For five months, Freedom Finance Global has been studying consumer confidence, inflation and devaluation expectations of residents of Central Asian countries, including Kazakhstan, Uzbekistan, Kyrgyzstan and Tajikistan. As the research period increases, the overall picture expands and understanding of the dynamics of various indicators deepens. It is important to note that in Kazakhstan the study has been ongoing for 15 months.

In November, a multidirectional movement in consumer confidence was recorded. In some countries, the records are being updated, in others, on the contrary, certain indicators are being reduced for the first time. Inflation expectations in some countries show dynamics that stand out from the general picture of the falling official inflation throughout the Central Asian region. This topic may become a key topic in future waves of research, if this trend continues.

It is worth reminding that in Kazakhstan and Uzbekistan, analysts collect 3,600 questionnaires monthly, in Kyrgyzstan – 1,600 questionnaires, in Tajikistan – 1,200 questionnaires, in proportion to the size of the population. The research is based on the methodology used to obtain the consumer confidence indices in many countries around the world and adapted to local needs by the United Research Technologies Group research company. The data collection method is telephone survey. The survey questionnaire is localized, meaning that the study is conducted in the native language of the respondents.

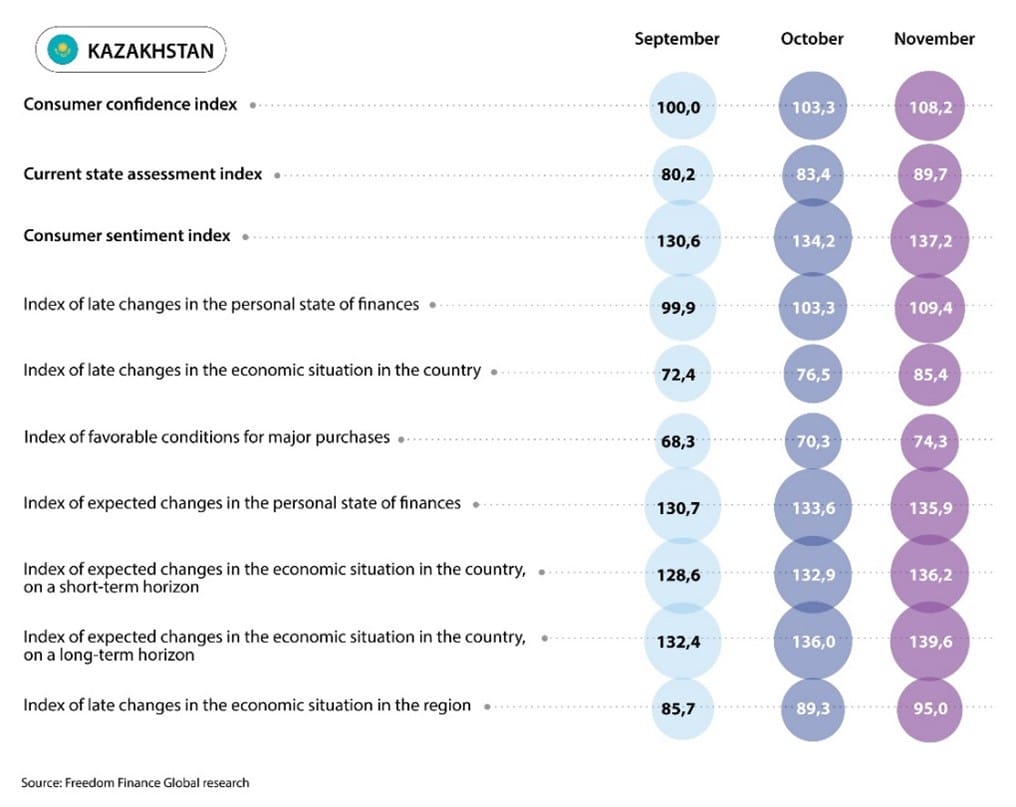

Kazakhstan

The Consumer Confidence Index (CCI) of the Kazakhstanis, in November, reached a record of 108.2 points, in the history of the study, demonstrating growth for the second month in a row. A year ago, the CCI index was only 101.7 points. Monthly growth was shown by all five subindices from which the final result is calculated. But those related to the assessment of the current state increased the most. In November, the Kazakhstanis began to evaluate much better the changes in the country’s economy and personal financial situation, over the past 12 months.

Optimism continues to grow

The subindex of assessing the current state of the economy increased by 8.9 points, reaching 85.4 points, that is a record figure in the entire history of the research. Last year, the same figure was 80.4 points. Almost 23% of the Kazakhstanis believe that the economy has shown improvement over the past year. This is noticeably higher than the October result of 18%. The share of negative responses also decreased significantly, from 44.7% to 39%. A trend towards optimism among the Kazakh-speaking respondents continues, 33% of the respondents believed that the country’s economy has shown improvement over the past year. But among the Russian-speaking residents, only 15% agreed with this.

