Why Kazakhstan’s monetary policy remains so hawkish

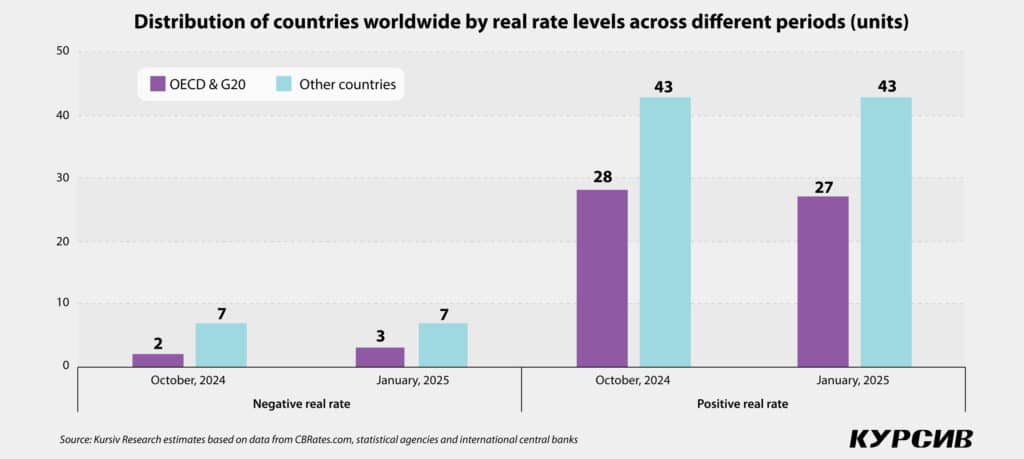

Borrowing is becoming increasingly expensive for Kazakhstani businesses, even compared to other developing countries. In the fourth quarter (Q4) of 2024, regulators worldwide largely eased monetary policy, either reducing base rates or keeping them unchanged amid stabilized inflation. However, Kazakhstan stood out as one of only seven countries that did not follow this trend.

How have base rates changed around the world?

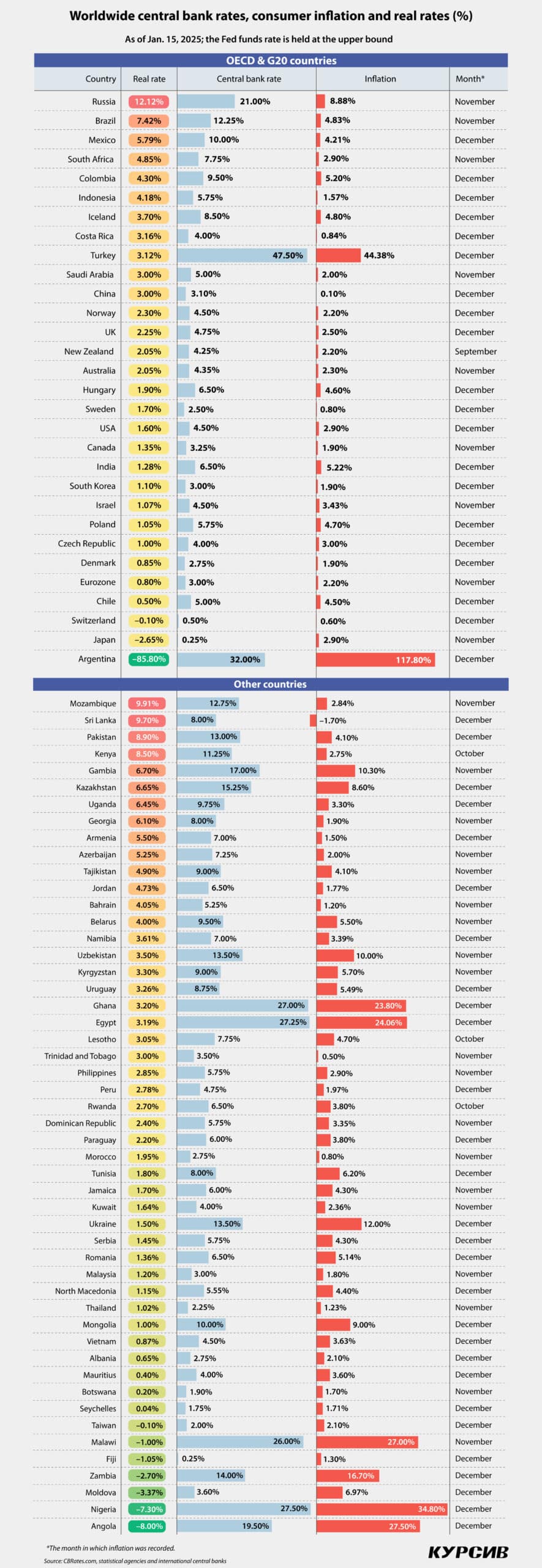

Kursiv Research presents its quarterly analysis of three key metrics of monetary policy in 80 jurisdictions around the world: the level of central bank base rates, the trends in consumer inflation in annual terms and the differential between these values, also called the real rate.

