aviation, an electric vertical takeoff and landing (eVTOL) aircraft manufacturer, is one of the small-cap stocks that could benefit from the incoming administration of Donald Trump, according to Freedom Broker. Its analysts have set a target price of $4.80 per share for Archer, implying 23% upside versus the last closing price.

Details

Freedom Broker considers Archer Aviation a potential beneficiary of a second Trump term. The stock surged 20% in the four trading days following the election. Given Trump’s focus on domestic manufacturing, Archer looks poised to maintain the positive momentum until the end of 2024, Freedom Broker notes.

Archer could also gain from the struggles of its German peer, Lilium N.V. In October, the German government denied Lilium a loan guarantee, after which Lilium filed for bankruptcy for its subsidiaries, saw its stock rating downgraded, and received a notice of delisting from Nasdaq. Lilium is one of the top five companies by commitment orders, according to the aviation analytics firm Cirium, as cited by Freedom Broker. These orders might now go to competitors like Archer, whose orders are already growing, suggests Freedom Broker.

About Archer

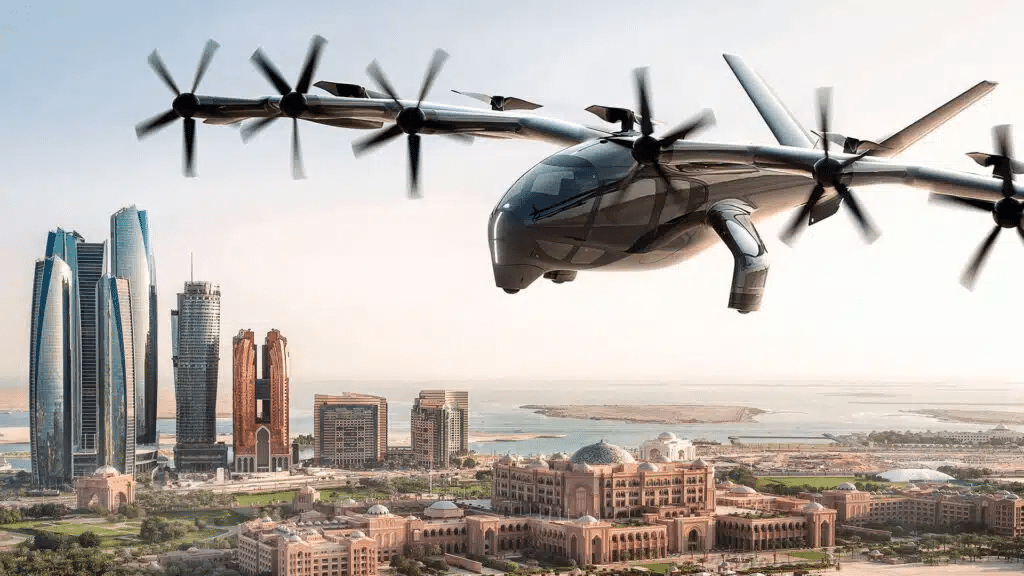

Archer Aviation, with a market capitalization of nearly $1.4 billion, develops eVTOL aircraft. In the third quarter of 2024, Archer announced a partnership with Soracle for a planned order of up to $500 million of Archer’s aircraft. Soracle is a joint venture of Japan Airlines and Sumitomo Corporation, which itself includes companies from the financial sector and mechanical engineering and electrical industries, among others.

Archer has over $6 billion in indicative orders, with partners including Southwest Airlines, United Airlines, and auto parts maker Stellantis, which has committed up to $400 million to support Archer’s production of up to 650 aircraft annually. With its manufacturing facility set to be finished in the coming weeks, Archer aims to start building type-design aircraft for use in testing and early commercial deployment in 2025. It is also advancing through the final phase to secure type certification and has established a consortium in the UAE to launch flights there next year.

Morgan Stanley expects the urban air mobility market to exceed $1 trillion by 2040, pointing out that Archer Aviation is well positioned to capitalize on this growth. The Motley Fool, meanwhile, has highlighted Archer as having “far more” upside than the so-called Magnificent Seven, and last week it reported that Cathie Wood‘s Ark Invest fund has been scooping up Archer shares.

Analyst insights

Freedom Broker views Archer as a high-risk investment and recommends allocating no more than 1% of a portfolio to the stock. Its target price for Archer is $4.80 per share, implying upside of more than 23% versus the last closing price.

Note that this valuation is one of the lowest on Wall Street. According to MarketWatch, the eight analysts covering Archer have an average target price of $9.19 per share, 2.4 times the last closing price.