Kazakhstan’s exports soar by 66% in the first quarter of 2022

During the first three months of the current year, Kazakhstani exporters reported a record surge in exports thanks to favorable prices for commodities on the global market.

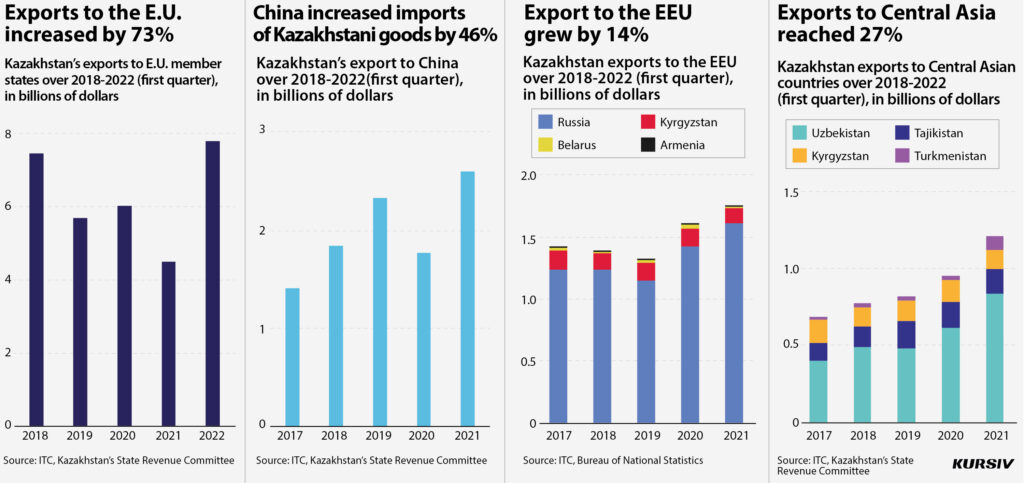

Kursiv Research is presenting this year’s first review of Kazakhstani exports to identify the key points of growth. Over the period from January to March, Kazakhstani exports grew by 65.8% and reached $19.1 billion – a five-year record. Energy products became key drivers of that surge. They have been on their high since March due to the Russian invasion of Ukraine.

Stable oil price and sulfur

Oil is the key export article for Kazakhstan which brought the country $11.1 billion (+98%) of revenue over the first quarter of 2022. The OPEC+ megadeal became one of the main drivers that contributed to the twofold growth in Kazakhstan’s oil export revenue at the beginning of the year. In March, amid the war in Ukraine, the oil price hit $120 per barrel, a ten-year record. As a result, Brent crude oil cost $99 per barrel during the first quarter (+63.4%).

However, the high oil price isn’t the only driver for the growth of exports in Kazakhstan. Oil and gas condensate output over that period increased to 22.7 million tons (+7.4%) thanks to Kashagan and Tengiz oil fields, according to KazMunayGaz, a national oil company in Kazakhstan.

Copper is the second most highly-demanded commodity exported by the country. However, as the Kursiv Research uses HS code to make this review more detailed, the top ten commodities of the review include two copper positions at once: cathode copper (second position) and copper ore and concentrates (seventh position). Both export positions brought the country about $1.3 billion in the first quarter.

Amid the surge in copper prices to almost $10,000 per ton on average (+17.8% over the same period last year), Kazakhstani exporters were able to earn 22.4% more revenue (about $857 million) by exporting cathode copper and reached 47.4% growth in revenue ($431 million) from copper ore export if compared to last year’s figures. It is worth noting that over the first quarter the physical volume of cathode copper exports changed just slightly (+1.9%), while copper ore export was increased by one-third.

On the other hand, the melting of refined copper, crude copper and non-alloyed copper in that period dropped by 0.4% while production of copper concentrate surged by 19.7%.

In contrast, ferrous metal producers reported low demand (global ferrous metal prices dropped by 14.8%) and a plunge in domestic production. Production of iron-ore concentrate and sintered iron-ore dropped by 8.7% and 4% respectively, while iron pellet output increased by 2.3%. On the other hand, production of the third most demanded commodity – ferrochrome – surged by 55.8% and reached $592 million in revenues.

In the wake of the first quarter, Kazakhstan reported a surge in export of all key products including wheat (+112.1% up to $565 million), uranium (+193% up to $349 million), natural gas (+20.4% up to $320 million), crude zinc (+65.8% up to $220 million) and petroleum oil (+33.1% up to $210 million).

Surprisingly, sulfur became one of the top ten most popular export commodities. Over the first quarter of 2022, the country exported much more sulfur than the same period last year (+263.1%) and earned $199 million. The main contributor to that increase was Tengizchevroil which put into service a new manufacturing site at Tengiz last year. The plant produces 40,000 tons of sulfur granules per month. Almost all this additional volume of sulfur was bought by traditional importers of the product: Brazil (increased imports of Kazakhstani sulfur sevenfold), Israel (fivefold increase), Morocco (fourfold growth), Russia and the U.S. (threefold increase).

