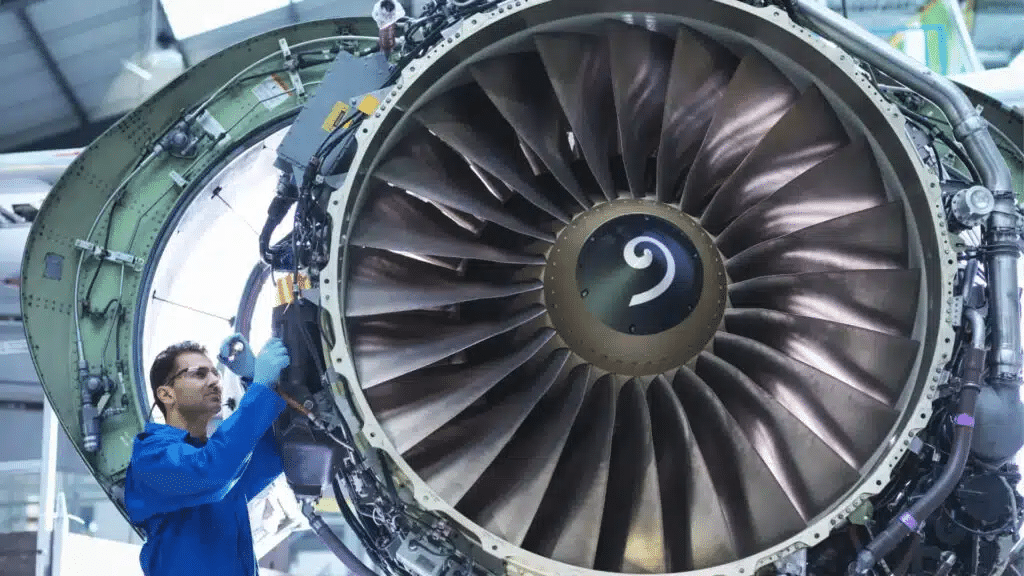

FTAI Aviation, a provider of aftermarket services and jet engine repairs, has helped several small-cap funds tracked by LSEG to outperform the large-cap S&P 500 index this year, Barron’s highlights, with the company’s stock among the top 10 holdings of these funds.

Details

Eight small-cap funds, with assets ranging from less than $20 million to $2.7 billion, have managed to outperform the S&P 500 index this year, Barron’s reports. This was even before last week’s rotation into small-cap stocks. According to market data provider LSEG, which tracks nearly 400 actively managed small-cap funds, FTAI Aviation stock is one of the top 10 holdings for seven of the eight funds mentioned by Barron’s and one of the top three for five of the funds. In other words, just one of the eight funds outperformed the S&P 500 without owning FTAI.

In 2023, FTAI Aviation beat Wall Street’s earnings expectations thanks to a bump in demand for aircraft, which was driven by a tourism boom and manufacturing issues in the industry, particularly at Boeing. FTAI Aviation’s 2023 profit reached $212 million, 45% above the consensus forecast. Analysts now expect 50% growth in earnings over the next two years.

Stock performance

Over the last 12 months, quotes on FTAI Aviation have surged more than 200%, according to MarketWatch. The stock did see a decline at the start of July, dropping in four out of five days during the week of July 8-12 and marking its biggest loss since August 2022. However, it has managed to rebound since then, while year to date FTAI has more than doubled, up 126%.

Due to this surge, Wolfe Research recently downgraded FTAI from “outperform”, equivalent to a buy recommendation, to “peer perform”. Analysts are concerned that the company’s shares are trading at about 40 times next year’s expected earnings, Barron’s reported.

“Following a big run in the stock, we are running out of valuation runway even with anticipated potential positive revisions,” Barron’s quoted Wolfe Research analyst Myles Walton.

According to MarketWatch, 11 analysts cover the company, with nine buy recommendations and two holds.