By age, young people under 29 showed the greatest improvement in results, as well as traditionally the highest rates of positive responses. If in October the share of such answers was 21%, then in November it increased to 33%. We also note improvement in positivity among the older generation over 65 years of age, 21% were optimistic compared to 14% in October. Let us especially highlight the age group of 45–59 years, the share of the positive responses decreased from 17% to 15%.

Regionally, the best result is observed in the Kyzylorda region, where 36% of residents note positive changes in the economy. Also, positivity prevails over negativity only in the Turkestan and Zhetysu regions. The most pessimists regarding the current state of the economy can be seen in the West Kazakhstan and Karaganda regions. In both regions, the share of negative responses reaches 51%. The Karaganda region again found itself at the very bottom of the ranking.

More Kazakhstanis notice improvement of their material position

The subindex of actual assessment of changes in the personal material position over the past 12 months increased by 6.1 points. Among the surveyed residents of the country, 37.9% believe that their personal material position has improved over the past year. In October there were 33.5% of them. Here, traditionally, the Kazakh-speaking respondents showed more optimistic results. 49% of these note the improvement in personal well-being, while among the Russian-speaking people this figure was only 30%. In this matter, age groups behaved traditionally, as the age increases, less positive behavior is observed. 59% of young people chose positive answers, and among the older generation the proportion was 25%.

Once again, the Kyzylorda region took the lead, where 56% of residents positively assessed changes in personal well-being over the past year. The leader of October, Mangistau was the second with a result of 41%. The last in the regional ranking was the North Kazakhstan region, where the share of positive answers was 23%. The region again finds itself in the last place, but, nevertheless, we note the improvement of the indicator, since in October it was 21%.

Conditions for large purchases steadily improve

The subindex of favorable conditions for large purchases showed a noticeable increase. It increased by four points, reaching a record of 74.3 points for all 15 months of research, that nevertheless indicates predominance of negative responses over the positive ones. 32.8% of the Kazakhstanis believe that now is, to one degree or another, a favorable time for major purchases. We note that in October the same figure was 30.1%. Also, slight improvement can be seen in negative responses, from 61.5% to 60.1%. Difference between the Kazakh-speaking and Russian-speaking people turned out to be much smaller than on other issues, as in October. The share of positive answers among the Kazakh-speaking people reached 39%, and among the Russian-speaking people – 28%. Age groups also show the expected inverse correlation with increasing the age. 45% of young people gave a positive answer, while among the older generation there were 24%.

Regionally, the Kyzylorda region again turned out to be the best, where 47% of residents responded positively. The latest result was recorded in the West Kazakhstan region, where 25% of people believe that now is a favorable time for major purchases. Last month, there were as many as 38%. However, 25% is higher than the October outsider figure of 20%.

Inflation expectations update maximums

Indicators of inflation expectations of the Kazakhstanis rose sharply in November and reached maximums. The share of those expecting acceleration in price growth during the month increased from 24.6% to 30.2%, that is the maximum since December 2022. At the same time, the expectations for a strong price increase over the next 12 months are from 24.4% to 27.3%, which is the highest figure in the entire history of the study. We note that the study by the National Bank of the Republic of Kazakhstan, on the contrary, showed a slight decrease in the inflation expectations. According to the study, the share of those expecting a strong price increase fell from 32% to 27% during the year, and from 22% to 21% during the month. In general, we note that the inflation expectations in the last couple of months, according to both studies, are at or near the maximums of 2023.

While the Kazakhstanis’ inflation estimates, on the contrary, decreased, 47.7% of residents (48.8% in October) noticed a strong increase in prices during November. However, over a one-year horizon, the share of those who noticed a significant increase in prices falls for the sixth month in a row: from 60.2% to 59.2%. Let us recall that annual inflation in November continued its slowdown, which began in March and now stands at 10.3%.

Among separate goods and services, the Kazakhstanis are most concerned about rising of prices for meat and poultry, bread and bakery products, as well as milk and dairy products. For all these goods, 32–35% of the Kazakhstanis noticed a strong increase in prices, in November, which, however, was about 3 percentage points below the October result. One notes that flour has dropped out of the top list and now occupies the fifth place, behind vegetables and fruits. Compared to the last month, fewer residents noted flour 3.2 percentage points, in the survey. In general, only for 12 out of 44 goods and services, the increase in public concern regarding the strong price growth can be noticed. The share of gasoline continues to decline (from 9.3% to 8.7%) and the share of housing and public utilities services (from 9.6% to 8.4%).

Slight growth of devaluation expectations

The devaluation expectations of the Kazakhstanis increased slightly in November and approached the maximums that were recorded in September. This is despite the tenge strengthening by 2% in November. 55.4% of the Kazakhstanis expect the tenge to weaken against the US dollar (53.9% in October) in a year, and 36.1% (34.4% in October) in a month.

