Surging TSS seen as alternative to Super Micro as new hot AI stock

TSS, a small company that provides data center services, might replace the embattled server maker Super Micro Computer as an investor favorite in the AI segment, Barron’s writes. While Supermicro may be delisted soon, TSS has surged 4,000% this year and has just gained entry to the Nasdaq. Barron’s cautions, however, that investing in TSS comes with risks.

Details

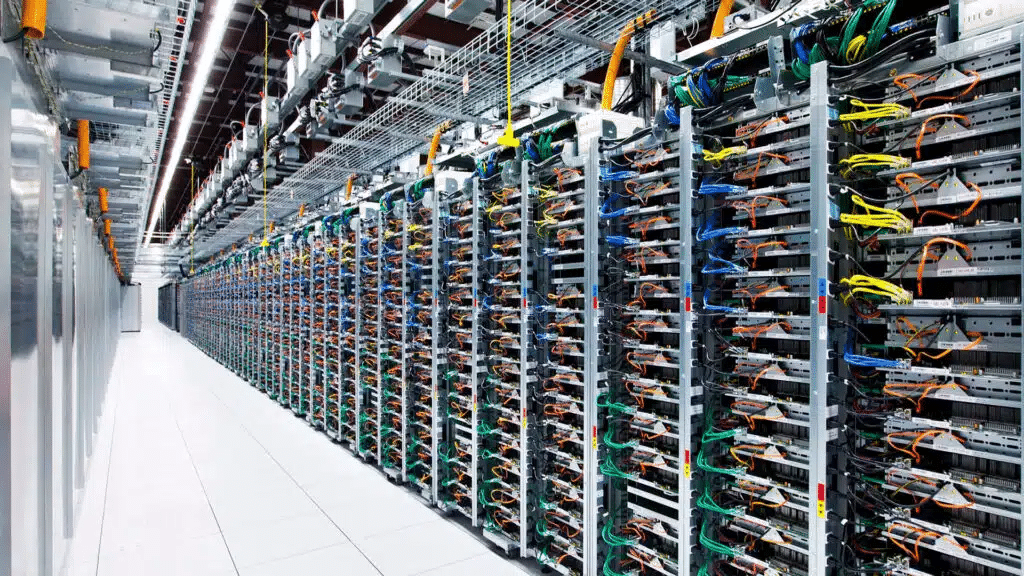

TSS builds and supports data centers. It also helps companies with data centers to elevate their performance, reduce downtime, and minimize outages, often by integrating AI technologies. The company has close ties with Dell Technologies, which represented 96% of TSS revenue in 2023, as reported by Barron’s. Revenue for the full-year 2023 came in at $54.4 million, up almost 80%.

“Customers visit Dell for servers, and then head on down the road to TSS for help incorporating the products in their data centers,” Barron’s explains, alluding to the proximity of the companies’ offices. For investors, TSS presents an opportunity to tap into Dell’s flourishing data center business, as noted in the article. In the fiscal-2025 second quarter (ended August 2), Dell’s Infrastructure Solutions Group (which includes servers) grew 38% year over year to $11.6 billion in revenue, with a record servers and networking performance of $7.7 billion, up 80% year over year, driven primarily by growing demand for AI-optimized products, as reported by Dell.

Barron’s cautions that while the partnership with Dell is a great asset, TSS’s reliance on a single partner makes it vulnerable and poses a risk for investors.

For investors

TSS stock has soared 4,340% since the beginning of the year. On Tuesday, November 12, the company announced that it had been uplisted from the OTCQB market to the Nasdaq Capital Market. The following day, the stock jumped 22%. On Thursday, November 14, TSS released third-quarter earnings: Revenue soared 689% year over year to $70.1 million, while net income skyrocketed 1,166% to $2.6 million.

TSS may benefit from the challenges of a former Wall Street favorite, Super Micro Computer. In late October, Ernst & Young resigned as Super Micro’s auditor, leading to delayed quarterly filings and a potential delisting. Nvidia also redirected one of its orders from Super Micro to a competitor. Over the past month, Super Micro stock has plunged more than 60%. Barron’s speculates that Nvidia’s search for new suppliers might lead it to Dell — and, by extension, to TSS.