Shares of hearing implant developer Envoy Medical surged almost 20% on Monday, August 12. Before the market opened, the company reported its second-quarter 2024 results and announced that, after 18 months of preliminary research on its cochlear implant — which essentially replaces the function of the inner ear — it plans to move forward to a clinical trial.

Details

Envoy Medical stock on the Nasdaq gained 19.47% on Monday to $2.70 per share. Though it has now added 49% since the beginning of the year, it is still down about 74% for the last 12 months.

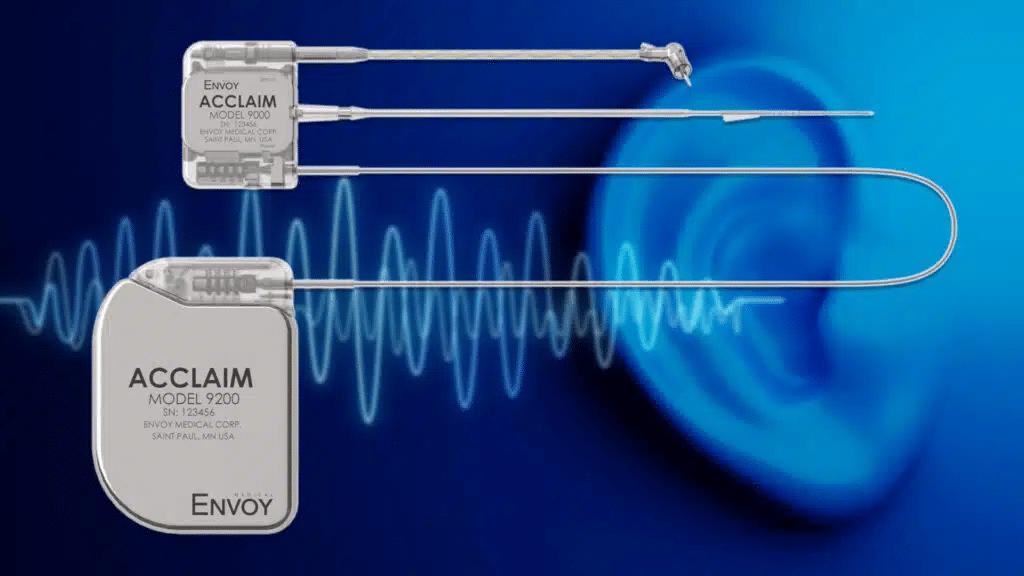

Before the market opened on Monday, Envoy Medical announced that the early feasibility study of its Acclaim cochlear implant did not reveal any serious adverse effects, and all three study participants completed their 18-month follow-up visits.

Acclaim is for adults with severe to profound hearing loss that cannot be treated with hearing aids. Unlike hearing aids, cochlear implants do not just amplify sound — they use software to convert and filter sound, essentially replacing the function of the inner ear. Acclaim had issues with system noise, but the company has implemented updates to reduce it.

This, according to Envoy, justifies moving on to a clinical trial. If successful, Acclaim would become the first fully implantable cochlear device on the market, the company claims. Sales could begin as early as 2026.

About the company

Envoy Medical describes itself as a pioneer in fully implanted devices for people with hearing loss. Its portfolio includes two products: Acclaim, as well as the FDA-approved Esteem middle ear implant, designed for adults with moderate-to-severe hearing loss.

In the second quarter, Envoy’s revenue grew almost 8% to $68,000, driven by the sale of two Esteem implants. Currently, Esteem is not covered by government insurance and not widely covered by private insurers. However, the company reported in July that U.S. senators had introduced a bill to recognize implanted active middle ear hearing devices as prosthetics. Envoy Medical says it is one of the few manufacturers of such devices globally and the only one with FDA approval. If the bill is passed, Esteem would be covered by Medicare, the federal health insurance program in the U.S. According to the company, nearly 40 million Americans suffer from disabling hearing loss.

Analyst insights

According to MarketWatch, four analysts cover the company. All four recommend buying the stock, with an average target price of $5.88 per share.