Daktronics stock slips on moves to block activist investor

Shares of video display and scoreboard manufacturer Daktronics fell over 5% on Wednesday, November 20. This came after it was announced that the company’s board of directors had amended its shareholder rights agreement to prevent an activist investor — a nominee proposed by Alta Fox Capital Management’s affiliates — from joining the board. Alta Fox, a holder of Daktronics convertible bonds, is demanding early repayment of the bonds. Daktronics now plans to force the conversion of part of the bonds while seeking to limit the influence of the new major shareholder.

Details

On Wednesday, Daktronics stock dropped 5.4% to $14.35 per share, its lowest close since November 5. It is still trading nearly 70% higher than at the start of 2024.

The Daktronics board of directors agreed to amend the company’s shareholder rights agreement, the company announced on Wednesday. Recall that this document outlines shareholders’ rights and responsibilities, as well as how the company makes decisions, such as nominating candidates to the board. Under the amended agreement, Daktronics shareholders may exercise certain rights if their beneficial ownership reaches 15%, or 20% in specific cases.

The new agreement is designed to block Alta Fox and its affiliates from nominating a director to the Daktronics board, as the company’s statement indicated. Recall that in 2023, Alta Fox purchased $25 million in Daktronics convertible bonds maturing on May 11, 2027. The terms are that Daktronics has the right to force conversion of these bonds into equity after 1.5 years if specific financial metrics are met.

Alta Fox demanded accelerated repayment of the bonds, seeking $79 million — more than three times the face value of the bonds and roughly 50% above their fair value, according to Daktronics. In response, the Daktronics’ board announced on November 8 that it would exercise its right to convert part of the bonds.

About the conflict

After Daktronics rejected its demands, Alta Fox threatened to put forward candidates for the Daktronics board. Now, following the bond conversion, Alta Fox is expected to hold about 6% of Daktronics shares, according to Daktronics. However, under South Dakota law, both equity and debt holders have a say in board votes, which potentially gives Alta Fox the ability to change the composition of the board even without substantial backing from other shareholders. Daktronics is trying to prevent this scenario.

According to SEC guidelines, a shareholder who owns 3% of a company’s stock for at least three years may nominate a board candidate, explained Georgiy Timoshin, a financial analyst at Freedom Finance Global. However, companies often have their own rules, which may be stricter or more lenient than SEC guidelines, he added.

About Daktronics

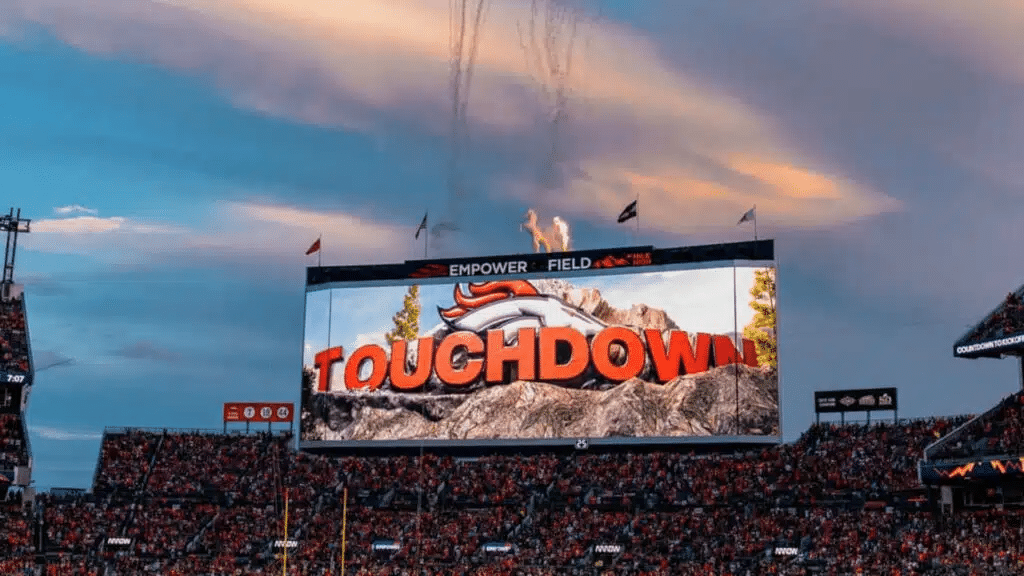

Daktronics describes itself as the world’s largest supplier of large-screen video displays, electronic scoreboards, LED text and graphics displays, and related control systems. Among other things, it supplies scoreboards and video displays for high school and college sports, professional sports installations, and LED and electronic advertising signs. In the first quarter of the 2025 fiscal year (ended July 27), the company’s top line was up about 5% quarter over quarter at $226.1 million.

Analyst insights

According to MarketWatch, Daktronics is currently covered by a single analyst, who rates it as a “buy.” The target price is $15.94 per share, implying 11% upside.