The credit confidence index increased by 1.3 points and remains approximately at the level of the previous four months. The share of the Kazakhstanis who believe that now is a good time to get loans increased from 14.8% to 16.6%. At the same time, the level of deposit trust decreased slightly, from 35.5% to 34.1%. This is exactly how many Kazakhstanis approve of bank deposits in the current situation.

The level of calm also increased markedly, as did the consumer confidence index. 57.3% of the Kazakhstanis note that now is a calm time rather than an anxious one (56.3% in October). At the same time, among them the proportion of people who gave a clear answer that now is the calm time increased significantly, from 32.9% to 35.8%. Expectations for unemployment growth remain stable for the last six months, at the level of 40.3%. Still, concerns about joblessness are at their lowest, since May. A year ago, the same figure was 38.3%, that is, the Kazakhstanis’ fears of rising unemployment increased during this period.

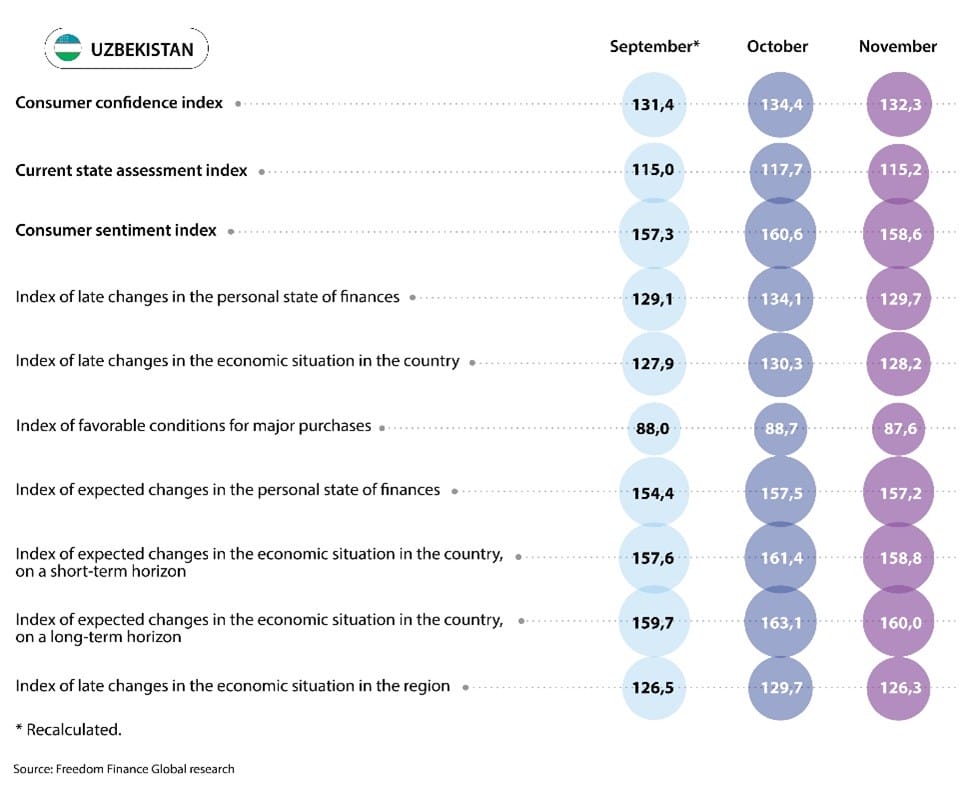

Uzbekistan

The consumer confidence index of the Uzbek citizens in November decreased for the first time in five months of the research in the country and amounted to 132.3 points, which is nevertheless the second-best result in the Central Asian region. This time, all components of the index showed a decrease, but the strongest drop was observed for assessments of changes in the personal material position, the subindex of which fell by 4.4 points. In addition, the population’s expectations have noticeably decreased both, regarding the prospects for the economy over the next 12 months and in assessing its current state.

The personal situation of the Uzbek citizens has worsened

The subindex of changes in the personal material position fell to 129.7 points. If in October, the share of those who noted improvement of this component was 61.9%, then in November this figure decreased to 57.3%. In terms of an age, young people continue to be the most positive on this issue, and the difference with the older generation has narrowed again. 63.8% of young people reported improvement of their personal material position over the past year, while among the older generation this figure was only 48.4%.

Regionally, the Fergana region continues to be a leader, where 64% of the residents mention that their material position has improved, although a month ago the result here was 10 percentage points higher. The outsider region represented by Tashkent also did not change during this month. The share of optimists there is only 46%, which, nevertheless, is not so much lower than the October result of 49%.

We also note that the breakdown by income level again shows the expected result in this matter. Among the richest people, 80% of them note improvement of their personal material position over the past year, while among the poorest people only 34% of them report on this.

