Zacks spotlights stock of perinatal-tissue therapy developer as undervalued

The fair value of BioStem Technologies, a manufacturer of perinatal tissue-based treatments, should be nearly 80% higher than the current share price, according to Zacks Small-Cap Research (Zacks SCR). BioStem has seen rapid growth recently, and its second-quarter 2024 earnings beat expectations, Zacks SCR points out. BioStem stock rose 8.4% in OTC trading on Tuesday, August 13.

Details

Zacks SCR puts the fair value of BioStem at $24.25 per share, almost 80% higher than the closing price on Tuesday ($13.55 per share) and a dollar upgrade versus the last Zacks SCR review of BioStem in May (at that time the target price was set at $23.25 per share).

Zacks SCR argues that BioStem is “changing the skin graft market” with its use of the natural properties of perinatal tissue. The company’s growth is accelerating, it notes, driven by the management’s “smart and aggressive” moves. On Monday, BioStem reported second-quarter revenue of almost $74.5 million, which marked a 6,872% improvement versus the same period last year. Gross profit came in at $70.7 million for a margin of 95%.

The stock added about 8% to $13.55 per share in OTC trading on Tuesday. It is now up 131% since the beginning of the year and 674% over the last 12 months.

About BioStem Technologies

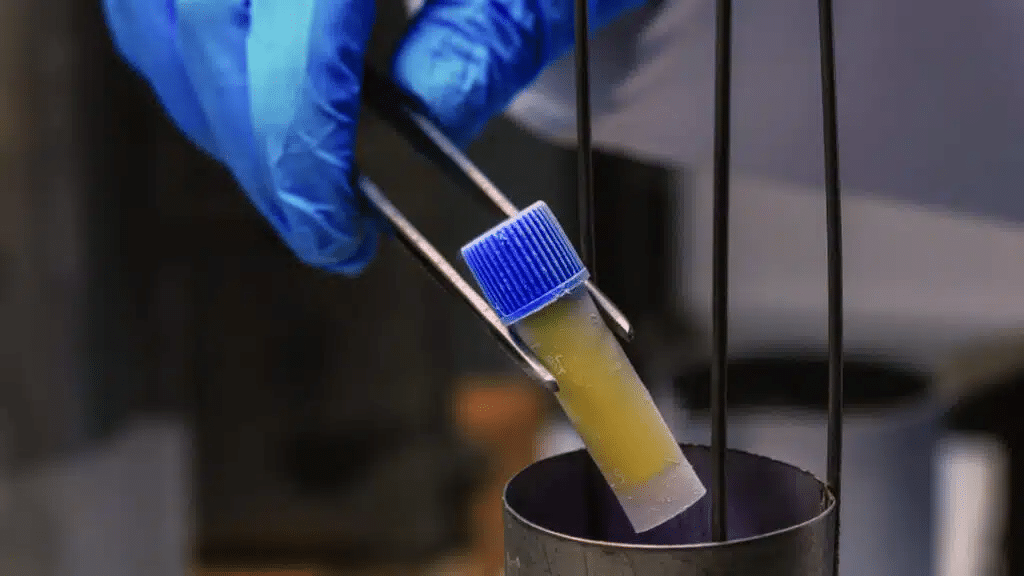

The company was founded in 2014 by Mazda Factory Race Team mechanic Jason Matuszewski and former U.S. Marine Andrew Van Vurst, along with Andrew’s father, Chip Van Vurst. The latter used to be a professional race car driver and has twice battled brain tumors. His father’s diagnosis motivated Andrew to go into regenerative medicine. BioStem uses perinatal tissue for regenerative therapies. Its products are used, for example, for vision restoration and as a protective covering for soft-tissue wounds.

Last year was a pivotal one for BioStem, laying a “solid foundation” for future expansion, according to hugealerts.com. The company signed several agreements to commercialize its treatments nationwide. Since January 2024, its product for covering soft-tissue wounds has been covered by Medicare, the federal health insurance program in the U.S. In June, the company received Institutional Review Board (IRB) approval to clinically study the effects of its product, AmnioWrap2, on diabetic foot ulcers. BioStem believes this will contribute to the progress of AmnioWrap2 toward commercialization.