June 11, 2024, is a date that BioSig Technologies shareholders, a developer of heart signal interpretation technology, will long remember. Nasdaq announced that it would delist its shares from the main listing effective June 12. Following this announcement, the company’s market capitalization plummeted by 70% in just a few hours. This is not the first upheaval in BioSig’s history. The company had previously been “on the edge of the cliff,” having lost part of its team and received a regulatory verdict stating that its development was not groundbreaking. However, it managed to recover. Will investors give it another chance this time?

An investor with a vision

BioSig Technologies was founded by Kenneth L. Londoner in February 2009.

He became interested in the healthcare sector while working in finance. Londoner started as an analyst at J. & W. Seligman & Co. and later founded his own hedge fund in 1996. In an interview with Ashton Tweed, he recalled that in the late ’80s and early ’90s, healthcare was a significant sector for growth stock investments, though not as prominent as it is now. When Wall Street recognized the sector’s potential, money started flowing in, Londoner said.

“We had a lot of success investing in medtech because laparoscopic instruments, pacemakers, stents, among other things, were all burgeoning back in the 90s,” he added.

Londoner left Wall Street after the September 11, 2001, attacks, partly because he no longer wanted to manage money and decided to focus on building companies. His first project was Safe Ports, a port logistics company in South Carolina. “My business partner realized that the Panama Canal’s third set of locks were about to be completed and opened, which would allow large ships with big containers of goods to go from China through the Panama Canal to the East Coast ports,” Londoner explained. The partners decided to capitalize on this opportunity. As a hired manager, he worked at NewCardio, a Silicon Valley cardiology software developer, and Alliqua BioMedical, a medical hydrogel manufacturer.

Homework

Around 2008, an inventor of heart rhythm recording technology approached Londoner. This individual knew that Londoner had experience investing in cardio tech and proposed a startup idea. Subsequently, Londoner spent a year doing “homework”—talking to major medical centers, gathering industry information, and only then decided to invest.

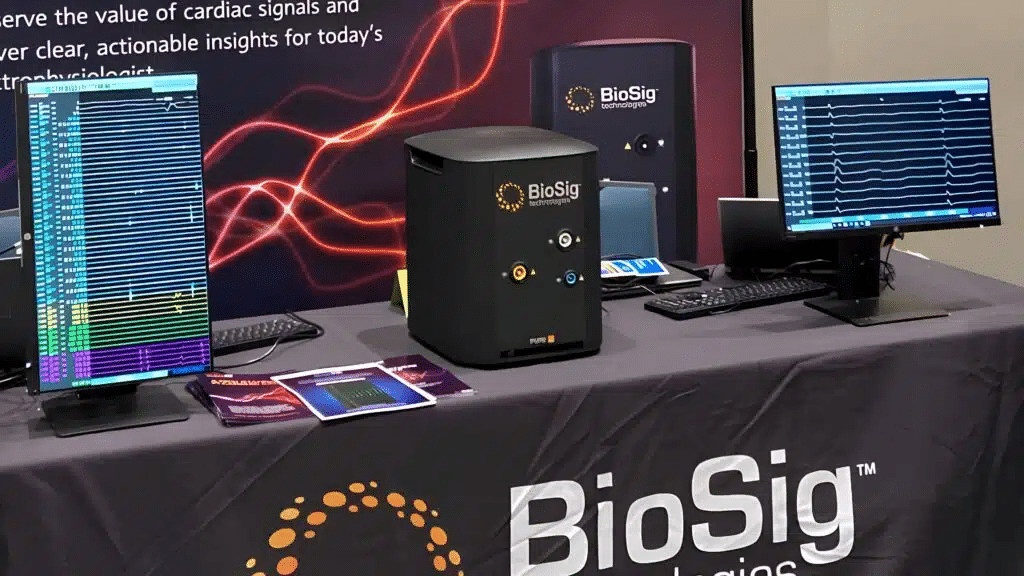

Thus, BioSig was born. Londoner is listed as its sole founder. The technology BioSig aimed to develop, called Pure EP, is designed to record heart rhythms and provide better understanding of arrhythmias.

The most common arrhythmia worldwide is atrial fibrillation, affecting up to 3% of the adult population and up to 60% of those over 60. This condition is costly for healthcare systems, writes Medhealth Outlook. People with atrial fibrillation are nine times more likely to see a doctor, and in the US, the average treatment cost for people with atrial fibrillation is $27,896 higher than for those without it.

Electrophysiological heart studies help identify the development mechanism of atrial fibrillation, determine treatment, and monitor its effectiveness. BioSig claims its technology is more accurate than traditional methods as it can eliminate environmental noise. It also shortens the study procedure by 11 minutes, potentially saving $385 per procedure.

Ambitious plan

BioSig aimed to become a leading player in the electrophysiology market, which, according to the company’s own estimate, exceeds $4 billion annually..

