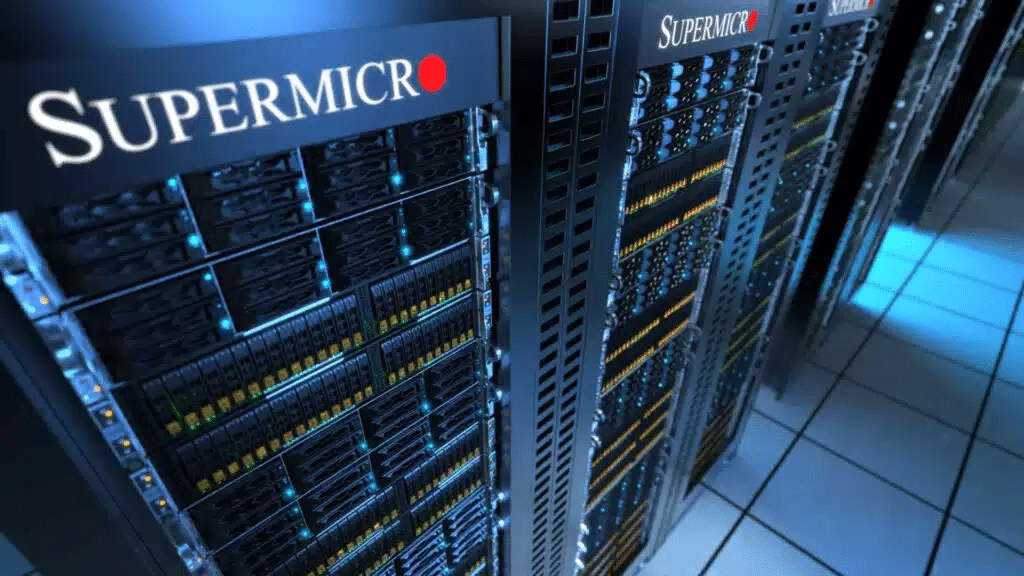

At the end of June, Super Micro, a manufacturer of data center equipment, was removed from the Russell 2000, a small-cap stock index. Investors should brace for the consequences of this move, as it was largely thanks to Super Micro that the Russell 2000 had been growing over the past year, a Barron’s report points out.

Details

The Russell 2000 index, which tracks 2,000 small-cap stocks, has lost its savior — Super Micro — writes Barron’s. In the first half of 2024, the Russell 2000 grew only 1.0%, versus the 14.5% gain for the large-cap S&P 500 during the same period. The main driver of the growth for the small-cap index was Super Micro, according to Barron’s.

According to DataTrek, Super Micro, with a market capitalization of just over $15 billion at the beginning of 2024 but around $48 billion now, accounted for more than 1% of the Russell 2000’s total market value and contributed nearly two percentage points to the index’s return from January through June.

Why Super Micro exited the Russell 2000

Every May, FTSE Russell conducts its annual index rebalancing, adding and removing companies. Issuers initially enter the Russell 3000 and are then distributed across subindexes, with this taking place every Friday up until July 1. As a result of this year’s rebalancing, Super Micro exited because the stock had grown too large to be part of the small-cap Russell 2000. Over the past year, Super Micro’s share price is up more than 233%.

Investment managers and institutional investors rely on the Russell indexes in their strategies, highlighted pre-prepared food producer Mama’s Creations in its announcement about joining the indexes. According to another index constituent, nonlethal weapons manufacturer Byrna Technologies, the indexes serve as the benchmark for approximately $10.5 trillion in assets (as of end-December 2023).

What this means for investors

Since July 1, the first trading day after the rebalancing, the Russell 2000 has gained 0.4%. Currently, there are no giants like Super Micro left in the index, and if the number of high-performing stocks does not improve, the Russell 2000 will falter, Barron’s believes. The past year has been rough for most small-cap companies, largely due to the high interest rates maintained by the Fed.

Additionally, with Super Micro’s exit, there are fewer tech stocks and more financials in the Russell 2000, which will probably make the index even more dependent on Fed policy and the macroeconomic outlook, Barron’s adds.