Shares of diamond supplier to Tiffany & Co. plummet by 15%

Shares of diamond mining company Diamcor Mining fell sharply on Tuesday, June 18, on the Canadian exchange and in over-the-counter trading in New York, continuing to decline on June 19 in Frankfurt. The company announced it had extended the closing of the second tranche of its private placement, from which it aimed to raise up to CAD 2.5 million (approximately USD 1.8 million).

Details

On Wednesday, June 19, Diamcor’s stock price dropped over 15% on the Frankfurt exchange, falling to EUR 0.016 per share. On Tuesday, shares had declined by 10% on the Canadian exchange to CAD 0.045 and by over 19% in over-the-counter trading in New York to USD 0.028.

On June 18, Diamcor announced the extension of the second tranche closing for its private placement. The initial offering, announced on May 1, was oversubscribed due to high investor interest, requiring additional time to complete the procedures. The second tranche is now expected to close by June 27, pending approval from the TSX Venture Exchange.

Context

On May 1, Diamcor announced a private placement to raise up to CAD 1.5 million (approximately USD 1.09 million). The company intended to offer investors 30 million units, each consisting of one share priced at CAD 0.05 and a three-year warrant priced at CAD 0.075. Major shareholders and Diamcor’s management were expected to subscribe to new shares worth up to CAD 1.25 million (approximately USD 911 million).

Initially, the deal was set to close on May 15, with proceeds allocated to furthering the Krone-Endora project in South Africa, adjacent to De Beers’ Venetia mine. Diamcor intended to avoid utilizing a convertible loan of up to CAD 2 million (approximately USD 1.46 million) thanks to the raised funds.

However, due to significant investor interest, the deal was delayed. The first tranche closed on June 4, and the offering parameters were revised. Diamcor now plans to raise up to CAD 2.5 million (approximately USD 1.8 million), with CAD 1.4 million (approximately USD 1 million) constituting the first tranche.

About Diamcor

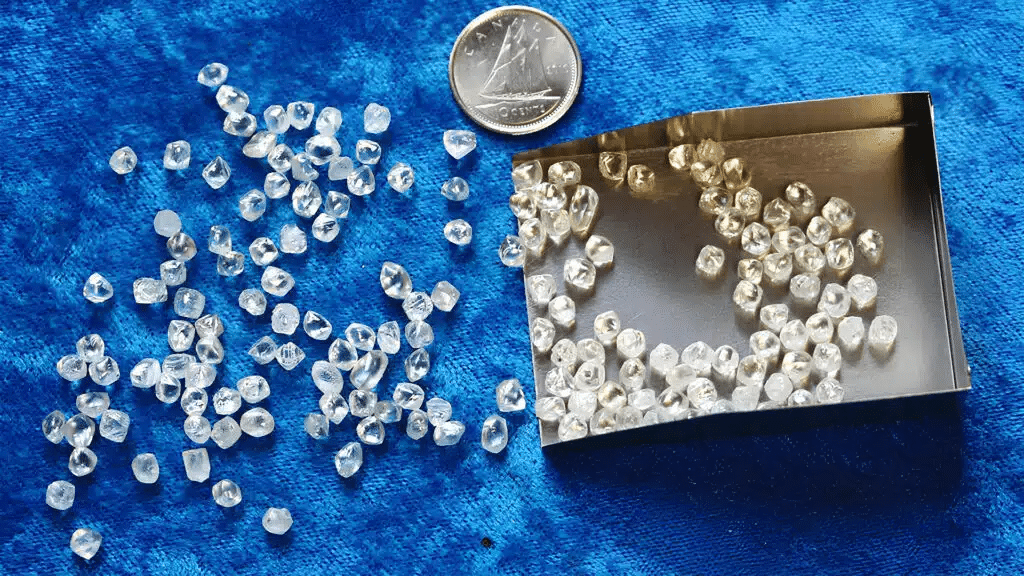

Diamcor extracts and supplies rough diamonds to industry players and luxury retailers. It has a long-term contract with the Canadian subsidiary of Tiffany & Co (owned by LVMH) to purchase 100% of rough diamonds from the Krone-Endora mine in South Africa. Presently, this mine is Diamcor’s flagship project, with the company planning to acquire and develop additional sites in the future. Tiffany & Co’s Canadian subsidiary has also provided financing to accelerate the project’s development, according to Diamcor.