In mid-January 2025, the median value of base rates in these countries was 6.0% (compared to 6.5% in October 2024), while median inflation stood at 3.4% (down from 3.6%) and the median real rate was 2.1% (previously 2.2%).

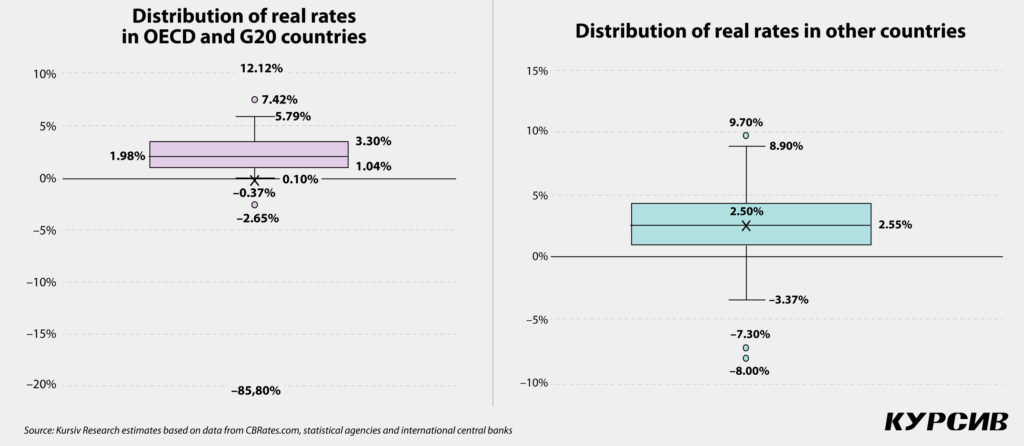

Most economies continue the trend toward lowering base rates. In a group of 30 economies representing OECD countries and other large markets (OECD+), during Q4 2024, 20 central banks cut rates and only two raised them. Among a group of 50 developing economies (including Kazakhstan), 16 central banks lowered interest rates, while five, including Kazakhstan, raised them. As a result, the median real interest rate in the OECD+ group was 2.0%, compared to 2.6% in the group of developing countries.

In developed countries, inflation has stabilized at levels above the target and shows growth potential. In the U.S., inflation at the end of December stood at 2.9% (up from 2.7% in November), with food inflation at 2.5%, energy at -0.5% and services at 4.4%. The personal consumption expenditures index (PCE), which is the Federal Reserve System’s (the Fed) primary focus, increased by 0.3 percentage points (p.p.) between September and November, reaching 2.4% year-on-year (YoY). Its core component rose by 0.1 p.p., bringing the annual value to 2.8%. Across the main and additional inflation indicators, the primary driver has been paid services: while goods prices in the PCE index declined by -0.4% in November, service prices grew by 3.8% YoY.

In the U.K., prices increased by 2.5% in late December, slightly down from 2.6% in November, mainly due to higher transportation costs, while price growth in hotels and catering slowed. Final data for the Eurozone in December is expected soon, but preliminary figures indicate that inflation rose from 2.0% in October to 2.2% in November and 2.4% in December, driven by higher prices for services and energy products. The Fed will make its next rate decision on Jan. 29, the European Central Bank (ECB) on Jan. 30 and the Bank of England (BoE) on Feb. 6.

Persistently high price trends and the anticipated increase in tariffs on U.S. imports — planned by the incoming administration of President-elect Donald Trump on key trading partners such as China, Canada and Mexico — are prompting macroeconomists to revise their 2025 rate cut forecasts to more modest expectations: from four rounds of monetary easing to just two.

Meanwhile, developing countries are experiencing mixed trends. Among the central banks that raised rates were the Bank of Russia, the Bank of Brazil, the National Bank of Ukraine and the National Bank of Kazakhstan. All of these countries, except Kazakhstan, are showing steady inflation growth.

In Russia, as of November 2024, inflation increased by 8.9% YoY, driven by strong consumer demand supported by an 8.9% rise in real income (based on January-November data) amid high labor demand. The country’s economy is currently in an overheating phase. According to estimates by the Russian Ministry of Economic Development, the cumulative growth rates for 11 months of 2024 were: industrial production at 4.3%, retail trade at 7.4%, construction at 2% and the overall economy at 4.0% YoY. Russia’s central bank is expected to further tighten monetary policy, with its next key rate decision scheduled for Feb. 14. Following the increase at the end of last year, the real rate in Russia now stands at 12.1%.

