‘A kind of Apple looking product’: The EV charging company Beam and how it will gain from ban on gas-powered car sales

Starting in 2035, the EU and several U.S. states plan to ban sales of new internal combustion engine vehicles — those powered by gasoline or diesel. This plays directly into the hands of Beam Global, a small company creating EV charging infrastructure and serving clients such as Google and the U.S. government. Beam’s solutions require no wires or trenching, can be quickly deployed and scaled, and are portable. The company believes these features will make its products the top choice for customers. Analysts expect that Beam Global’s stock, with a current market capitalization on the Nasdaq of just over $44 million, could grow nearly threefold.

Mobile phone meets EV

What do mobile phones and electric vehicles have in common? As Beam Global CEO Desmond Wheatley explains: you should not have to go somewhere to charge them.

“I plug my phone in any time I see a little white wire. I top it off continuously. I charge at my desk, while eating lunch, when I’m sleeping and while I’m waiting for a flight at the airport. And that’s exactly how I fill up my electric vehicle. It never takes me more than ten seconds to plug it in and then I’m off to do something I’d rather be doing. Topping off is the best way to keep your EV and you happy,” Wheatley wrote to investors back in 2017.

The International Energy Agency (IEA) estimates that 14 million new EVs were sold globally in 2023, with 95% of them concentrated in three markets: China, Europe, and the U.S. EV sales grew 35% year over year in 2023 and have grown sixfold in five years. Each week in 2023, 250,000 EVs were registered — more than the total number of registrations in all of 2013.

“I opened a recent meeting with a group of investors in New York by asking if any of them had ever driven an EV,” Wheatley wrote to shareholders. “Of the fourteen or fifteen in the room about half raised their hands. I’ve been asking that question for many years now and have happily observed this micro-indicator of the macro trends in EV adoption – from zero then, to half the people in the room now.”

In 2024, EV sales are expected to grow over 20% to approximately 17 million, according to IEA forecasts. Beam believes consumer adoption will outpace expert predictions, driven by government initiatives and automaker commitments. A pivotal year for the industry could be 2035, when the EU plans to ban sales of combustion-engine vehicles, supported by automakers like GM, Ford, and Volvo. In the U.S., the situation remains uncertain: 12 states plan similar bans and have had the backing of the administration of President Joe Biden, but President-elect Donald Trump opposes such bans. This could lead to legal disputes between states and the federal government, as reported by the New York Times.

Banning gas-only vehicle sales is a boon for Beam Global, as more EVs drive demand for charging infrastructure. Beam cites industry experts who forecast the EV charging market will grow 31% annually to $222 billion by 2030. Convenient charging locations — such as next to the dumpsters behind supermarkets — will soon run out, necessitating the development of more expensive network infrastructure. Beam’s solutions, which are wireless, scalable, and portable, stand to benefit from this trend.

Always at hand

Founded in 2006 by architect Robert Noble, Beam Global originally operated under the name Envision Solar. Noble initially envisioned building structures to shield parked cars from the sun — a novel idea at the time, according to Wheatley in an interview with Renewable Energy magazine. Wheatley joined the company as a consultant in 2010, leveraging his experience in renewable energy and telecommunications infrastructure.

“Some of the leading investors in the company were looking for some help [to determine where the company would go from there],” Wheatley explained.

Aware of the difficulty of scaling architectural services, Wheatley proposed reorienting the company. Since 2011, Envision Solar (renamed Beam Global in 2020) has focused on EV infrastructure powered by renewable energy rather than grid electricity.