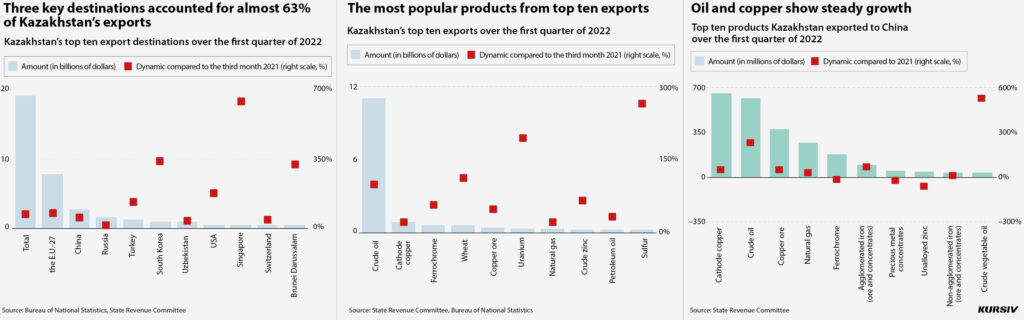

In general, the top ten most popular exported goods accounted for 77.4% of Kazakhstan’s exports over the first quarter. Last year this rate was 71%. The concentration of exports was a result of a sharp surge in oil prices.

The U.S., Singapore and Brunei

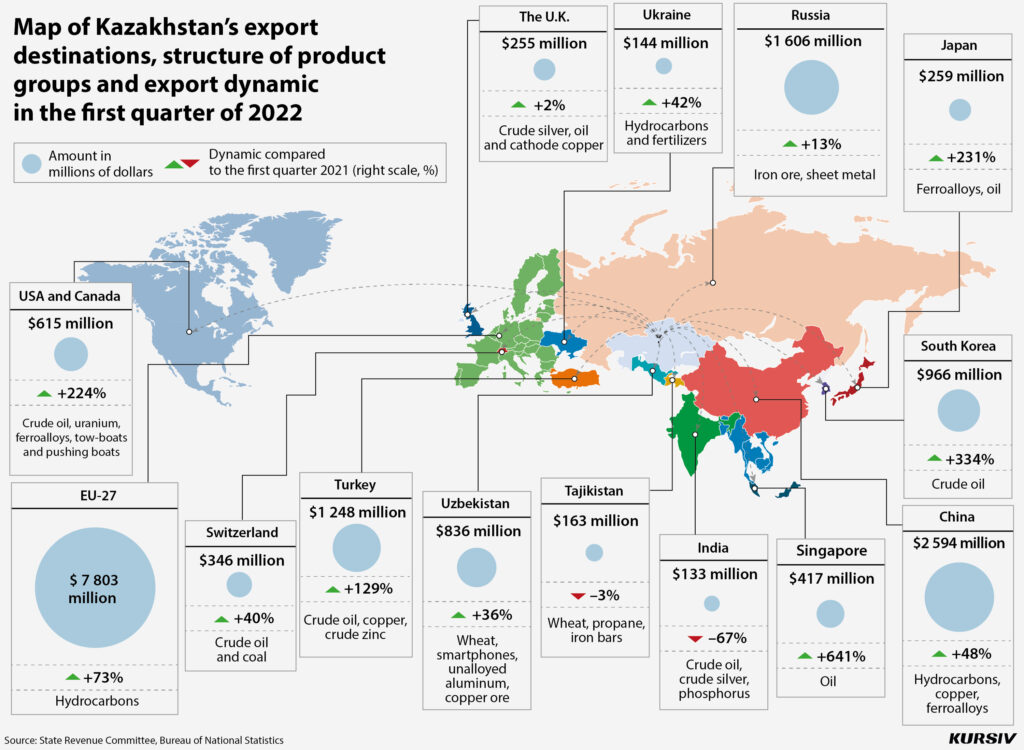

Both geographical and commodity concentrations over the covered period were quite high. Three key destinations for Kazakhstani exports – the E.U., China and Russia – accounted for 62.8% (a five-year record) of all export transactions during the first quarter, although last year this rate was even bigger – 66.6%.

The European Union is the key trading partner of Kazakhstan. Europeans are very interested in Kazakhstani oil; the share of hydrocarbon fuel accounted for 88.6% of transactions between the E.U. and Kazakhstan over the period from January to March. Thanks to these deals the country earned $6.9 billion (+71% over the same period last year) even though the physical volume of oil export declined by 4% to 4.7 million tons.

China is the second-biggest foreign market for Kazakhstani hydrocarbons and metals. Over the first quarter of 2022, China increased its procurement of cathode copper by 46% (to $653.1 million), crude oil by 231.9% (to $618.8 million), copper ore by 51.4% (to $376.1 million), natural gas by 31.3% (to $266.1 million), agglomerated iron by 65.7% (to $98.9 million) and non-agglomerated iron by 9.9% (to $36.5 million). At the same time, shipments of ferrochrome dropped by 18.9% (to $180.8 million), precious metal concentrates by 24% (to $48.4 million) and unalloyed zinc by 59.9% (to $43.4 million).

