Small-cap stocks historically shine in U.S. presidential election years, points out Francis Gannon, co-CIO at Royce Investment Partners, 98% of whose assets under management are invested in small caps.

Details

Historically, in presidential election years, the Russell 2000 index, which comprises 2,000 small-cap stocks, outperforms the Russell 1000, made up of 1,000 large-cap stocks, Gannon notes.

He analyzed the last 10 presidential elections and found that at the beginning of the election year, the Russell 1000 slightly outperforms its small-cap sibling; however, by the end of the election year the Russell 2000 pulls ahead, extending the outperformance throughout the year following the election as well.

Context

Past performance is no guarantee of future results, Gannon cautions. He emphasizes that politics and the stock market typically do not experience volatility at the same time. Exceptions are crises and other events that simultaneously impact both areas. This year, Gannon writes, has already proven to be notable for its unpredictability and unprecedented events in politics and the stock market. However, they have not been related.

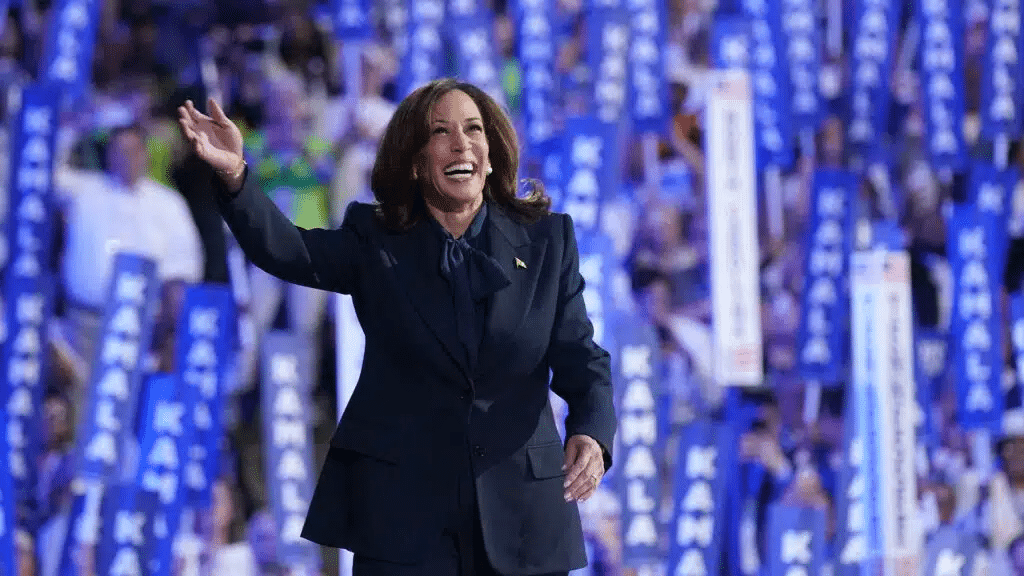

Recall that in mid-July, there was an assassination attempt on the U.S. Republican presidential nominee Donald Trump. Then, current President Joe Biden announced his withdrawal from the race, with Vice President Kamala Harris taking his place on the Democratic ticket. The election is scheduled for November 5.

Meanwhile, the stock market has seen its own fluctuations: a rotation out of big tech and into other sectors and small-cap stocks, followed by a global selloff in equities. The U.S. markets have begun to stabilize, but “much uncertainty” remains, Gannon adds.

Takeaways for investors

“While recent events in both politics and the markets offer lessons in the importance of patience and caution, we are hopeful that small-cap investors will find plenty to cheer about regardless of which direction the election takes,” Gannon concludes.

So far this year, the Russell 2000 has gained nearly 6.8%, trailing the Russell 1000, which is up 16.6%. Small-cap stocks still have the potential to outperform large caps in the intermediate term — “call that the next year or 18 months,” ClearBridge Investments analyst Josh Jamner told MarketWatch. He believes much will depend on whether the Fed succeeds in staving off a recession.

About Royce

Royce Investment Partners was founded by Chuck Royce, regarded as a small-cap stock pioneer. He began investing in small caps more than half a century ago, even before the Russell indexes were created, and has always avoided big names, like Microsoft, IBM, and Walmart. Instead, he invests in what Forbes calls “unsexy” companies, such as knit fabric maker Fab Industries, exhaust manifold producer Wescast Industries, and milk cooler manufacturer Paul Muller. Today, Royce Investment Partners manages 11 open-end funds, three closed-end funds, and an ETF that has outperformed the Russell 2000 by 2.83% on market-price return over the last five years (as of July 31).