Shares of drug test manufacturer rise after new contract announcement

Shares of Intelligent Bio Solutions, whose technology enables drug testing through fingerprints, rose more than 13% on Wednesday, June 12. The company announced a new contract with a European provider of transportation and infrastructure solutions.

Details

Intelligent Bio Solutions (INBS) shares on Nasdaq rose by over 13% on Wednesday, June 12, to $2.24 per share. This is the highest level in the past five days, but far from the company’s all-time high. Since the beginning of the year, its stock has dropped nearly 45%, and over the past 12 months, it has decreased by almost 94%.

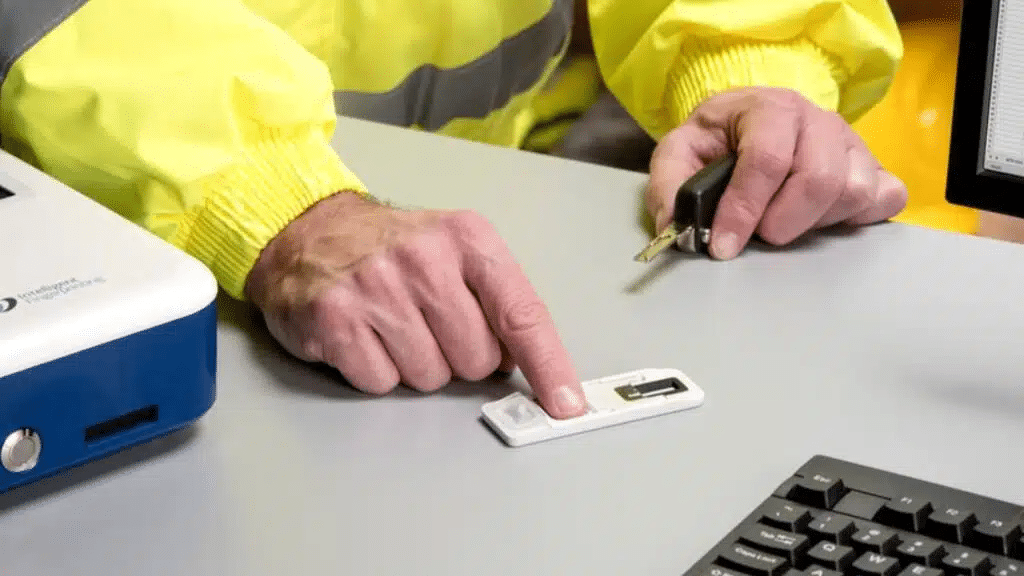

On the morning of June 12, INBS announced a new contract with a European transportation and infrastructure solutions provider, whose name has not been disclosed. The company will supply its new client with a fingerprint-based drug testing system to monitor employees’ fitness for duty at its UK facilities.

INBS’s solution uses sweat from fingertips to quickly test for common drugs, including cocaine, cannabis, methamphetamine, and opiates. It is designed to replace traditional urine sample testing. The new client, according to the company, previously conducted periodic urine tests with pre-scheduled lab technician, but wanted to implement on-site random testing.

Context

More employees are deceiving their employers during drug tests—more than at any time in the past 30 years, according to The Wall Street Journal in May. The number of substituted urine samples increased sixfold in 2023, the publication cites data from Quest Diagnostics, one of the largest laboratories in the US.

The drug screening industry is fighting fraud in testing and looking for simpler, faster, non-invasive, and cost-effective solutions, INBS wrote, explaining the growth in its metrics. For the nine months ending March 31, 2024, the company’s revenue was $2.38 million, up 193% from the previous year. Approximately 93% of the revenue came from the UK, where over 400 clients in more than 15 industries use INBS’s rapid tests.

In the US, the company plans to present its development to the industry regulator, the FDA, in the fourth quarter of this year and launch sales in the first half of 2025, it announced during the 14th Annual LD Micro Conference held in New York in April.

What analysts say

According to MarketWatch, one analyst is tracking the company. Their recommendation is to buy its shares, with a target price of $12 per share, implying a potential upside of nearly 436% from the current level.