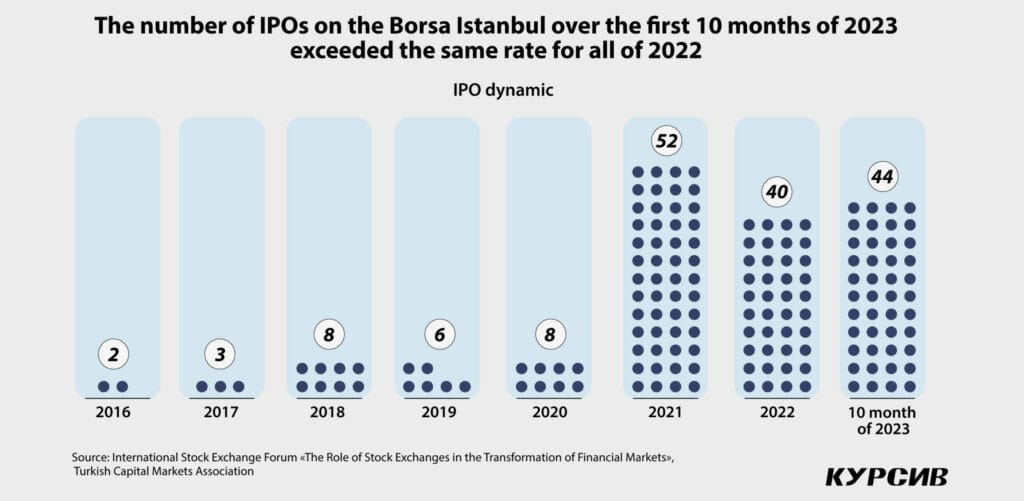

The Turkish market of IPOs has demonstrated record-high results this year, both in terms of the number of companies that went public and the amount of funds that have been raised. In 2023, Turkish companies raised more than $2.3 billion through IPOs.

In November, Borsa Istanbul conducted an opening bell-ringing ceremony at least once a week celebrating the start of trading with a new stock.

Over the period from January to October 2023, 44 companies went public at Borsa Istanbul compared to 40 companies in the entire year of 2022, according to Mahmut Aydogmus, director of the International Relations Department at Borsa Istanbul, who took part in the International Exchange Forum in Almaty.

Listing for everyone

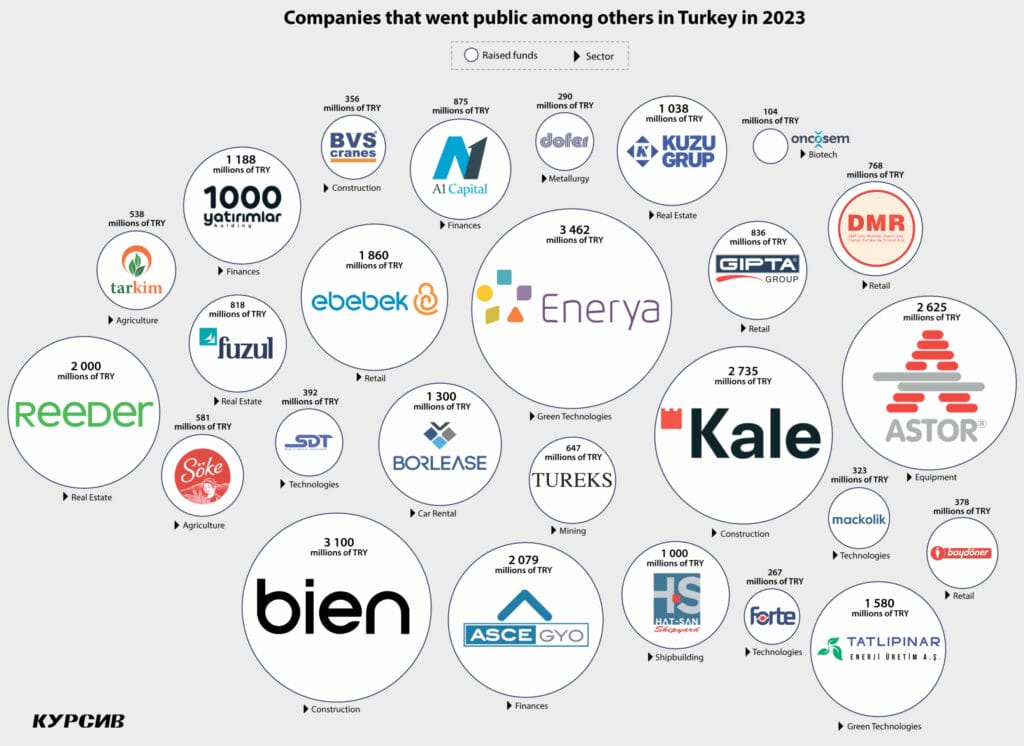

Kursiv has checked what kind of companies went public on Borsa Istanbul this year and was surprised by the diversity of local businesses that went public recently. Among them is a company developing software for analyzing satellite pictures, a doner kebab restaurant chain and a car rental company, for example. The initial public offering of the latest company has set two records within Borsa Istanbul: the number of those who wanted to buy the company’s shares reached 4.3 million, while the number of those who bought them reached 4.2 million. Demand for the stock was 4.5 times higher than the offering.

Even an open-ended mutual fund investing in businesses supporting equal rights for women has entered the Turkish market. According to Aydogmus, there are several factors that drive interest in IPOs on Bursa Istanbul. One of them is a significant increase in the number of retail investors. This trend started to form during the COVID-19 pandemic when the public’s ability to spend money was limited, while massive digitalization significantly simplified the investment process. In 2022, this trend intensified when a crypto bubble burst, many retail investors in Turkey switched from the crypto market, where they were quite active, to local stocks.

