Royce spotlights three small-cap innovators reshaping their industries

Lauren Romeo, a portfolio manager of three Royce funds, has highlighted a trio of innovative smaller companies whose stocks are high-confidence holdings. She points out that technological advances often stem not just from giants like Nvidia and Amazon but also from small-cap companies.

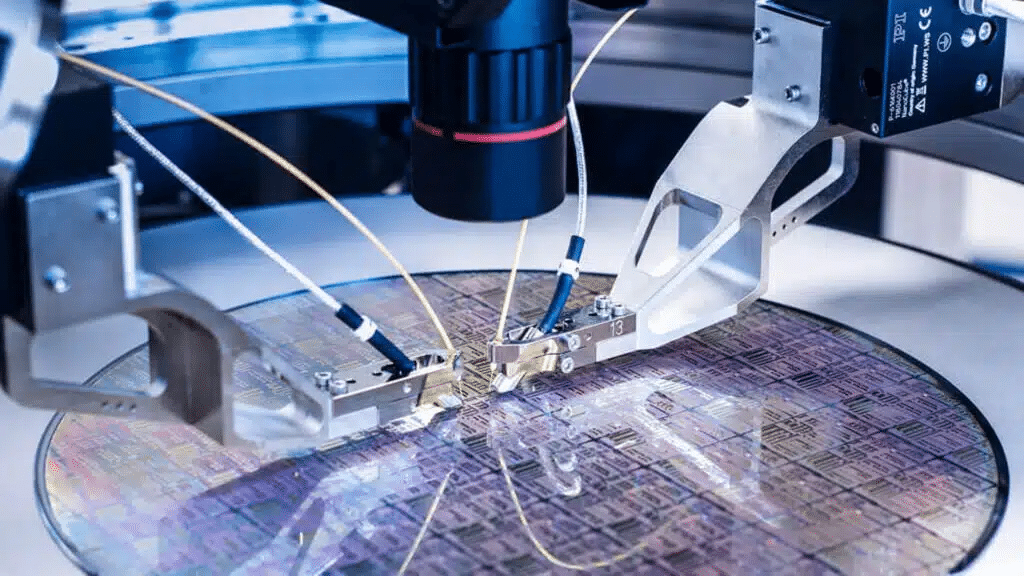

MKS Instruments

The first company is MKS Instruments, with a market capitalization of $7.73 billion. It supplies components and subsystems to semiconductor and electronics manufacturers, including generators, pressure transducers, and vacuum isolation valves. It also sells chemicals used in advanced electronics manufacturing. Romeo notes that through organic investment and strategic M&A, MKS has expanded its portfolio and addressable market, securing the first or second market share spot in 20 of the 24 categories in which it competes. In the third quarter of 2024, MKS reported $896 million in revenue, down almost 4% year over year. Romeo attributes this decline to MKS’s higher exposure to the PC and smartphone markets and their slow recovery.

Since the beginning of the year, MKS Instruments stock has gained more than 11% to $114.90 per share. According to MarketWatch, the average target price from the 14 analysts who cover MKS stands at $140.90 per share.

FormFactor

FormFactor, with a $3.2 billion market capitalization, makes test and measurement products for semiconductors and mobile devices for the full semiconductor lifecycle — from modeling to production testing. According to the 20-year Royce veteran manager, the company generates 80% of its sales from the production of advanced probe cards, used in chips for game consoles and wearables, among other things. As Romeo points out, three players control 75% of the probe card market, with a 33% market share for FormFactor. Probe cards are consumables, but due to chip makers’ long manufacturing qualification process, a manufacturer can hardly replace the probe card supplier for a specific chip, meaning they work together for the entire lifetime of the part, she notes. For the third quarter of 2024, FormFactor reported record revenue of $207.9 million, up 21% year over year.

Since the start of the year, FormFactor stock has dipped around 1% to $41.30 per share. According to MarketWatch, the average target price is $53.90 per share, indicating 30% upside versus current levels.

Brady Corporation

Unlike the other two companies, Brady Corporation, with a market capitalization of $3.48 billion, operates outside of the semiconductor space. It manufactures identification solutions, including industrial printers and barcode scanners, as well as labels, wire markers, and other consumable media. Romeo describes the company as a “quality, long-term compounder,” saying, “We’ll look to add to our position on any share price weakness.” Brady’s focus on niche and customized applications has enabled it to build high market shares of 30% on average across its products and strong brand name recognition, the Royce portfolio manager notes.

Since the beginning of the year, the stock has gained 24% to $72.80 per share. According to MarketWatch, the two analysts covering Brady have an average target price of $87 per share.