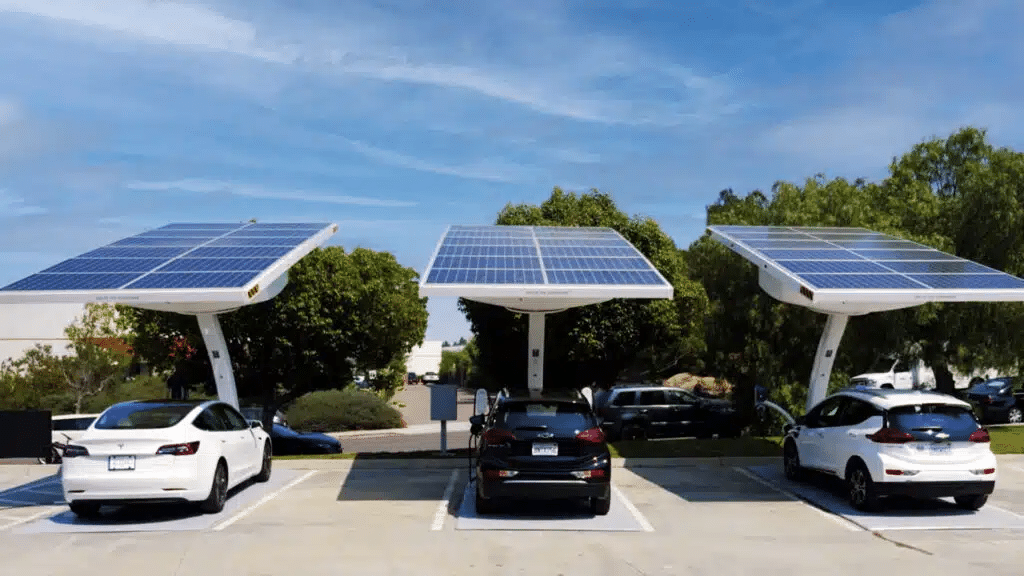

Its first products included the Solar Tree energy generation and storage system and the autonomous EV charging station EV ARC (invented by Wheatley, according to the company). The EV ARC resembles a streetlamp with a big canopy that shades the parking spot below while allowing multiple vehicles to charge. Unlike other market solutions, it does not obstruct parking spaces.

“Some people say we have a kind of Apple looking product… Most people like the way it looks,”Wheatley wrote.

Beam emphasizes that its products are quick to deploy and scale. Wheatley believes companies must be prepared to act rapidly when demand arises.

“The consumer is an impatient animal. Leaders need to position their company to be ready to go as soon as the need, or the want, for your product or service is there,” he said.

Beam’s systems operate on renewable energy, eliminating the need for trenching, concrete, wires, construction permits, and utility payments — a process that can take up to two years. They are particularly useful in places where grid connection is costly or where grid reliability is critical. For example, during the 2020 pandemic, EV ARCs served as emergency centers for power and vehicle charging. They also supported Florida authorities during Hurricane Helene. EV ARCs are easy to move. This feature is useful for Beam’s clients, many of whom operate on leased properties, the company noted.

Beam’s website lists its 170 clients, ranging from Google and pharmaceutical giant Pfizer to NASA, the cities of New York and San Diego, and the state of California. However, its largest client is the U.S. government, represented by various agencies and departments. For instance, in 2024, the U.S. Department of Homeland Security ordered EV ARCs and transport trailers from Beam worth $4.8 million (the fifth-largest contract in the company’s history) for the Customs and Border Protection Service, the Coast Guard, the U.S. Secret Service, and other agencies. In 2023, CEO Desmond Wheatley noted that since the pandemic, government contracts have accounted for the majority of the company’s sales.

The company’s top line has shown double-digit amd even triple-digit growth in recent years. In 2020, Beam made $6 million, which grew to $9 million in 2021. In 2022, revenue soared 144% to reach $22 million, followed by 206% growth in 2023 to $67.4 million. The company expanded its order portfolio, entered new regions, and completed several acquisitions, according to its public communications.

In 2022, Beam acquired All Cell Technologies, a manufacturer of lithium-ion batteries, for $30 million. These batteries are used in drones, underwater vehicles, medical equipment, and EV ARCs, the company stated. The following year, it purchased the European company Amiga, a producer of steel structures with integrated electronics, such as streetlights and cell towers. The acquisition, costing approximately EUR10 million, was reported by tech.eu and aimed to accelerate Beam’s entry into the promising European market, the company explained.

Like Citigroup bikes in New York

In the third quarter of 2024, Beam reported $11.5 million in revenue, a 30% decline year over year. The company attributed this drop to election uncertainty and the need to upgrade EV ARCs to meet new certification requirements. However, the gross margin for the same period rose 9 percentage points to 10.7% of revenue. Beam has no debt and has access to an unused $100 million credit line. According to Crunchbase, the company has raised $105.6 million across six funding rounds. In 2019, Beam sold shares for $12 million and announced an uplisting, moving its stock from the over-the-counter market to Nasdaq’s main bourse.

