Where will Kazakhstan’s $28 billion infrastructure plan go?

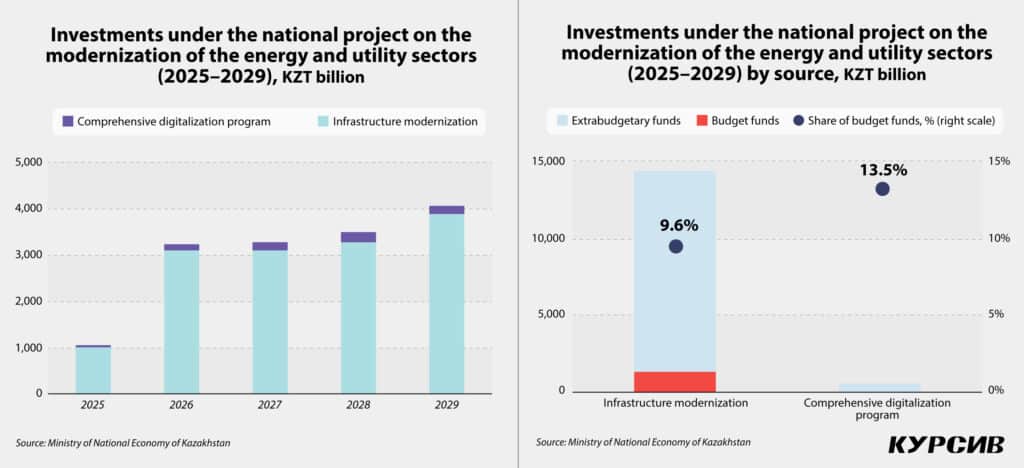

Kazakhstan’s national project for the modernization of the energy and utility sectors, adopted at the end of 2024, marks the launch of the most significant investment cycle in the country’s housing and utility infrastructure in decades. Between 2025 and 2029, 15.1 trillion tenge (approximately $28 billion) will be allocated for constructing new power plants and upgrading heating, electricity, water supply and wastewater networks. Notably, 10% of these funds will come directly from the state budget.

Overview of the national project

The national infrastructure project, adopted by a government decree on Dec. 25, 2024, and published in early January 2025, was developed in response to an audit of Kazakhstan’s domestic housing and utility systems. This review followed a winter plagued by numerous infrastructure failures in 2023. Over the past year, the five-year plan was crafted under the supervision of Deputy Prime Minister Kanat Bozumbayev. The project encompasses medium-term initiatives from various entities, including regional heating and electricity grid operators, water utilities, the main power grid operator KEGOC and energy-producing organizations under holdings like Samruk-Energo and KKS (Kazakhstan Utility Systems).

The primary objective is to modernize existing energy and utility assets, focusing on at least 200 natural monopoly entities and 30 combined heat and power plants. By the end of the project, the government aims to reduce infrastructure-related accidents by 20% and lower the average depreciation rate of energy and utility assets nationwide to 40% from 2023 levels.

The scale of this national project is nearly unmatched in Kazakhstan’s history of state programs. For context, the 15.1 trillion tenge allocated is equivalent to 80% of the country’s total fixed capital investment in 2024. Moreover, the funding for the energy, water supply and wastewater management sectors in the next five years will be 2.3 times greater than the total investments made in these sectors between 2020 and 2024.

Funding sources

The project is designed to rely primarily on extra-budgetary funding, with the government allocating approximately 1.5 trillion tenge (about $2.8 billion) from the national budget, representing just 9.8% of the total funding. However, the public sector will continue to play a significant role within the extra-budgetary funding structure. This includes projects led by national companies, such as eight KEGOC initiatives valued at approximately $2 billion, as well as funding through the state budget and financial instruments managed by Baiterek Holding, the financial operator of the national project.

Seven mechanisms for financing the projects have been outlined:

- Direct lending to projects led by natural monopoly entities.

- Financing through the purchase of municipal bonds by the Kazakhstan Housing Company (KHC) and the Development Bank of Kazakhstan.

- Budget lending.

- Capitalization of monopolies via akimats (local administrations).

