Byrna Technologies produces non-lethal weapons and bullets but promotes its products in the same way as, for example, fashion brands. Its inventions are mentioned in Fox News, social media, and podcasts, and can be purchased on Amazon. Byrna’s first two products — electric bullets that work like a taser and less harmful blunt impact projectiles (BIP) for non-lethal pistols — were intended for the military and law enforcement agencies and did not generate the desired revenue. Success came when the company refocused on the needs of ordinary people and began selling pistols that fired rubber bullets and tear gas balls.

Four parents

Byrna Technologies was created in March 2005 under the name of Security Devices International (SDI). It was founded by Canadian entrepreneur Sheldon Kales, Soviet and Israeli radio physicist Natan Blaunstein, former Israeli military Boaz Dor, and former Canadian law enforcement officer Gregory Sullivan. The company calls them «parents» even in official reports and documents for the U.S. Securities and Exchange Commission (SEC)

The story of how they met and came up with the business idea is unknown. But it’s possible that three of them were linked through their previous occupations. Sullivan served in law enforcement for 20 years and trained government and private agents. Kales is the founder of the investigative company Argus Investigation Services. Dor was the head of security at the Israeli consulate in Toronto. After leaving public service, he remained in Canada and opened a security consulting firm.

The «parents» planned to make money by creating and selling non-lethal weapons for the military and police. The military frequently has to operate in populated areas, and the police need that kind of weapons to avoid costly lawsuits in cases of injury and death during arrests or mass riots. If they respond adequately to the level of threat, it might reduce the likelihood of escalation.

Adequate response

The first head of the company was Kales. He, along with Dor and Sullivan, refused a salary until the company accumulated $500,000 in gross revenue, SDI wrote in its fiscal year 2006 report (ended on November 30, 2006).

The first product SDI worked on was Lextrox. The company developed wireless electric bullets that worked like a taser and reached targets from a distance of 50 meters.

The mechanical part of Lextrox was handled by the weapon development company Elad Engineering from Israel. The electrical part was developed by engineer Emanuel Mendes and Israeli DP Electronic Systems, controlled by Alexander Blaunstein, Natan Blaunstein’s son and a scientist and owner of several patents. Alexander Blaunstein received a 15% stake in SDI and would retain it on the condition that a working prototype appeared by March 10, 2007, otherwise, he would only receive $50,000 and lose his share, the company wrote. At that time, SDI assumed that once working prototypes were available, it would create a joint venture with Elad Engineering and Blaunstein’s company or sign a licensing agreement with a major player with financial capabilities, experience, and connections in manufacturing, marketing, and sales.

SDI needed money for further development, so from the very beginning, the company actively attracted investor funds. By the fall of 2006, it had about 75 investors, according to its documents for the SEC. These were the four «parents»: Kales with a 24% share, Alexander Blaunstein (15%), Dor (9%), and Sullivan (2%). The rest received shares in exchange for their services or bought them during private placements. One and a half years after its creation, SDI went public on the OTC section of Nasdaq, where penny stocks — companies with small capitalizations — are traded, and raised $400,000.”

Big ambitions

The development of Lextrox did not progress as quickly as the partners wanted. Only in 2008-2009, it was tested by the Joint Non-Lethal Weapons Directorate of the U.S. Department of Defense, which gave the company a positive evaluation.

In the summer of 2010, alongside Lextrox, SDI started working on another project — BIP. These new, less harmful bullets were created as an alternative to batons, rubber bullets, and other similar products. Their potential consumers included the military, law enforcement, and peacekeepers. The company planned to produce the new product by 2011.

Around that time, one of the “parents,” CEO Kales, left the company. Sullivan became the new CEO. His task was to bring SDI to a level where it could create a partnership with a major defense company, the issuer wrote in its 2010 fiscal year report. That same year, SDI moved to Washington, and two lobbyists joined its board of directors. One of them, Harry Walters, had experience working with the U.S. government and the Pentagon. The second, Patrick Bryan, used to be the head of a weapons manufacturing company that collaborated with the U.S. government.

The new management temporarily ceased work on Lextrox and focused on BIP, reckoning that it would be quicker and cheaper to prepare for the launch. They planned to invest the received revenue in Lextrox.

Initially, SDI products were assembled and designed in Israel, but in 2011 the company established production in the U.S., at the Chemring Ordnance facility in Florida. According to the agreement, Chemring was to promote the products but branded them under its own name, SDI wrote in its 2013 financial report. Eventually, two years later, the company moved production to Boston, which allowed it to reduce costs and gain control over operations.

First money

In 2012, SDI completed the testing and began mass production of BIP. The following year, it reported revenue for the first time — $30,000. Its buyers included the Israel Defense Forces and the U.S. Border Patrol, which ordered the product for testing.

SDI shares began trading on the Toronto Venture Exchange, raising nearly 4 million Canadian dollars (approximately $3.7 million at the 2013 exchange rate).