Londoner brought on board two people from Johnson & Johnson—one of its top executives, Seth Fischer, and Roy Tanaka, head of the Biosense Webster division specializing in arrhythmias. Both joined BioSig’s board of directors in 2012.

In 2015, BioSig moved from Los Angeles to Minneapolis, home to most cardiology companies, Londoner explained.

Among BioSig’s investors ($1 million) is the Mayo Clinic in Rochester, Minnesota, one of the world’s largest research centers. The clinic tested the company’s development. BioSig also received investment from a BlackRock fund.

In total, according to data from Crunchbase, the company has held over two dozen funding rounds, raising nearly $120 million. BioSig’s shares were traded over the counter on Nasdaq since 2014 and on the main exchange since September 21, 2018. Going public was one of the founder’s goals—in 2016, while preparing for the commercialization of Pure EP, Londoner outlined BioSig’s main development stages: product development, production, regulatory approval, and listing on Nasdaq..

On the edge of the cliff

BioSig planned to start selling its systems in 2017 but only received FDA approval in 2018. BioSig provided the FDA with a comparison of its system to GE Healthcare’s GE CardioLab device, already in use by doctors.

The development was approved, but the FDA’s verdict was harsh—it was not revolutionary. BioSig’s device had the same indications, anatomical sites, and fundamental technology as the comparison device. It did not add anything new to the effectiveness and safety of Pure EP, the verdict stated.

In 2019, Tanaka and Fischer resigned. The company did not publicly announce this, only sending documents to the SEC. Tanaka and Fischer’s departure was significant as the two experts had collaborated with BioSig for many years, wrote White Diamond Research in a blog on Seeking Alpha. “It’s also strange that they would resign right at the time when BioSig is supposedly about to do a product launch and reveal clinical data,” noted White Diamond Research. “It’s as if they were climbing a tall mountain, just to quit right before they reached the top. Their resignations would make more sense if the more correct analogy is they quit right before they reached the edge of a cliff.”

However, there was no catastrophic collapse following this news. By summer 2020, BioSig’s stock was hitting records, surging above $120 per share during trading.

The company may have “bounced back from the edge” because some investors still believed BioSig’s development would yield returns. At that time, the company resumed its trials, paused due to the Covid-19 pandemic, and within six months secured its first commercial contract to supply Pure EP systems. Additionally, BioSig’s subsidiary was testing a therapy for coronavirus treatment. In 2020, at the height of the pandemic, it was hard to find a more promising field in applied medicine.

Gradually, investor interest in the company waned, and from fall 2020, BioSig’s stock price began to decline, reaching $4.05 per share by early 2024.

Unprofitable development

Despite more than a decade of development, the technology has yet to generate revenue, BioSig admitted in its Q1 2024 report submitted to the SEC.

In Q1 2024, BioSig’s revenue amounted to $14,000, which is 180% more than the same period in 2023. This revenue primarily came from maintenance services for the devices. BioSig’s operating loss was $3.4 million. R&D expenses for the same period decreased by 77.6% to $238,000.

BioSig has been laying off employees since the beginning of the year, and by the end of February, it had fired almost everyone except the CEO. Around that time, BioSig’s founder, Londoner, left all positions in the company and its subsidiaries.

In March, BioSig received two letters from Nasdaq. One stated that it did not meet listing requirements: the company’s minimum share price should exceed $1. The other expressed Nasdaq’s concern about the company’s layoffs, suggesting that BioSig might not be conducting genuine business activities and could be a “public shell company”.

All these factors were grounds for delisting, Nasdaq indicated, scheduling a hearing for May.

BioSig assured it had a plan to resume operations. In late April, Anthony Amato was appointed CEO and president. In May, he addressed shareholders, assuring them that the new team aimed to restore BioSig’s business. The company raised $3 million, formed a new board of directors, and hired eight employees and four consultants. It planned to recruit an additional team of 4-6 people to further commercialize Pure EP and develop new products, according to its report. For example, the company planned to work on deep brain stimulation methods, potentially applicable in treating Alzheimer’s disease, pending board approval.

Ultimately, the company managed to challenge the delisting decision in arbitration, and its shares remained listed on the exchange.

But not for long. On June 10, Nasdaq notified the company of delisting due to non-compliance with the minimum shareholder equity requirement.

Effective June 12, its shares ceased trading on Nasdaq and were moved to the over-the-counter list, the company disclosed in SEC documents. On Tuesday, June 18, BioSig’s stock dropped more than 18% in OTC trading, with shares priced at 33 cents each.

Whether BioSig can regain investor interest remains an open question. While medical practices evolve quickly, the field of medicine inherently retains a level of conservatism that upholds the status quo in the market, according to a Medical Devices article on barriers to innovation in medical equipment:”Years may pass before a device or procedure is widely utilized”.