Among others, the most popular products exported to China from Kazakhstan are sunflower oil and safflower oil. Chinese companies bought much more vegetable oil than last year (+532%), which brought Kazakhstan $36 million of revenue. However, experts doubt that this surge would last for long as China is already decreasing the procurement of vegetable oil from Kazakhstan.

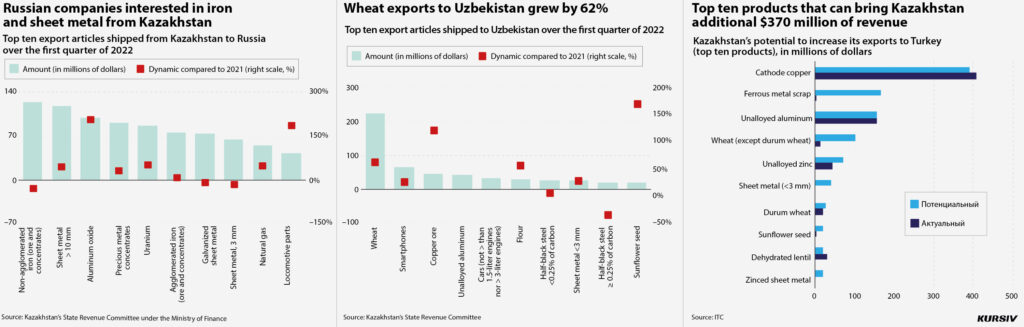

Russia is the third market for Kazakhstani export. Over the first quarter, however, exports to Russia showed moderate growth (+12.8%) if compared to the other top-ten export destinations. Amid the Western sanctions, the growth of the Russian economy has slowed down. In March this rate was 1.6% (year-on-year), although in January and February the Russian economy grew by 5.8% and 4.3% respectively. Russia continues to get revenue from export of its natural resources. However, Russian machinery manufacturing and metallurgy, which used to buy metal ore and concentrates from Kazakhstan, have cut their output.

The situation that the Russian economy finds itself in has affected Kazakhstani export as well. For example, the export of unalloyed iron, the key product Kazakhstan had exported to Russia in the past years, dropped by 31.6% (to $124 million). The export of zinced sheet metal products declined by 10% (to $73.3 million) while exports of sheet metal and steel with a thickness of three millimeters dropped by 17.8% (to $63.9 million).

On the contrary, export of sheet metal and steel with a thickness of 10-mm increased by 43% (to $117.7 million), aluminum oxide by 205.2% (to $99.2 million), precious metal concentrates by 29.2% (to $90.4 million), uranium by 51% ($86.2 million), agglomerated iron by 5.6% (to $75.4 million) and natural gas by 48.5% (to $54.1 million). Moreover, Kazakhstani export of locomotive parts to Russia grew by 184.9% (to $42.5 million).

At the same time, Kazakhstani exports to India, the U.K. and the U.A.E. over the first quarter of the current year have seriously declined. For instance, India cut its import of Kazakhstani oil by 67% as the country started to acquire more oil from Russia – amid western sanctions India is purchasing Russian oil at a big discount. Last year, the share of India in Kazakhstan’s oil exports was 95.5%.

This year, the biggest export destinations for Kazakhstan over the first quarter were the U.S. ($448.9 million), Singapore ($416.7 million) and Brunei Darussalam ($343.6 million). The U.S. imported from Kazakhstan mainly crude oil (70.4%) and ferrochrome (11.2%). Singapore and Brunei were importing only oil.

Kazakhstan focuses on Turkey

In early May 2022, President Kassym-Jomart Tokayev of Kazakhstan visited Turkey. Leaders of the two countries agreed to intensify the strategic partnership between Kazakhstan and Turkey and make the bilateral turnover reach $10billion (it was $4.1 billion last year).

Kazakhstan is ready to increase the export of 89 types of non-commodity products for $547 million in total. these include machinery, chemicals, metallurgy products, food and aerospace industry products. The governments of the two countries agreed to set up an interagency working group to find ways to expand and deepen the industrial cooperation between Turkey and Kazakhstan.

According to the International Trade Center (ITC), the easiest way for Kazakhstan to increase its export to Turkey is to expand exports of low-added-value products. For example, this might be ferrous scrap (the gap between the real export and potential export is $164.9 million), durum wheat and soft wheat ($97 million), sheet metal with a thickness of three millimeters ($41 million), unalloyed zinc ($27 million), sunflower seed ($22.3 million) and zinced sheet metal ($20 million).

In general, Kazakhstan can get an additional $662 million from the expanded export to Turkey if it succeeds in eliminating bureaucratic obstacles and improving the cooperation between Turkish and Kazakhstani companies. Currently, Turkey is ranked fourth in the top ten destinations for Kazakhstani exports. Turkish companies are interested in oil, copper and zinc. Over the first quarter of 2022, these groups of products accounted for 87.3% of all Kazakhstani export to Turkey.