As SDI kept growing, fewer “parents” remained: Blaunstein left the company’s shareholders in 2007 when SDI bought his shares for $50,000, Dor quit in 2013, and neither of them is listed among the major shareholders. Sullivan left the company in 2016 and is also no longer mentioned among the major shareholders.

In 2016, Brian Ganz became the head of SDI and has been leading the company ever since. He chairs the board of directors of Northeast Industrial Partners, which invests in non-lethal weapons developers.

«People’s product»

SDI kept securing more contracts. In 2016, it signed agreements with Bob Barker, a vendor of prison supplies, and Tac Wear, a supplier of products for law enforcement, military, prisons, and private security specialists in Canada and the U.S. However, the company realized that the costs of attracting new clients were “unacceptably high” due to the fragmented nature of the market, as noted in its 2019 financial year report.

On the other hand, the retail market, given that in many U.S. states, self-defense weapons can be purchased relatively freely, presented attractive opportunities.

As a result, the company decided to reach out to ordinary consumers and bring its Byrna HD pistol, which shoots rubber bullets, to the market.

It turned out that the company had struck gold — in just a year, it received orders for over 4,500 units, and its revenue for the 2019 fiscal year reached $924,000, a 269% increase from the previous year. Out of that amount, $850,000 came from the newly launched Byrna HD. Afterward, the company started selling tear gas bullets for this pistol.

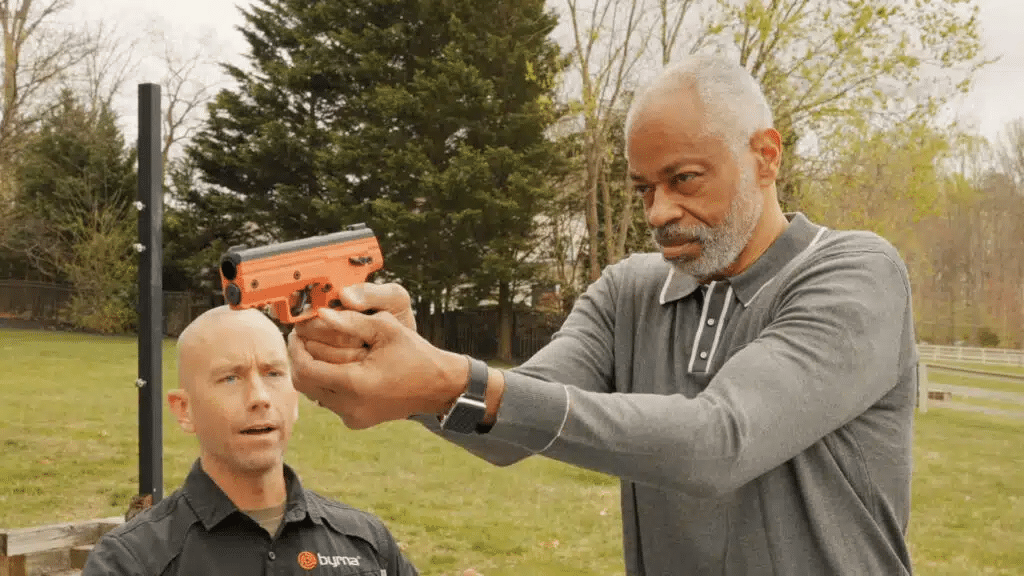

Star campaign

The coronavirus pandemic, which soon erupted, also played into their hands. It heightened people’s anxiety about their safety.

In 2020, the company was renamed Byrna Technologies and launched a large-scale marketing campaign, primarily on social media and blogs. In the summer of 2020, when the country was gripped by protests following the killing of African American George Floyd by a police officer, Byrna was already being mentioned in Fox News news programs.

Its revenue for the 2020 fiscal year soared to $16.6 million. Since then, Byrna has focused on expanding its product line and accessories. It sells them through its own online store, an Amazon storefront, and sports and outdoor equipment stores. Abroad, it primarily uses local distribution partners.

As for promotion, the company uses celebrities. It partnered with American television and radio host Sean Hannity, who also collaborates with Fox News. The journalist talks about Byrna products on his radio show with a weekly audience of 16.2 million people and on his social media. Earlier this year, Byrna also announced the start of a year-long advertising campaign in collaboration with journalist Glenn Beck and his company Blaze Media. In May 2024, Byrna signed three agreements with well-known radio hosts and podcasters Dan Bongino, Dana Loesch, and Mike Gallagher.

This promotional method works, claims Byrna, as in the second quarter of the 2024 fiscal year, its revenue already grew by 76%, which the company attributes to its new marketing strategy.

What analysts say

Since May 2021, the company’s shares have been listed on the Nasdaq in New York. Their price on the Nasdaq has increased by almost 107.5% over the past year and by 521% over the whole time.

Currently, individual investors own about 44% of Byrna, making them the largest group of shareholders. 28% is held by institutional investors, which Simply Wall St considers to be a significant portion of the stock that indicates certain credibility of the company within the investment community.

According to MarketWatch, two analysts are tracking the company. They rate the stock as a Buy with a price target of $18.13, indicating a potential upside of almost 95% from the closing price on June 25.