Slight decline in economic confidence

The subindex of expectations of economic prospects for 12 months decreased from 161.4 to 158.8 points and turned out to be the second most declining component. If in October 70% of residents expected the economy to improve, then in November the share of such people fell to 68%. Interestingly, across age, correlation with responses remains unusual in economics issues. Young people turned out to be the most pessimistic, and the older generation to be the most optimistic. Although it is worth noting that the difference is not that significant, and all age groups generally give more positive answers than negative ones. 65% of young people expect the economy of Uzbekistan to improve within a year, while among the older generation of such people – 71%. In the regional context, the Fergana region once again became the best, where 78% expect the economy to improve. Tashkent with a result of 56.5% was again at the bottom of the ranking, that is 0.7 percentage points, less than the result of October, when the city also took last place.

The third component that showed the largest decline was the subindex of current assessments of the economic situation. Over the month, the share of people who believe that the economy of Uzbekistan has shown improvement over the past year decreased from 60% to 57%. The age group correlation was again inverse. 62% of older generations have noticed improvements in the economic situation, over the past 12 months, while among young people the same figure was 52%. Note that the difference between these groups decreased by 2 percentage points.

The Namangan region turned out to be the leader with a share of positive responses of 67%, although the gap was small from a whole group of other regions that demonstrated similar results. But Tashkent turns out to be an outsider here too, gaining only 37% of positive responses.

Inflation experiences have fallen along with the official inflation

Uzbekistani inflation estimates continued to decline for the second month in a row in November after a sharp rise in September. Now the share of respondents noting a very strong increase in prices over the past month decreased in November from 33.2% to 29%. And yet, this figure is still higher than the values in July and August by 4–5 percentage points. The share of those who believe that the prices over the past year are growing faster than before also decreased slightly, from 49.8% to 47%. Officially, the monthly inflation in November accelerated from 1% to 1.13%, that is nevertheless the lowest November figure in at least the last 7 years. Thus, the annual inflation decreased from 9% to 8.76%, which correlates with the responses of residents, according to the Freedom Finance Global survey.

Among separate food products, the leaders for the third month in a row were «meat, poultry» and «flour». However, for flour, one can see a significant decrease in people who noticed its strong price increase, from 52.4% to 37.6%. But for the meat and poultry, the decrease is insignificant, and still more than half of the Uzbek citizens choose this option. The vegetable oil is still in the Top-3 with a result of 27%. However, this is the lowest value in five months of the research. Official statistics continue to show a decline in flour prices. If in October the price fell by 1.6% m/m, then in November the decline was another 0.8% m/m. And yet, after the 15% increase in September, these decline figures can hardly be called sufficient compensation to change the opinion of the population. Prices for beef and lamb remained at approximately the same levels, while prices for sunflower oil decreased by 0.5% MoM.

With all this, inflation expectations show multidirectional movement with a general upward slope. If the share of those expecting a very strong price increase in 12 months fell slightly from 27.2% to 26.8%, then the same figure, but with a one-month horizon, sharply increased from 19.6% to 24.2%. It turns out that the share of the Uzbek citizens expecting a strong rise in prices in the coming month is growing for the third month in a row. But at the same time, the number of the same pessimists regarding price growth for the year ahead has been getting smaller for the fourth month.

Devaluation expectations in Uzbekistan have risen back

In November, devaluation expectations of residents of Uzbekistan increased sharply. In terms of the weakening of the som against the US dollar during the year, one can see a sharp increase after record lows in October. 65.8% of residents expect weakening (60.8% in October) of the som during the year, and the share of those waiting for a weakening during the month increased slightly and amounted to 48.9%. However, we note that the som in November weakened by about 0.5%, which we also observed in the previous couple of months. We emphasize that in the first half of December, the country’s national currency has already weakened by 0.65%, reaching new maximums, which probably indicates some realization of the population’s expectations. The devaluation expectations of the Uzbek citizens continue to be the highest, in comparison with other Central Asian countries.

The credit confidence in November showed a downward movement for the first time in four months. The number of those who mention that now is a good time to take out loans fell from 33.8% in October to 31.6% in November. For the deposit index, also, a slight drop in November, from 58.5 to 57.7 points, is noticed. 39.5% of the Uzbek citizens (41.3% in October) believe that now is a good time for deposits. The Confidence Index fell along with overall consumer confidence. If in October 80.8% of the residents said that now is a quiet time in one way or another, then in November the share of such answers fell to 78.2%. But at the same time, the share of those waiting for unemployment to rise during the year decreased from 44.2% in October to 41.1% in November.

