Nvidia-backed data center builder Applied Digital to raise up to $5 billion; shares rise

Applied Digital, a builder of data centers, whose shares are held by AI chip market leader Nvidia, has reached an agreement for Australia-based Macquarie to invest up to $5 billion in Applied Digital’s AI data center projects. Following the news, Applied Digital stock surged almost 10% before giving back around 6% in premarket trading the next day.

Details

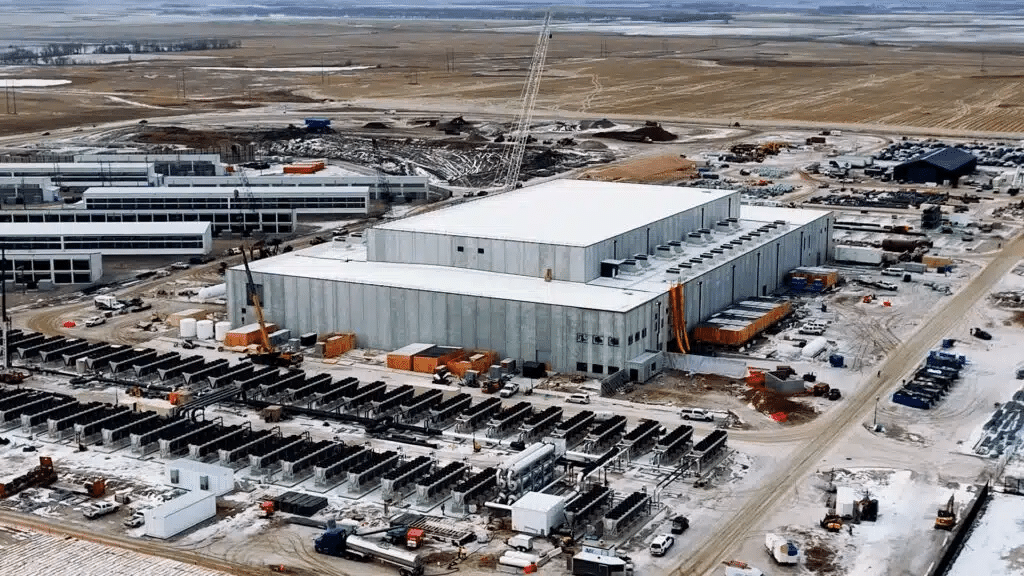

On Tuesday, January 14, Applied Digital (AD) announced that funds managed by Macquarie Asset Management had agreed to invest up to $900 million in AD’s high-performance computing (HPC) data center campus, which is being built in Ellendale, North Dakota. Macquarie also has the right to invest up to an additional $4.1 billion in other AD data center projects, selected at its discretion, over the next 30 months.

In return, the Australian firm will receive AD preferred shares and a 15% common equity stake in an AD subsidiary, APLD HPC Holdings LLC, which focuses on building HPC data centers. Applied Digital will retain the remaining 85% stake in the subsidiary. The preferred shares will accrue a 12.75% annual dividend.

Applied Digital plans to use the proceeds to complete the buildout of its Ellendale data center, repay a bridge loan of about $180 million, and thus recover over $300 million of its equity investment, according to the press release.

“As the demand for AI innovation accelerates, we believe Applied Digital will stand out as a leader in delivering next-generation data center solutions and GPU cloud services,” the company said.

Financial performance

On Tuesday evening, AD released its financial results for the fiscal-2025 second quarter (ended November 30). Revenue grew 51% year over year to $63.9 million, while its negative $138.7 million bottom line was 13 times the size of the net loss in the previous-year period. Still, the per-share adjusted loss of $0.06 was narrower than analysts’ estimates of $0.14 (more than double the actual figure), as noted by Barron’s.

In November, AI chip and GPU manufacturer Nvidia disclosed its investments in AD. As of September 30, 2024, Nvidia owned 7.72 million AD shares worth about $63.7 million, equivalent to a roughly 3% stake.

Market reaction

On Tuesday, AD stock jumped 10% to $8.54 per share before dropping nearly 6% in premarket trading today, Wednesday, January 15. It is now up about 66% over the last 12 months.

The eight analysts who cover AD unanimously rate it a “buy.” Their average target price of $11.50 per share suggests 35% upside versus the last closing price.