Wheatley described the third quarter as an unprecedented period of geographic and product expansion for the company.

In September, Beam acquired Serbia’s Telcom (the price tag was not disclosed), which develops and manufactures specialized power electronics, including inverters, charge controllers, power supplies, and LED lighting. Previously, Beam used third-party electronic components — now, these can be replaced with in-house solutions, the company explained.

In November, Beam signed its first sponsorship deal with the Serbian insurance company Globos Osiguranje to install five EV ARC units at Belgrade Airport. Sponsorships are an old idea of Wheatley. Traditionally, EV owners pay for energy on a per-unit basis, but such a business model takes around 30 years to pay off, as companies must invest heavily in infrastructure, he explained. According to Wheatley, industries with a “great deal of value, but as yet not much money” need a different business model. A sponsorship with a corporate client is one such model. Similar approaches are used by corporations working with stadiums and other venues. For example, Citigroup’s partnership with New York City: In 2012, it paid $41 million for the right to advertise on New York City’s public bikes for five years and later extended the deal for $70 million for the 2019-2024 period, Beam noted. In these arrangements, a corporate client sponsors system installation, puts ads on it, while the energy can effectively be provided for free, Wheatley described. For Beam, the advantage of this business model is stable and predictable revenue.

Apart from Globos, Belgrade Airport is also part of the deal. The airport is managed by VINCI Airports, an operator of over 70 airports in 14 countries. Under the agreement, the collaboration in Belgrade could be extended to other airports within the holding.

In the same third quarter of 2024, Beam launched four new products: BeamSpot for roadside EV charging (integrated, for example, into streetlight poles), BeamBike for e-bike charging, BeamPatrol station for law enforcement, and the BeamWell desalination system for war zones and areas with humanitarian crises.

The company received its first BeamSpot order, just a month after its launch, from a Fortune 500 company (neither the client nor the deal amount was disclosed). Humanitarian organizations are expected to be the first buyers of BeamWell for use in the Middle East.

The potential

“We will never satiate the demand in our wildest dreams because of the sheer volume of requirements for EV charging,” Wheatley said.

Beam has production facilities in Europe and manufactures several hundred EV ARCs annually at its San Diego plant, with the capacity to increase output to approximately 4,000 units.

“I believe, I’ll end up having to build 10 factories like this across the U.S. and even then we won’t be able to keep up with the demand,” Wheatley remarked.

Beam considers its products unique. They do not compete with EV charging companies, as Beam incorporates EV chargers into its systems. Utility companies are also not competitors — they are clients. Companies like Schneider, Eaton, Enel X, and Bosch offer solutions in the renewable energy market but lack EV charging services. Some companies provide both services and equipment for EV charging but do not handle installation. Beam, in contrast, does all of the above while utilizing proprietary patented components, which the company believes protect it from competitors.

Regarding Beam’s future, Wheatley says: “Is it impossible that at some time in the future, Beam Global owns a fleet of light electric aircraft that we use as a taxi service or a rental service? It’s definitely not impossible. That’s not one of my plans right now, but this just gives you an indication of how expansive our views are.“

For investors

Wall Street sentiment toward Beam Global is favorable. Five out of six analysts tracking the company have a “buy” call, according to MarketWatch. The other recommendation is a “hold.” The average target price for Beam is $8.40 per share, nearly three times the current market price.

According to Insider Monkey, as of the second quarter, two hedge funds held Beam shares in their portfolios. The publication ranked Beam as one of the 10 best companies involved in EV charging.

In November, Freedom Broker reiterated its recommendation to buy Beam while lowering its target price from $8 to $7 per share — still offering 134% upside. The target price revision reflects deferred demand for Beam’s flagship EV ARC product from government clients, which is likely to materialize only in 2025, analysts explained. They also downgraded their revenue forecasts for Beam in the coming years. For 2025, they now project $92.7 million, 17% lower than their previous estimate.

However, Freedom Broker expects further margin expansion for Beam, to approximately 12% in 2024 and 17% in 2025, partly driven by acquisitions. It noted that management’s strategic goal is a 50% margin. Among the key risks for the company are declining government interest in its products, Freedom Broker points out, though that looks unlikely judging by the company’s latest developments.