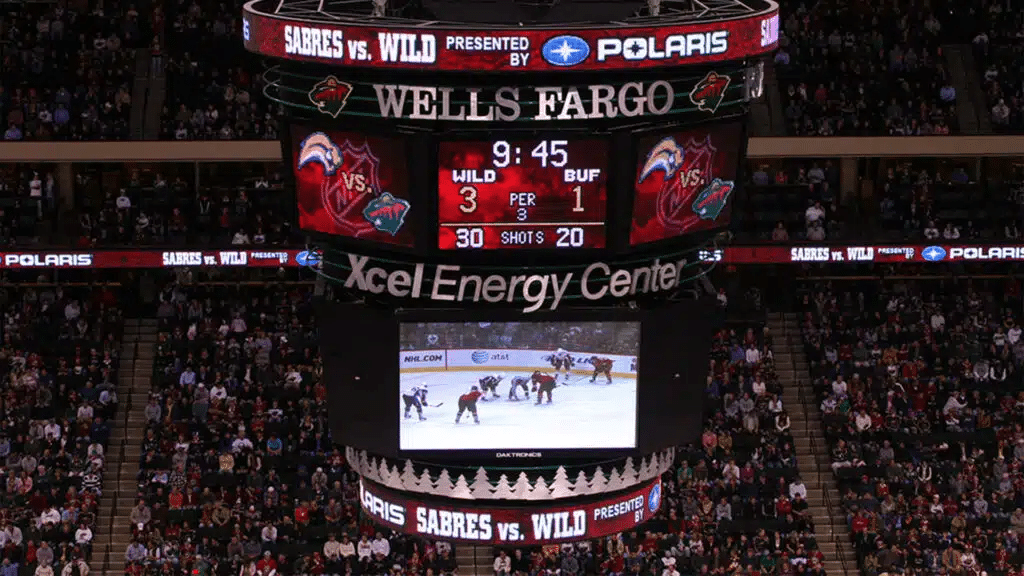

Shares of display manufacturer Daktronics surged nearly 22% on Wednesday, June 26. In the morning, at the opening of trading, the company announced record figures for the 2024 fiscal year, which ended on April 27, as well as significant growth in operating profit and cash flow.

Details

Daktronics stock prices soared 21.8% on Nasdaq on Wednesday, April 26, reaching $13.3 per share, and continued to rise after hours, adding another 16%. Over the past year, the company’s stock has increased by 120%.

The main growth occurred after 10 a.m. when the company promised to publish the results for the 2024 fiscal year. Daktronics called its figures record-breaking. Its revenue amounted to $818.1 million, indicating an 8.5% increase compared to the previous year. Gross profit margin reached 27.2%, the highest since 2009.

What else the company reported

Daktronics describes itself as the world’s largest supplier of large-screen video displays, electronic scoreboards, LED text and graphics displays, and related control systems. Among other things, it supplies scoreboards and video displays for school and college sports events, professional sports venues, LED and electronic advertising signs, as well as solutions for the transportation industry, such as intelligent highway systems and airport signs. In the 2024 fiscal year, its customers ordered goods and services worth $740.2 million, indicating an 8.7% rise compared to the previous year, which led to an increase in cash flow.

In the 2025 fiscal year, Daktronics will focus on prioritizing its market presence, working on reducing costs, and improving its operating model, says the company, citing its president, Reece Kurtenbach. He stated that the plans include focusing on high-margin products, such as the recently released line of LED displays as the market is growing rapidly.

To reduce costs and improve operational efficiency, Daktronics is working on optimizing production loads and installation methods for screens.

About the shares

According to MarketWatch, one analyst is following the company. The rating is Buy with a target price of $14 per share, indicating a potential upside of 5% from the closing price on June 26. Considering the strong price momentum of Daktronics shares, it may be worth taking a closer look at them, wrote analysts from Simply Wall St on June 16.