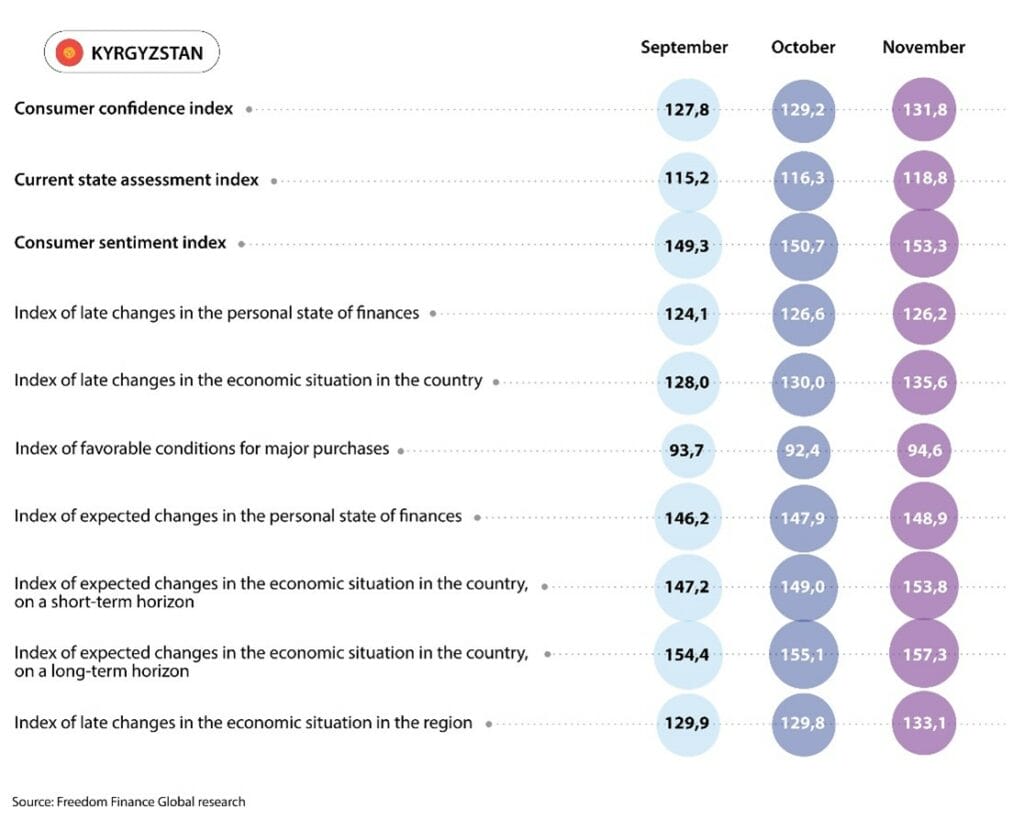

Kyrgyzstan

In Kyrgyzstan, the consumer confidence index in November amounted to 131.8 points, increasing by 2.6 points compared to October and showing growth for the fourth month in a row. Four out of five subindices showed an increase, except for assessment of the current personal material position. The indicators of assessment and expectations of the country’s economic prospects increased the most. The economic assessment subindex increased by 5.6 points, and the expectations subindex increased by 4.8 points.

Faith in the national economics is growing

In November, 60.4% of the Kyrgyzstanis noted that the economic situation had improved over the past 12 months, although a month ago the share of such people reached only 56%. We note continuation of the trend, in terms of an age, observed only in Kyrgyzstan. We are talking about the age group of 30–44 years old, which again showed the worst results on almost all issues. 67% of the older generation assessed economic changes most positively. At the same time, in the group of 30–44 years old, there were 57% of such people, which is nevertheless noticeably higher than the October figure of 48%. The best region in this regard was the Jalal-Abad region, where 73% of residents noticed improvement in the economy. Nevertheless, the October leader, the Batken region, was not far behind with a result of 71%. The outsider this time was Bishkek, where only 44% of the residents gave a positive answer. Although the capital was slightly behind the Chui region, which took last place in October.

When asked about expectations for economic prospects over the next 12 months, 65.3% of residents gave a positive answer, which is noticeably higher than the October figure of 60.8%. This time, the age groups showed very similar results to each other, but the oldest group of 65 years and older remains the formal leader. 68% of the older group gave a positive answer, while among young people the same was 62%. Regionally, the Osh region became the best with a result of 74% of positive responses. The aforementioned Jalal-Abad region also lagged behind slightly with an indicator of 71%. The last was the Naryn region, where only 47% of residents have a positive assessment of the economic prospects of Kyrgyzstan.

Conditions for large purchases improve

Another noticeably rising subindex was the «assessment of favorable conditions for large purchases,» which increased by 2.2 points, reaching 94.6 points, which is a new record over five months of research. 39.1% of the Kyrgyzstanis believe that now are favorable conditions for large purchases. In October, the share of such people was 37.6%. The share of negative responses also dropped noticeably, from 45.7% to 43.2%. And here the age group of 30–44 years old showed a weak result. Among them, 38% gave a positive answer, which is nevertheless much better than the October figure of 32%. It is interesting to note that the oldest generation turned out to be the best, with 42% indicating favorable conditions for large purchases, although in October the leaders were young people. In regional terms, the Jalal-Abad region again became the leader with a share of optimists of 47%. The worst result for the second month in a row was demonstrated by the Talas region, where only 34% of residents gave a positive answer, which is nevertheless noticeably better than the October figure of 28%. In terms of income, no surprises were found for all of the above three issues, the higher the income, the higher the share of the positive answers.

