Medical test developer VolitionRx retreats after additional stock offering announced

Shares of VolitionRx, a company that develops early-detection tests for serious diseases, fell over 7% on Friday, August 9. This came after the company announced a direct offering in which it plans to sell up to $21.5 million of new shares and warrants to an undisclosed investor.

Details

VolitionRx stock lost 7.19% on Friday to close at $0.53 per share, though it managed to claw back 4% in after-hours trading. It has dropped 26.5% since the beginning of the year and more than 56.0% over the last 12 months.

Earlier in the day on Friday, VolitionRx announced a direct offering, with 12.7 million new shares to be sold for $7 million. This corresponds to a price of $0.55 per share, 4% higher than the eventual closing price on Friday. Another $14.5 million could be raised in the deal from milestone-linked warrants, should they be exercised. The transaction is expected to close today, August 12, or sometime soon.

What VolitionRx does

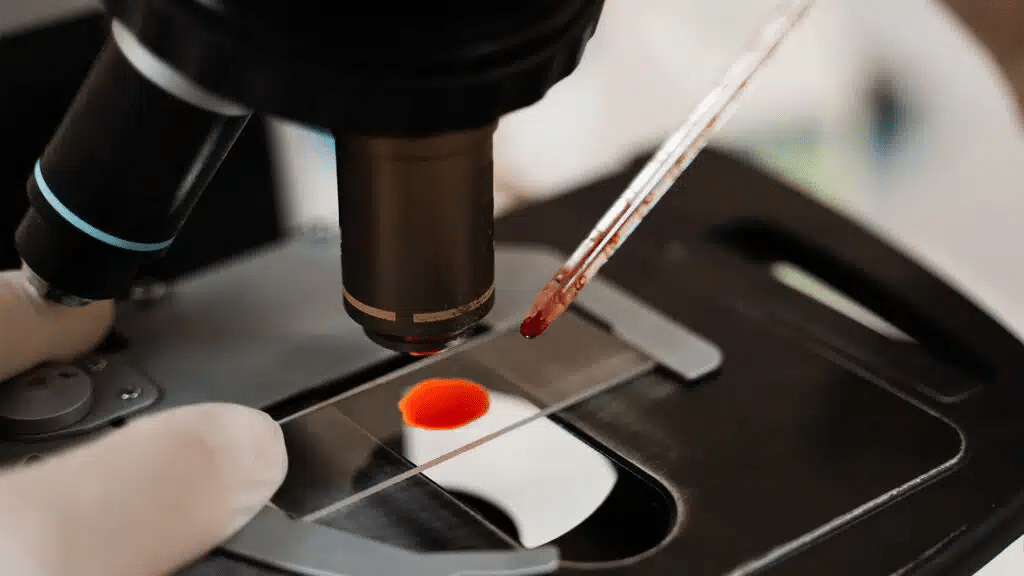

Through its subsidiaries, VolitionRx produces tests to help diagnose diseases in both humans and animals. For example, its Nu.Q technology, according to the company, can detect epigenetic changes before a standard biopsy and before the appearance of initial symptoms. The technology underpins its veterinary cancer tests and tests for detecting NETosis, a form of cell death found in patients with sepsis, cancer, and other conditions.

In the first quarter, the company said it was working toward neutral cash flow by 2025 and cutting costs, targeting $10 million in annualized reductions. In particular, it has applied for or is in the process of applying for $25 million in grants in the U.S. and another $18 million in Europe.

The company’s strategy, according to the first-quarter earnings announcement, entails monetizing its intellectual property through licensing, which would allow it to earn royalties. Such agreements are already in place for VolitionRx’s veterinary subsidiary. In March, it signed a contract with Fujifilm Vet Systems to supply tests to the Japanese market.

Analyst insights

According to MarketWatch, four analysts cover the company. Three recommend buying VolitionRx stock, while one has a hold recommendation. The average target price is $3.16 per share — nearly six times the closing price as of August 9.