- Syndicated financing.

- Redemption of monopolist bonds by development institutions (if the monopolist is a private company).

- Subsidized leasing for coal generation projects.

Despite the diversity of these mechanisms, enterprises will not have the liberty to choose their financing method. Regions with greater financial stability (determined by the project developers) will utilize rate increases and funds from development institutions to mitigate price growth trends. Networks owned by akimats will be funded by local executive bodies, with their bonds purchased by the KHC. Conversely, enterprises in less prosperous and sparsely populated regions will rely on direct budget financing.

The project also permits the use of funds from Kazakhstan’s National Fund and the Unified Accumulative Pension Fund (UAPF) through targeted transfers or the redemption of Baiterek bonds.

Targets for investment

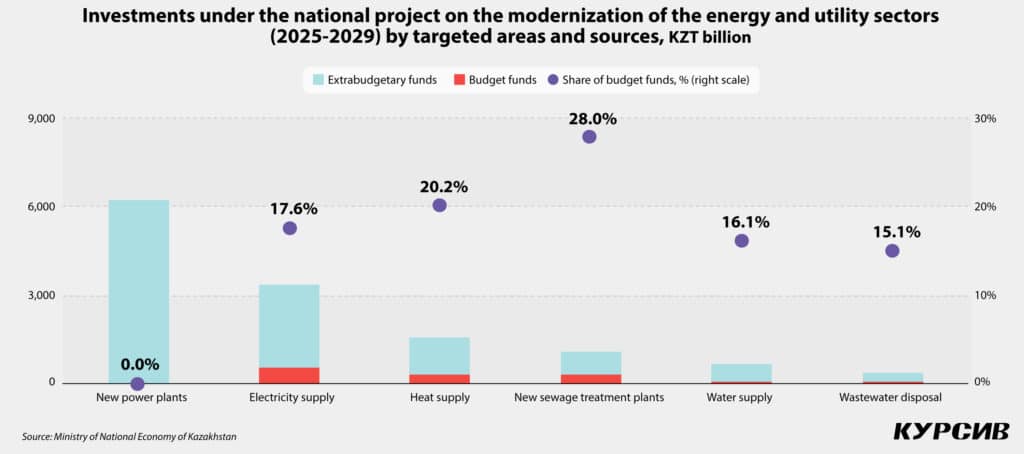

The national project focuses on two primary goals: the modernization of infrastructure and the comprehensive digitalization of the upgraded sectors. Approximately $1.3 billion of the total project budget will be allocated for digitalization efforts, while the remaining $27 billion is designated for modernization.

Key investment allocations include:

- Construction of new power plants – approximately $12 billion.

- Modernization of power supply networks – $6 billion (18% funded by the government).

- Upgrading heating networks – $3 billion (20% funded by the government).

- Construction of new wastewater treatment facilities – $2 billion (28% funded by the government).

- Modernization of water supply systems – $1.3 billion (16% funded by the government).

- Upgrading wastewater disposal systems – $700 million (15% funded by the government).