Inflation expectations remain the lowest in the region

Inflation estimates of the Kyrgyzstanis continued to decline, but only over a period of one month. If in October 34.8% of residents believed that prices had increased significantly over the past month, now this number is 31.8%. This figure has fallen for the fourth month in a row and is the lowest in the history of these studies. On the other hand, many more people felt the strong growth over the past year in November. In October, there were 58.9% of these, while in November the share increased to 61.6%.

Inflation expectations also showed mixed results over different time horizons. However, they still remain the lowest in the Central Asian region. Expectations for a strong price rise next month have risen slightly. 9.2% of residents expect this, while in October the same figure was 8%. Over the course of one year, 11.8% of the Kyrgyzstanis expect a strong rise in prices, which is a new record low and lower than the October value by 0.7 percentage points. The official inflation in the country continued to decline in November for the second month in a row. This time the slowdown turned out to be much sharper, from 9.2% to 8.1%, in annual terms. The last time such a low inflation rate was recorded was in October 2020.

It is interesting that, if we consider separate goods, flour continues to be in first place among the most expensive goods among the residents of Kyrgyzstan, which is no longer observed in Kazakhstan or Uzbekistan. However, this time too, the share of the respondents who noted that flour prices have increased significantly decreased, from 67.6% to 61.7%. Also, the vegetable oil (48.7%), sugar and salt (33.8%), vegetables and fruits (32.5%), continue to be the leader. The list of the Top-4 food products for which the most people noticed an increase in price has not changed for the third month in a row.

However, according to the official statistics, one can see a decrease in flour prices in November. The premium wheat flour fell in price by 0.9% MoM, and the first grade flour – by 1.7% MoM. Oils and fats overall fell by 0.4% m/m, but fruits and vegetables, on the contrary, increased in price by 2.5% Mom.

Declining of devaluation expectations in Kyrgyzstan

The Kyrgyz som strengthened in November for the first time since June, although the degree of strengthening was small and amounted to only 0.2%. Against this background, the devaluation expectations of the residents of Kyrgyzstan have decreased. If in October 34.8% of the residents expected the som to weaken in a year, then in November this figure reached 30.3%. On the issue of US dollar growth over a one-month horizon, the share of pessimists also decreased significantly, from 22.9% to 18.2%. However, these numbers are still higher than those we observed in July-August.

The population’s credit confidence remains stable. Over the month, the share of those who believe that the current situation is favorable for obtaining loans fell from 23% to 22%, which is close to the five-month average. The deposit confidence among the Kyrgyzstanis increased slightly, the share of positive responses increased from 31.9% in October to 32.8% in November. The calm index continues to grow for the fourth month in a row, 63.8% of residents believe that now is a calm time, while only 26.9% are worried. Last month, these figures were 62% and 28.1%, respectively. The residents’ expectations for an increase in unemployment fell for the second month in a row, from 34% to 31.3%, which is the lowest value during the study.

