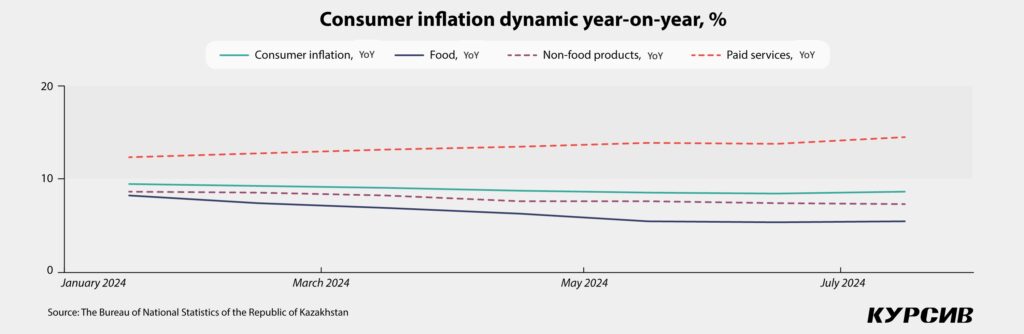

For the first time in 16 months, the year-on-year (YoY) consumer inflation has changed direction: after reaching 8.4% in June 2024, it surged to 8.6% in July. This increase was primarily driven by rising business costs and budget expenditures.

Annual consumer inflation in Kazakhstan has accelerated due to a strong upward trend in paid services (+14.5% YoY or +0.7 percentage points per month) and a renewed price surge for food products to 5.5% YoY, +0.1 percentage points. Meanwhile, non-food prices have slightly slowed to 7.3% YoY or 0.1 percentage points per month.

The Bureau of National Statistics (BNS) was primarily focused on prices for food and services in its latest report.

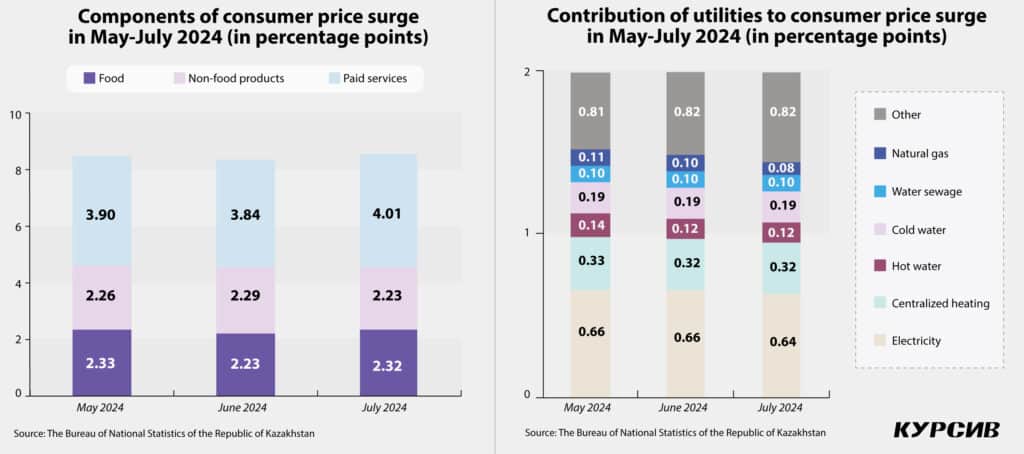

«Over the past twelve months, fruit and vegetable prices have risen by 6%; meat and meat product prices by 4.1%. Each group contributed to inflation growth by 0.5 percentage points. Bread and grain products surged by 6.3% (+0.4 percentage points). Non-alcoholic beverages rose by 8.2% and dairy products by 5.6%, adding 0.2 percentage points to inflation; egg prices surged by 10.5%, adding 0.1 percentage points to annual inflation. Utility costs rose by 17.3% over the year, contributing 2.3 percentage points to inflation. In July 2024, electricity prices increased by 31% compared to the same period last year, adding 0.6 percentage points to annual inflation. Rental costs surged by 12.4%, contributing 0.4 percentage points to inflation; centralized heating by 33% (+0.3 percentage points), cold water by 36.5% and housing maintenance and repair services by 6.8%, each adding 0.2 percentage points to inflation.»