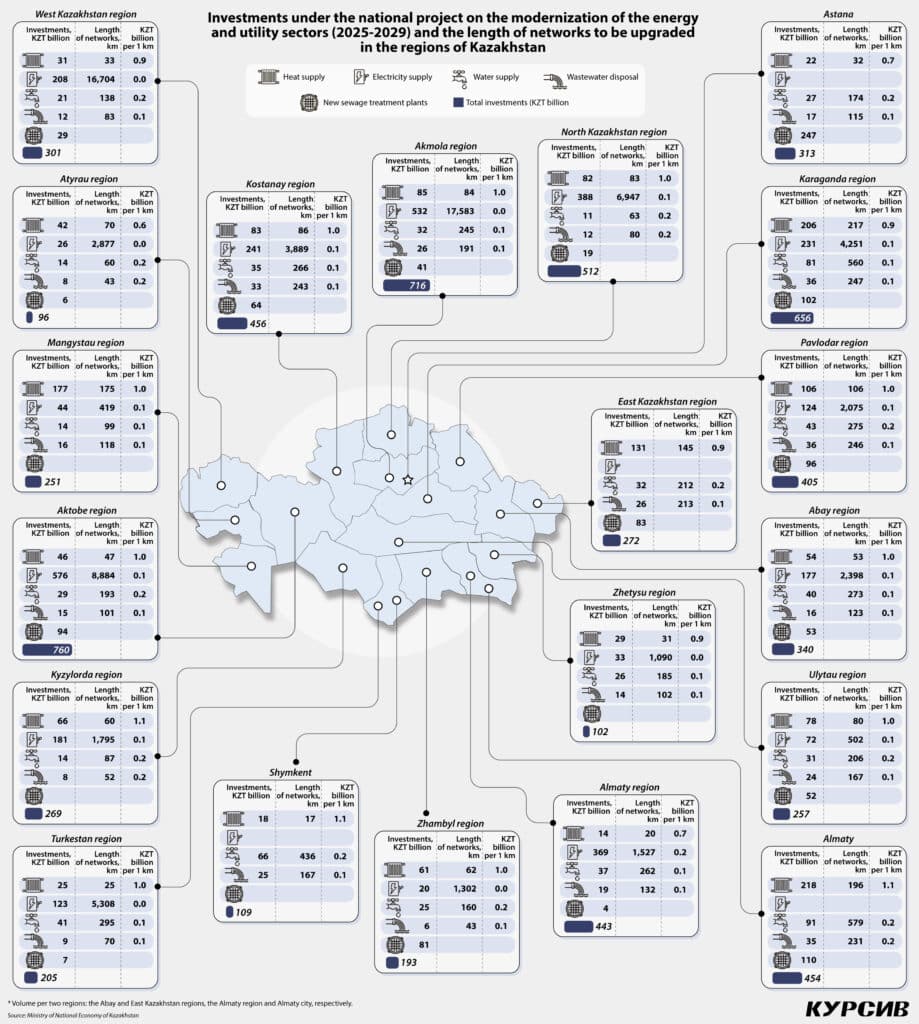

Based on the total cost of investment projects by region, the average cost of modernizing one kilometer of network infrastructure varies significantly by sector:

- Heating networks – approximately $1.9 million per km.

- Power grids – $190,000 per km.

- Water supply networks – $300,000 per km.

- Wastewater disposal systems – $190,000 per km.

These investments are expected to reduce network wear and tear by 2029 as follows: by 21 percentage points (p.p.) to 45% in electricity supply, by 12 p.p. to 42% in heat supply, by 15 p.p. to 41% in wastewater disposal and by 7 p.p. to 33% in water supply.

Notably, uniform wear and tear levels for all housing and utility networks were not specified. For operational purposes, the cabinet classifies natural monopoly entities into risk groups based on wear and tear levels: up to 55% is classified as «green,» 55% to 65% as «yellow» and over 65% as «red.»

«The existing classification by wear and tear levels does not always reflect the real degree of risk, especially in cases where the technical condition of facilities may deteriorate due to insufficient funding at all stages of modernization,» the project document highlighted. «Sometimes, entities classified at the yellow level may actually be closer to a critical state, requiring a more cautious approach than just long-term planning.»

Objective data on the state of housing and utility networks is still being collected, and improvements in digitalization across enterprises are expected to provide a clearer picture.

Regions such as Akmola, Aktobe, Karaganda and North Kazakhstan will collectively receive approximately $5 billion over five years for the modernization of housing and utility networks. These areas were among those most significantly affected by last year’s flooding. Meanwhile, just under $900 million will be allocated to the energy and utility sectors of the Kostanay, Pavlodar and Almaty regions, as well as Almaty city.

A key part of the plan is to promote domestic manufacturers, whose share in procurement by the end of the national project is targeted to reach 60%. To achieve this, a national electronic platform will be launched, showcasing the products of Kazakhstani companies.

According to the project document, «The purchase of products for the modernization of energy and utility infrastructure from imported sources is permitted only if these products are unavailable on the electronic platform or if domestic producers are unable to supply the required goods.»