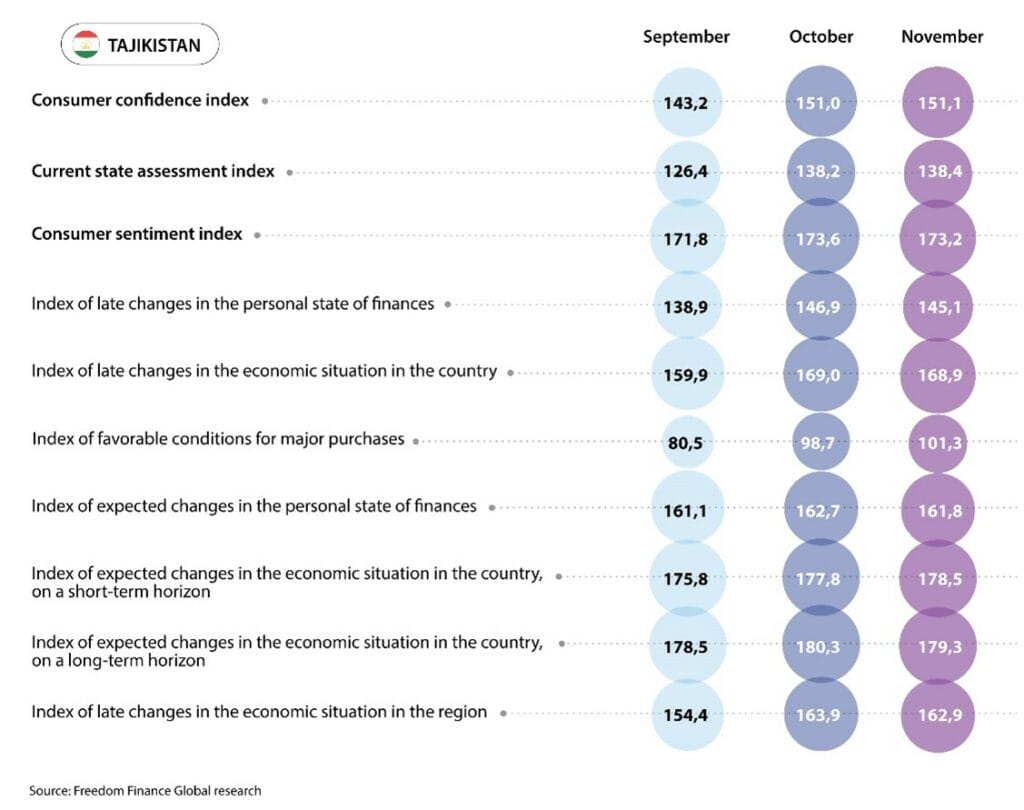

Tajikistan

The consumer confidence index in Tajikistan reached 151.1 points in November, indicating a virtual absence of monthly changes in the index. But still the figure remains the highest among the four Central Asian countries under consideration. The subindex of favorable conditions for large purchases has increased the most, but we also note a rather significant decrease in assessments and expectations of changes in personal material position.

Conditions for large purchases have become more favorable

The subindex of favorable conditions for large purchases continued to grow in November and reached 101.3 points (98.7 points in October). This was the first positive indicator in the entire history of studies of the countries of Central Asia. That is, the share of positive answers turned out to be higher than the share of negative answers from respondents. 49.7% of residents of Tajikistan note that now is one way or another a favorable time for large purchases and expenses. 45.9% of respondents disagreed with this. A month ago, the ratio was as follows: 47.8% – 47.9%.

In terms of an age, a tendency remains towards pessimism in this matter, among people aged 45–59 years. This category received 49.5% of positive responses, which is nevertheless much higher than the October value of 43.3%. Young people turned out to be the best, 51.2% of whom believe that now is a favorable time for major purchases. In the regional context, the undisputed leader is the Gorno-Badakhshan Autonomous Region with a result of 71%. The worst results were shown by regions of republican subordination with 46% of residents who chose positive answer options.

The personal material position has deteriorated slightly

On the other hand, we note a noticeable decrease in the subindex regarding assessments of changes in the personal material position by 1.9 points. In November, the share of those whose situation has improved over the past year was 63.2% compared to 66.1% in October. In terms of an age, young people under 29 years of age stand out, 68.8% chose positive answer options. The remaining age groups showed approximately the same results, around 60%. The Sughd region with a result of 68.9% again became the best among the regions, which is significantly less than the October result of 74.5%. The last place was again taken by Dushanbe, although here the share of positive responses, on the contrary, increased from 56.5% to 59.2%.

In addition, expectations for the personal material position over the next 12 months have also decreased. True, the decrease in the subindex was much less than 0.9 points. 74.2% of the Tajik residents believe that their financial situation will improve in a year. In October, the share of such people was higher by 1 percentage point. Here you can see the unconditional leadership of the age group under 29 years old and the similarity of the results of the other groups. 82% of young people are optimistic about the future, while for other age groups the figure was approximately 70%. In regional terms, the Sughd region with a share of positive responses of 78% performed best. Nevertheless, the regions of republican subordination and the capital were not far behind the leader.

Price increase is becoming less of a concern

Inflation estimates and expectations among the population of Tajikistan continued to decline for the second month in a row after a sharp increase in August and September. Moreover, estimates of actual inflation have decreased very significantly. If in October 40.5% of the population felt a strong increase in prices over the past month, then in November the same number increased to 27.1%. The story is similar with the assessment of price growth over the past 12 months. In October, 45.6% of the residents noted the «prices are rising faster than before,» but in November the share fell to 36.9%. However, these figures still remain higher than in July.

As for inflation expectations, the decline was not so dramatic. In October, 14.8% of residents expected a very strong rise in prices next month, and in November the share fell to 11.3%. Expectations for strong price growth over a 12-month horizon decreased to approximately the same extent, from 16.6% to 13.6%. Thus, inflation expectations returned back to July levels after rising in August and September.

