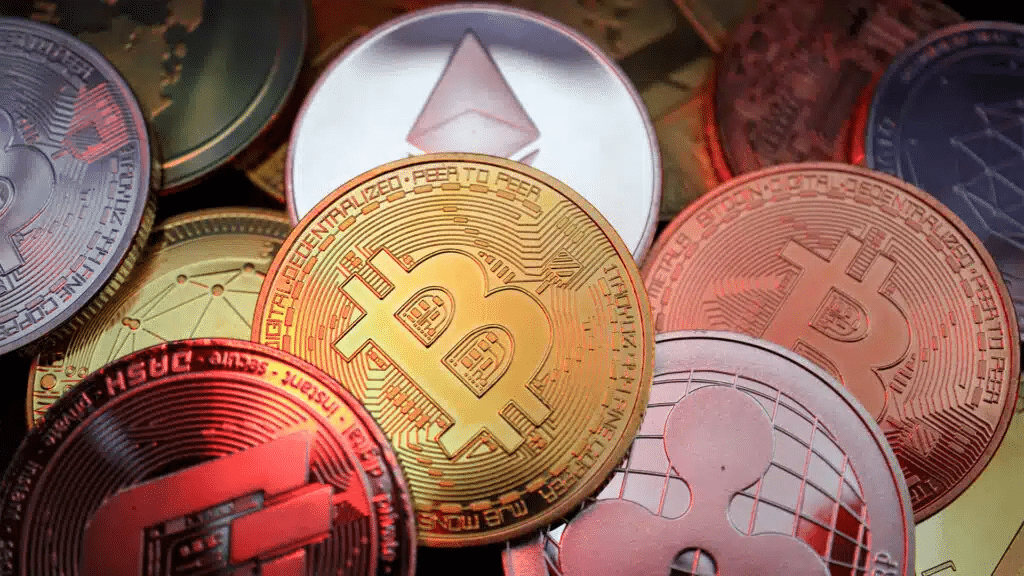

Shares of fintech company DeFi Technologies surged more than 13% in OTC trading on Thursday, August 15. The company reported its “strongest financial quarter to date” and raised its full-year revenue guidance by approximately 50%.

Details

DeFi Technologies stock rose 13.3% to $1.70 per share in OTC trading on Thursday. Before the opening bell, the company reported CAD128.2 million ($98 million) in revenue for the second quarter, a 1,700% year-over-year jump. Net income came in at CAD90.4 million ($66.5 million) versus a loss the previous year. DeFi called this “its strongest financial quarter to date.”

The company also upgraded its full-year guidance, now expecting revenue of CAD179 million ($131 million), about 50% above its previous estimate.

About DeFi Technologies

DeFi Technologies describes itself as a pioneer in bridging the gap between traditional capital markets and the world of decentralized finance (hence the name — DeFi). One of its subsidiaries, Valour, issues exchange-traded products (ETPs) that enable retail and institutional investors to access digital assets like Bitcoin via their traditional bank accounts. As of June 30, Valour had approximately CAD730.1 million ($533.4 million) in assets under management.

In addition, DeFi noted in its second-quarter financials that Valour had launched several ETPs, “significantly enhancing the company’s product offerings and market position.” Valour also launched a trading desk in the UAE to expand ETP listings and its presence in the Middle East.

Another key DeFi unit, DeFi Alpha, aims to identify low-risk arbitrage opportunities within the crypto ecosystem, exploiting price differences for digital assets across various markets or exchanges. It has rapidly become a significant revenue driver, generating over CAD111.5 million ($82 million) in the second quarter.

DeFi Technologies also makes venture investments through its subsidiary DeFi Ventures and provides research and infrastructure support services through Reflexivity Research, which partnered with CoinMarketCap in the second quarter.