The Borsa Istanbul 100 index has grown along with the number of retail investors, which is another factor of incredible interest to the exchange, Aydogmus says. Since early 2022, the index has grown by 318%. The Borsa Istanbul international relations director also noted that the low cost of stocks offered within the Turkish IPO market (similar businesses have higher valuations on other exchanges) and active communication with potential issuers have also contributed to this rapid growth. The exchange has put significant efforts into marketing aimed toward potentially interested businesses as it wanted them to know what is necessary for listing. «We talked to local companies and have simplified the IPO procedure,» Aydogmus said.

He didn’t talk much about inflation in Turkey and definitely didn’t describe it as a key trigger for the IPO boom in Turkey. However, almost all experts interviewed by Kursiv said that inflation was the main driver of the IPO boom in that region as thousands of regular people wanted to mitigate losses of their savings nominated in the rapidly devaluating Turkish lira due to high inflation.

Inflation as a stimulus

Inflation in Turkey reached double digits in 2016 and continues to grow. In October 2023, Turkey reported 61.4% inflation year-on-year.

In 2021, President Tayyip Recep Erdogan embraced an unusual economic policy to fight inflation and cut the base rate amid high inflation. In 2021, the local central bank cut the base rate by 300 percentage points and by 500 p.p. in 2022.

After Erdogan was reelected as the country’s president in May 2023, the government’s approach to the economy changed: the base rate has now been growing for five sessions of the National Bank in a row, even though the real rate is still negative. In late October 2023, the regulator set the base rate at 35%, although the official inflation rate was 61.4%.

As a result of the so-called Erdoganomics (the economic policy of Turkey since 2021), inconsistency in the government’s actions and lack of predictability, many foreign investors have lost their trust in Turkey. Over the past five years, the share of non-residents in Turkish stocks has declined twofold to less than 30%, while the share of foreign investors in Turkish bonds dropped from 10% in 2019 to less than 1% in 2023.

On the other hand, the number of retail investors in Turkey has been growing exponentially from 1.2 million to 8 million over the period from 2020 to October 2023. Many people in Turkey started investing in stocks after the new economic policy against high inflation pushed the base rate into a negative zone in 2022-2023. At the same time, investors’ appetite for IPOs is driven by potentially high yields of those stocks that entered the market just recently. According to Bloomberg, the share price of two out of three Turkish companies that went public in 2023 rose by 60% within five days after the initial offering.

Sergey Domnin, head of Kursiv Research, has shared his vision on the reason why Turkish retail investors are so interested in the stock market:

«Hyperinflation makes investors more interested not only in physical assets like gold but also in equity instruments, specifically when they have an opportunity to buy shares of companies from the real sector with fixed assets like buildings, equipment, patents and licenses. Against the backdrop of gradual devaluation of currencies, deposits and fixed-income bonds, these assets are going to be more expensive. In turn, the inflow of investors drives companies’ interest in going public to boost demand, liquidity and market cap. A similar situation might be seen in Argentina, where retail prices soared from 42% to 122% over the period from 2020 to 2023 because of high inflation. The S&P Merval Index has risen 18 times in the past three years, even though the inflow of issuers wasn’t that big there. The factor of inflation isn’t rock solid and depends on the state of the market.»

Another important factor according to Domnin is the presence of infrastructure necessary for an IPO:

«Even though the Turkish economy is quite closed, a pool of companies and entrepreneurs ready to go public has emerged there along with corresponding institutions and regulation that stimulates the development of small businesses. During the pre-COVID age, the ratio of combined market cap and GDP in Turkey was about 30%, which is a standard level for medium-sized developing economies like Kazakhstan and Poland, for example. The next level is countries with more developed stock markets and the ratio at 50%. Before the pandemic, this cohort included Russia, Germany, Spain and Indonesia. It seems that the Turkish market has matured for a leap forward into that middle echelon.»

What about foreign investors?

An expert from one of the Kazakhstani brokerage companies familiar with the situation in Turkey pointed out that the share of foreign investments in Turkish stock has gradually grown since September, which is a positive sign, he said. The expert also noted that authorized agencies in Turkey have done a lot to make foreign capital more welcome within the country’s market.

«The country’s strategy of developing capital markets directly says why the country should put more effort into attracting foreign capital. In turn, foreign investors expect significant improvements in the investment environment and the introduction of transparent rules. Moreover, they want the country’s legislation to be simpler and clearer. This is important for them. At the same time, they know that the investment environment in Turkey provides a lot of opportunities and there are many different issuers in the country. It’s safe to say that the number of foreign investors in Turkey will rise very soon,» the expert said. «The country is working on all these issues. For instance, the Capital Markets Board of Turkey is working on simplification of legislation aimed at attracting foreign investors,» he added.

Domnin is less optimistic as he points out inflation has again been accelerating this fall, trade volume has shrunk and the Turkish lira has weakened. He also says that neither the PMI nor CCI index offer hope.

«Don’t forget about such a pure market negative factor as the following: the more public offerings, the more negative cases. I mean, investors in developed markets got used to this, while investors in the Turkish stock market might be shocked. Some Turkish experts already talk about the threat of zombie companies,» the head of Kursiv Research emphasized.

All these factors can prevent foreign investors from returning to the country’s market anytime soon.

Nevertheless, more than 40 IPOs are scheduled to be held at Borsa Istanbul by the end of this year. In other words, the opening bell is going to ring almost every day there.