Brain cancer treatment developer gives up huge gains after additional share issue

Quotes on shares of CNS Pharmaceuticals, a developer of drugs to treat brain and central nervous system cancers, surged over 100% at one point on Wednesday, July 3. However, after announcing its third share issue in a month, the company saw its stock plummet. In the latest round, almost $2 million of stock is to be sold.

Details

CNS Pharmaceuticals’ shares skyrocketed to start the day on Wednesday, reaching as high as $2.87 per share, a 127% gain from the previous day. However, by mid-session, the stock had sharply dropped, and ended up closing with a 15% gain at $1.46 per share. In after-hours trading, it fell another 10% to $1.30 per share.

On Wednesday, 55.8 million CNS shares changed hands, compared with an average daily volume of 422,000. Over the past month, the number of CNS shares in circulation has nearly tripled as a result of two share issues to private investors. On Wednesday, the company announced yet another private placement: it will sell 1.4 million shares to institutional investors at $1.39 per share and the same number of five-year warrants at $1.26. It expects to raise $1.98 million from this placement (before offering expenses), which is to be used for working capital and general corporate purposes.

Context

CNS announced an additional share issue to institutional investors three weeks ago. On June 10, it filed a registration statement with the U.S. Securities and Exchange Commission (SEC) for $9.2 million in shares and warrants and has since completed two offerings. In the first, it sold 366,000 shares at $3.75 per share and the same number of five-year warrants at $3.62 each, while in the second offering, the company set a lower price: 568,000 shares were sold at $2.45 per share and the same number of five-year warrants at $2.32 each. The third offering saw an even lower price at $1.39 per share and $1.26 per warrant.

The latest placement will nearly double shares outstanding. Compared to the number of shares before all the offerings, it will be a roughly fivefold increase.

About CNS Pharmaceuticals

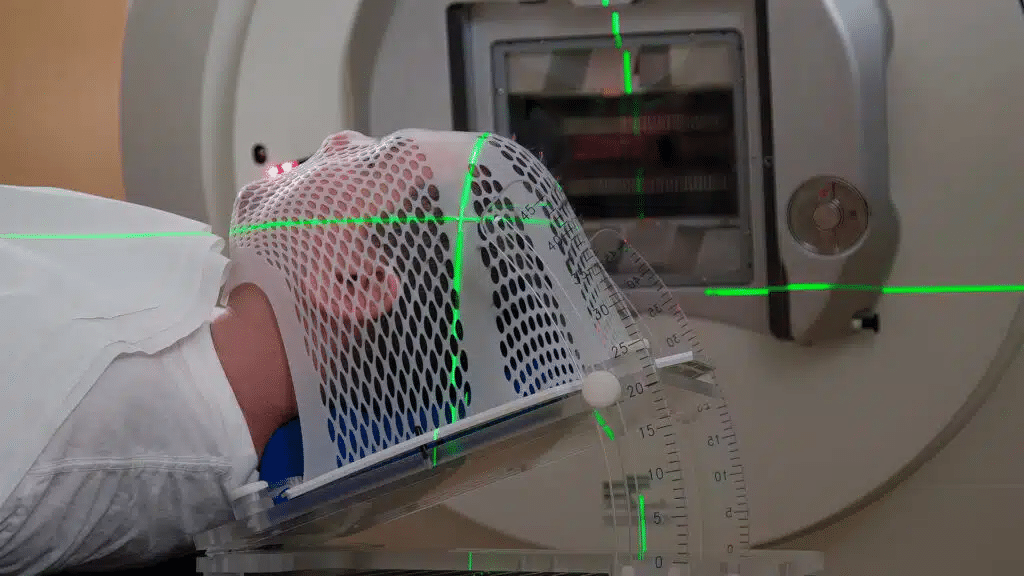

CNS Pharmaceuticals is developing drugs to treat brain cancer and central nervous system lymphoma. Its lead drug candidate is Berubicin, a type of anticancer anthracycline already used to treat certain cancers. The company expects that, unlike its predecessor, Berubicin can cross the blood-brain barrier, a sort of filter that prevents various microorganisms and toxins from entering the nervous tissue but also hinders the treatment of certain diseases, perceiving drugs as a threat.

CNS’s drug might aid in treating glioblastoma multiforme, a rare and malignant type of brain cancer. The median survival time from diagnosis is 15-16 months, with only about 25% of patients surviving more than two years, according to the company’s statistics. The main clinical data for the drug is expected to be reported in 2025. For now, the company is loss-making, as indicated by its financial results for the first quarter of 2024.

What about the stock

According to MarketWatch, the company is covered by one analyst, who rates the stock a hold.