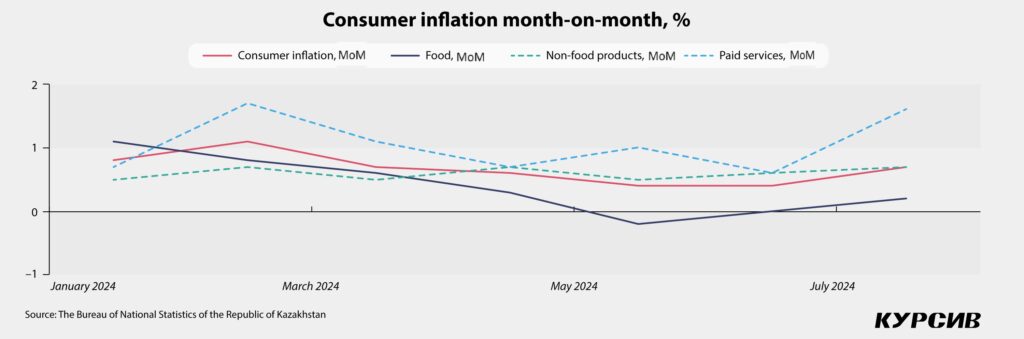

The overall picture becomes even more complicated when analyzing changes in consumer prices. The composite rate has changed by 0.7% month-on-month, close to the average inflation in June over the past five years (0.68%). A sharp surge in paid services also stands out, reaching 1.6% in July after 0.6% in June. There have been at least four similar surges of service inflation over the past two years: in February 2023 (+1.3% month-on-month), in August 2023 (+1.9%), November 2023 (+1.7%), and February 2024 (+1.7%).

Other components of inflation also accelerated month-on-month (MoM). For instance, food products surged by 0.2% MoM: in June, the BNS reported zero price surge, while in May the rate slipped by 0.2% for the first time since August 2020. Non-food products reported a 0.7% price increase in July (+0.6% in June).

Indeed, the cost of services strongly influences the surge of consumer inflation: their annual dynamic is three times more powerful than the dynamic for food prices and twofold higher for non-food products. Within the structure of annual inflation growth, they account for about half of the growth (4.0% out of 8.6%). The aforementioned utilities sit at the core of service inflation.

However, utilities are not the only driver for service inflation: from May to July 2024, the contribution of these services to inflation dropped from 2.34% to 2.27%. Let’s look at other elements of «paid services.» Although detailed data for July prices is already available, necessary hints are found in the statistics for June. In June 2024, prices for several services were surging above average both year-on-year and month-on-month, including kiddie rides (16.9% YoY and 4.4% MoM), gym services (15.4% YoY and 2.8% MoM), hairstyle and beauty salons (13.5% YoY and 1.9% MoM), car maintenance and repair (12.1% YoY and 0.4% MoM) and fast food (12.3% YoY and 1.0% MoM). It seems businesses from the service industry were adjusting their prices/income to a new level of costs, primarily labor expenditures.

Let’s look at this picture from a different angle. Against the backdrop of slowing base consumer inflation from 8.5% in January to 7.3% in June, the base inflation for producers accelerated from 4.2% in April to 5.9%. At the end of July, industrial product manufacturers reported a price surge of 9.6% YoY (6.9% in June and 2.1% in January 2024) and 2.3% MoM. Furthermore, manufacturers actively raised prices for energy services like electricity distribution services (22.9% YoY and 0.7% MoM), liquefied petroleum gas (19.5% YoY and 8.3% MoM) and heating (16.9% YoY and 0% MoM).

This dynamic of producers’ and consumer prices could be explained by the upsurge of inflation when growing nominal incomes drive price surges which in turn stimulate raising salaries and social benefits, pushing prices up further. Over the past several years, salaries in the budget sector have been growing at outperforming rates thanks to government support. In 2022, national companies reported a significant salary increase and then the entire economy of Kazakhstan adjusted to the new employee income level. As a result, nominal salaries rose by 23.7% in 2022, compared to a 20.2% increase in the nominal income of the population. Even amidst sharp inflation, the real income of Kazakhstanis has risen by 4.5%, according to the BNS.

At the end of 2023, nominal salaries rose by 17.6%, nominal income of the population grew by 15.8%, and real income by 1.1%. In the first quarter of 2024, the BNS reported that the nominal and real income of Kazakhstanis grew by 14.4% and 4.7%, respectively. Against this backdrop, money aggregates M0 and M1 rose in June by 12% and 9% YoY, respectively, compared to 7% (M0) and 10% (M1) last year.