In 2024, the number of automated teller machines (ATMs) in Kazakhstan decreased by 0.6% year-on-year (YoY) to 12,569 machines. This decline is occurring while the cash-out share in the payment card transaction composition has stabilized. Kursiv Research is trying to figure out whether this is the end of ATMs as demand for their services is shrinking or just another pause before further expansion.

The decline in the number of ATMs in Kazakhstan is one of the consequences of growth in online banking services. According to Kazakhstan’s National Bank, cashless transactions accounted for 87% of all card transactions in Kazakhstan last year. These include internet payments, smartphone transactions, as well as transactions via POS terminals or QR codes.

Even though the increase in cashless transactions has been driven by overall digitalization, the COVID-19 pandemic was a pivotal moment. In 2020 alone, the share of cashless transfers soared from 46% to 67% within the card transaction composition. The figure then reached 78% over the following year and rose to 86% by 2023.

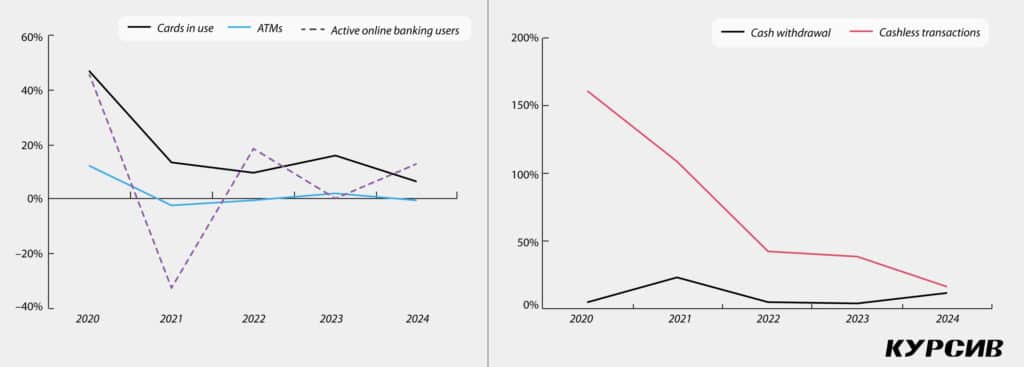

The average annual increase in cashless transactions amounted to 73% from 2020 to 2024. However, this sharp growth simmered down by the end of the timeline. While in 2020, the cashless turnover soared by 160%, in 2024, the growth pace slowed to 16% YoY. During the same period, the number of banking cards in use across Kazakhstan showed an average annual increase of 19% YoY (with a 6% increase in 2024). The number of operating POS terminals grew by 57% (compared to 31% in 2024) and the number of active online banking users increased by 9% (13% in 2024).

The lion’s share of cash-related card transactions is carried out through ATMs (85%). Over the period from 2020 to 2024, the number of withdrawals showed a moderate growth of 10%. Notably, the amount of money withdrawn from ATMs demonstrated a similar growth rate. Despite the rapid development of online banking, Kazakhstanis withdrew 22 trillion tenge (approximately $44 billion) via ATMs in 2024. The number of transactions decreased by 6% YoY on average, though.

Hence, the average amount of a single withdrawal transaction increased from 51,000 tenge to 93,000 tenge (around $102 to $186), reflecting an 81% increase over the period from 2020 to 2024. This trend was driven not only by the price surge but also by a 56% increase in cumulative inflation from December 2020 to December 2024.

This data suggests that these factors contributed to the decline in the number of ATMs after it peaked in 2023. However, it may be too early to talk about a «peak ATM» moment in Kazakhstan, as we would normally talk about «peak oil.»

First, the decrease in the number of ATMs doesn’t prove that their time is gone. In 2021, for instance, their number saw a 2.2% YoY decline to 12,278 machines but then restored within two years.

Second, the annual decline in ATM withdrawals was minimal in 2024, at roughly 1%, compared to 9% in 2023 and 4% in 2022. This signals a new normal and the stabilization of the cash share in total card transactions, which has remained stable at 12% to 13% for the second year in a row.

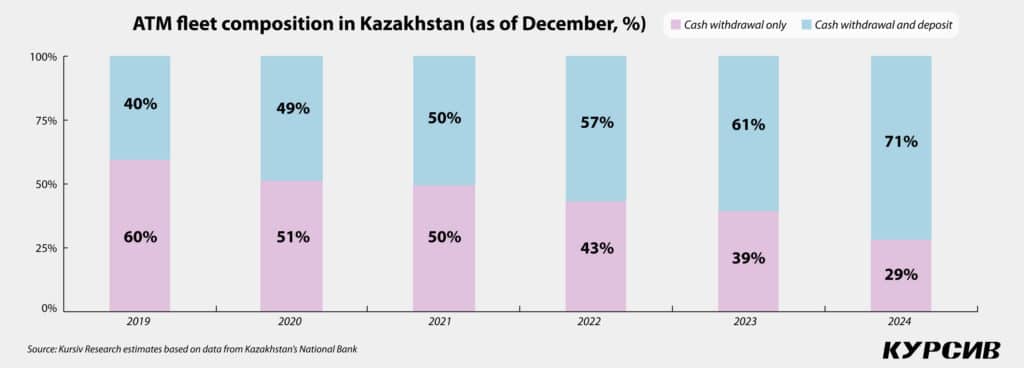

A growing sector can be seen within the ATM fleet composition, consisting of machines that support both cash withdrawal and deposit transactions. The number of cash machines of this type has doubled since 2019, with their share in the entire fleet hiking from 40% to 71%. It is likely that banks are upgrading their fleet by replacing less-functional machines with more advanced ones.

This assumption is confirmed by comments from market players. Freedom Bank, which began developing its branch network in the past couple of years, highlighted that as of the end of 2024, it had 91 cash machines in its possession.

«Every device supports both cash-in and cash-out options,» Freedom’s press service told Kursiv.media. «We aim to expand our ATM network in 2025. This strategy is primarily related to the fact that the bank is trying to take into account the interests of those clients who prefer traditional banking services while offering its online products and services.»

«Until 2018, 285 ATMs supporting only the withdrawal function operated in Kaspi Bank offices. They were capable of performing basic tasks and were located exclusively inside the bank’s branches. In 2018, we initiated a massive upgrade of the network, replacing outdated devices with modern cash recyclers that support both cash-in and cash-out. In the first stage, 285 machines were replaced,» Kaspi reported. «Since 2019, we have been actively expanding our network to meet our clients’ needs and the growing number of payment transactions. As of today, it consists of 3,300 state-of-the-art cash machines, ensuring convenient service for our valued clients.»