In the countries with the highest inflation, Argentina and Turkey, the situation is stabilizing. Argentina’s authorities successfully slowed inflation from 209% in September to 117.8% in December. However, the real rate remains significantly negative at -85.8%. In Turkey, inflation decreased by 5 p.p. over the last quarter, reaching 44.4%. Despite this, Turkey’s central bank maintains a formally tight monetary policy with a base rate of 47.5%. The actual conditions are much more moderate, with the real rate at +3.1%.

How will the rate change in Kazakhstan?

The key macroeconomic development in Kazakhstan during the recent quarter was the depreciation of the tenge, which declined by 6% between late November 2024 and mid-January 2025. To ensure a «soft landing» for the tenge, the National Bank intervened several times. In November, it sold approximately $1.2 billion from foreign exchange reserves (including transactions to purchase shares of Kazatomprom using the National Fund’s assets) and in December, it sold an additional $308 million.

Amid the exchange rate correction, Kazakhstan’s National Bank revised its short-term inflation forecast. Previously expected at 5.5% to 7.5% by the end of 2025, the November update to its monetary policy report now projects inflation at 6.5% to 8.5%. Surveys of inflation expectations among the population and experts also show an upward trend. In December, participants in the National Bank’s macroeconomic survey raised their inflation expectations from 6.9% in November to 7.5%. Households were less affected by the inflation shock, with their inflation expectations for the year adjusted slightly, from 14.1% in November to 14.6% in December. Meanwhile, perceived inflation remained almost unchanged in December, at 13.2%, up from 13.0% in November.

Based on the values reported in the National Bank’s surveys over the past year, it would be inaccurate to suggest a significant rise in inflation expectations among the population at this time. One year ago, with actual inflation at 9.8%, perceived inflation stood at 18.2%, while expected inflation was 16.4%. At the lowest point, in October 2024, with actual inflation at 8.5%, perceived and expected inflation were 12.7% and 12.5%, respectively. Despite a notable correction in the exchange rate, nothing resembling the acceleration of inflation expectations seen at the end of 2021 has been observed.

Instead, we are facing persistently high inflation expectations from households, driven by a significant increase in government spending over the past five years and the effects of rising housing and utility rates to support the aging assets of natural monopoly entities. Experts continue to debate how much room Kazakhstan’s primary monetary policy tool, the base rate, has in this environment.

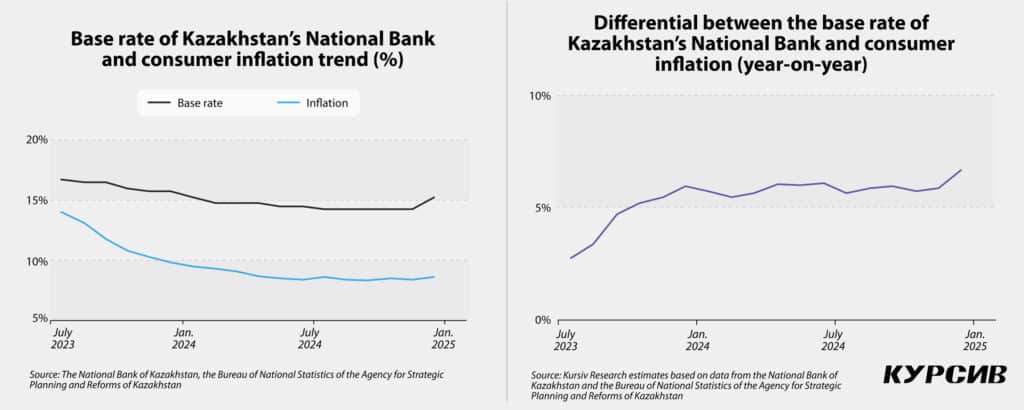

Operational indicators suggest that consumer inflation in Kazakhstan, like in most countries globally, has stabilized: in December 2024, prices rose by 8.6% YoY, compared to 8.4% in November. Monthly consumer inflation has remained relatively high for the third consecutive month, aligning with seasonal trends at 0.9% month-on-month.

Even without the seasonality factor, Kazakhstan’s economy continues to experience consistent price pressure: core inflation (excluding prices for energy products, fruits and vegetables) reached 7.6% YoY in December, up from 7.5% in October and November.

Nevertheless, there is limited room for tightening monetary policy. Following the 1 p.p. increase in the base rate to 15.25% in November, the real rate reached 6.65%, the highest level in the past three years. Compared to other developing countries, Kazakhstan’s National Bank appears to have one of the most restrictive policies.

The National Bank now faces a difficult decision: either continue making money more expensive, which could reduce investment activity in the real sector, or allow the economy to catch its breath.