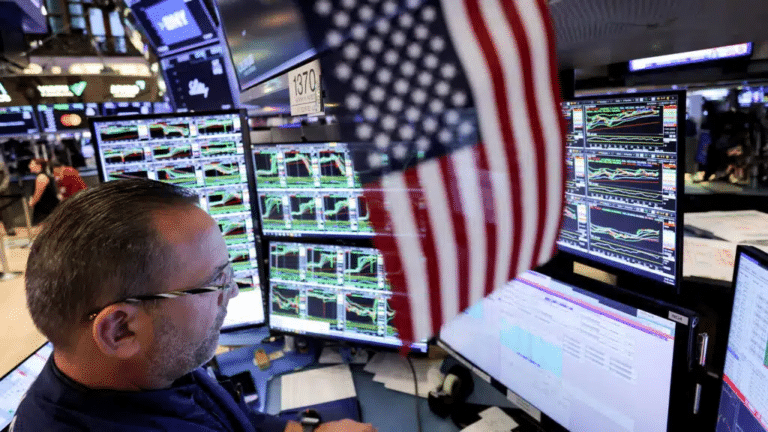

Benzinga has spotlighted three stocks from the Russell 2000 Index that have at least doubled in value in 2024: the fintech company Dave, the voice AI and speech recognition company SoundHound AI, and the large language model developer Innodata. Meanwhile, Wall Street analysts foresee further growth for all three.

Dave

Dave, with a market capitalization of $486.8 million, is the best-performing stock among the three, up 358% for the year to date. It is a banking app that positions itself as an alternative to traditional banks. For instance, Dave offers users cash advances to avoid bank overdraft fees. In addition, its proprietary AI-based underwriting model analyzes the advance eligibility of customers. Analysts see “substantial room” for the company to expand, according to Benzinga. Currently, Dave stock trades at $38.40 per share, with a consensus target price of $61.86 per share among the seven analysts who track the company, according to MarketWatch. They all recommend buying Dave.

SoundHound AI

This company, with a market capitalization of $1.8 billion, develops speech and sound recognition technologies. Its clients include hotels, restaurants, and the automotive industry. In particular, SoundHound is developing an in-vehicle voice assistant in partnership with Nvidia and deploying it in Stellantis-owned brands (including Alfa Romeo, Chrysler, Citroën, Dodge, DS, Fiat, Jeep, Maserati, Opel, Peugeot, and more). The company’s systems for the restaurant industry can take and process orders, review menus, and respond to frequently asked questions.

So far this year, SoundHound AI shares have climbed more than 132% to $4.93 per share. According to MarketWatch, the consensus target price among the seven analysts covering the company is $7.79 per share. Six of them have a buy recommendation, while one has a hold. Last month, Yiannis Zourmpanos, an InvestorPlace contributor and the founder of the stock-market research platform Yiazou Capital Research, included SoundHound AI in a list of three stocks that investors might consider buying instead of Nvidia.

Innodata

This IT services and enterprise software company, with a market capitalization of $517.2 million, was long overlooked by investors. However, its expansion into AI and big data services has put it back on their radar. Innodata has Big Tech companies as clients, developing large language models for them, which has driven double-digit growth in its financial metrics. For example, in the second quarter of 2024, revenue grew a record 66% year over year to $32.6 million, while adjusted EBITDA was up 76% at $2.8 million.

This year, Innodata stock has gained 119%. According to MarketWatch, the two analysts who cover the company recommend buying Innodata, with a target price of $34.00 per share. This suggests upside of almost 191% versus the August 22 closing price.

Focusing on AI large language models, Innodata is capitalizing on the growing demand for sophisticated data solutions, Benzinga notes. Zourmpanos also included the company in his list of three alternatives to Nvidia, while the Motley Fool has spotlighted Innodata as one of three AI stocks “ready for a bull run.”