The inflation data for November are not yet available, but in October the annual inflation slowed from 5.1% in September to 4.4% in October, that is quite consistent with the opinion of citizens. For at least the third month in a row, the majority of the population of Tajikistan noted flour as the product for which the largest price increase was noticeable. However, the proportion of such people is decreasing, as in neighboring countries. If in October, there were 71.8%, then in November the figure was only 58%. The share of those who note a strong increase in prices for vegetable oil (from 46.6% to 37%), vegetables and fruits (28.3% to 20.7%) also decreased significantly. One notes that the official data continue to show a noticeable increase in flour prices. If in September the monthly average price growth was 13%, then in October it reached 4.5%. Although, if we consider the period of the last year, flour officially fell in price by 9.2%.

A slight decrease in expectations for weakening of the somoni

The devaluation expectations in Tajikistan fell slightly in November, after four months of stable figures. In November, the US dollar exchange rate remained virtually unchanged and remained stable for the ninth month in a row. The share of those who expect the national currency to weaken within a month fell from 20.6% to 16.9%. Over the next one year, 25.3% of the country’s population expects weakening (26.8% in October).

The credit confidence index rose after three months of decline, in a row, and reached the maximum for five months of the research. 27.6% of residents believe that now is a good time for loans (24.9% in October). The deposit confidence continues to remain stable. In November, the index rose from 66.7 to 67 points. The share of people who have a positive opinion on deposits at the moment has reached 53.7% (52.6% in October). The calm index in Tajikistan decreased slightly, continuing to move along with overall consumer confidence, 84% of residents note that now is a calm time (85% in October). Unemployment expectations dropped again, hitting a new minimum. 30.9% of the respondents expect the unemployment rate to increase during the year, although in October there were 34.4% of such people.

Conclusions

In November, the dynamics of the consumer confidence index of the Central Asian countries under consideration was quite interesting. Kazakhstan, having slightly crossed the neutral limit of 100 points last month, continued its strong growth in November and updated historical maximums. Uzbekistan, in turn, showed a decrease in the consumer confidence for the first time for five months of research. Nevertheless, Uzbekistan continues to occupy the second place, even despite the growth of the index in Kyrgyzstan. Yet the difference between these countries has shrunk to half a point. Tajikistan continues to remain the leader, where the population showed almost the same level of the consumer confidence that was recorded in October.

The rise in the consumer confidence in Kazakhstan was driven by a significant improvement in actual estimates. More Kazakhstanis note improvement of the economy and personal material position over the past 12 months. The record high level also demonstrated the level of favorable conditions for large purchases and expenses. But in Uzbekistan, on the contrary, there is a drop in assessments of the personal material position and the economy, as well as deterioration in expectations of economic prospects. Nevertheless, the absolute indicators of Uzbekistan are still significantly higher than in Kazakhstan. In Kyrgyzstan, the increase in the consumer confidence was largely due to improved opinions regarding the economy along with the expectations. In Tajikistan, we note a continued increase in favorable conditions for large purchases. This subindex for the first time in the region and for the entire period of Freedom Finance Global research has overcome the neutral limit of 100 points. This means that more people in Tajikistan consider the current time favorable for large purchases.

Inflation estimates and expectations also showed multidirectional dynamics in various countries of the region, despite the synchronized continuation of the slowdown in inflation. In Tajikistan, inflation estimates, along with expectations, have noticeably decreased and approached summer levels. Inflation in this country fell in October after rising slightly in September, indicating a correlation between responses and statistics. In Uzbekistan, residents’ inflation perceptions also fell along with official inflation. At the same time, expectations increased, a particularly significant increase occurred in the expectations of strong growth within one month. In Kazakhstan, the inflation expectations reached new maximums. However, inflation sentiment has fallen somewhat, likely in line with the decline in annual inflation. In Kyrgyzstan, inflation expectations continue to remain the lowest in the region, and inflation estimates showed multidirectional movement. However, the annual inflation in Kyrgyzstan has dropped to three-year minimums.

In turn, the devaluation expectations demonstrated the expected dynamics to a greater extent. There is an increase in Kazakhstan and Uzbekistan, where there is a long history of weakening of the national currency. And at the same time, a slight decrease in devaluation expectations is recorded in Tajikistan and Kyrgyzstan, where the national currency is much less volatile. In Uzbekistan, the expectations for weakening of the som have risen sharply over the one-year horizon, despite the decline in October. The story is the same in Kazakhstan, where the devaluation expectations have almost returned to the maximums recorded in September. In Kyrgyzstan, the expectations for a weakening of the som returned back to the summer levels.

The fifth wave of research of the consumer confidence of residents of four Central Asian countries is characterized by multidirectional dynamics, both breakthroughs and declines in some indicators in separate countries. And yet, if one looks at the overall picture, for the second month in a row, the consumer confidence for the entire region is in the positive zone. This trend can be positively received by the state and business. On the other hand, despite falling of the annual inflation throughout the region, the residents have no unified confidence in the future rise in prices. Therefore, it is necessary to closely monitor the inflation expectations, without declaring a premature victory over the inflation. The next wave of the research will reveal whether these dynamics are one-time or long-term.