Quotes on shares of CNS Pharmaceuticals, a developer of drugs to treat brain and central nervous system cancers, plummeted more than 60% on Tuesday, July 30. This came after an agreement was announced with Cortice Biosciences that gives CNS Pharma the intellectual property rights to a brain cancer treatment molecule in four countries in exchange for shares and royalties from future sales.

Details

CNS Pharmaceuticals stock dropped 60.5% on Tuesday to $0.41 per share. The slide did not stop after the close, with the stock retreating further in premarket trading on Wednesday, July 31.

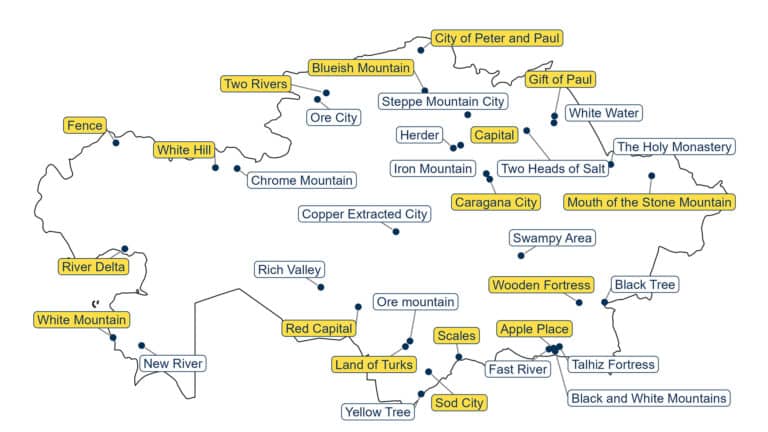

On Tuesday, CNS Pharmaceuticals announced an agreement with Cortice Biosciences whereby Cortice is to transfer to CNS Pharma a license for the intellectual property rights related to certain patents around a brain cancer treatment molecule in the U.S., Canada, Japan, and Mexico. In return, Cortice is to receive new CNS Pharma shares, including 573,400 shares upon the closing of the transaction and 43,300 shares upon the receipt of shareholder approval of the additional share issuance. The agreement also includes four additional milestone payments from CNS Pharma, either in cash or shares at Cortice’s discretion, totaling $100 million or 2.67 million shares. Additionally, CNS Pharma agreed to pay royalties ranging from 3.0% to 7.5% of sales.

About the drug

Cortice is the developer of the microtubule inhibitor TPI 287 for the treatment of glioblastoma multiforme (GBM), an aggressive form of brain cancer. The drug inhibits tumor cell proliferation and causes cancer cell death, explains CNS Pharma. Clinical trials have shown that the drug can cross the blood-brain barrier, which shields the brain from potentially toxic and harmful substances from the blood but can also hinder treatment when it perceives drugs as a threat. The TPI 287 molecule is undergoing clinical trials and has already been designated an orphan drug.

CNS Pharma is working on other brain cancer drugs. Its lead candidate is Berubicin, which can cross the blood-brain barrier as well.

Commenting on the logic behind the deal, CNS Pharma CEO John Climaco said: “For years, our team has searched for another drug candidate with the same high level of human data-supported therapeutic potential in GBM as Berubicin.”

Stock performance

CNS Pharma stock has lost 71% in the past month and almost 100% since the beginning of the year. This summer, the company announced several additional share issues, significantly increasing its share capital. According to MarketWatch, the company is covered by one analyst, who rates the stock a hold.