Ranking of biggest oil companies of Kazakhstan by Kursiv Research

In 2023, Kazakhstan’s oil industry finally reported solid growth, despite a decline in investments in the sector over the past several years. Furthermore, against the backdrop of ongoing legal disputes between the country’s government and participants in the Kashagan project, there is little hope for an inflow of new investments anytime soon.

After reviewing last year’s results, Kursiv Research has prepared a ranking of oil companies, including descriptions of key corporate events.

Last year, both internal and external conditions were challenging for Kazakhstan’s oil industry.

According to the International Energy Agency (IEA), global oil demand reached 101.7 million barrels per day in 2023, a 1% increase compared to pre-pandemic levels. China’s rapidly growing petrochemical industry accounted for about 80% of the entire global demand. The global appetite for oil might have been greater, as the IEA predicted, had European countries experienced stronger economic growth. However, the EU economy reported just 0.5% growth last year.

At the same time, the global supply of oil slightly exceeded global demand, primarily due to increased oil output by countries that do not participate in the OPEC+ deal. For instance, Brazil, Guyana and the U.S. reached new historical highs in oil production. On the other hand, countries participating in the OPEC+ deal cut their oil production by approximately 400,000 barrels per day, according to the IEA. Global supply reached 101.9 million barrels per day.

This correlation between oil demand and supply pushed down oil prices on the global market. By the end of 2023, a barrel of benchmark oil cost $82.60, reflecting a 17.2% decline.

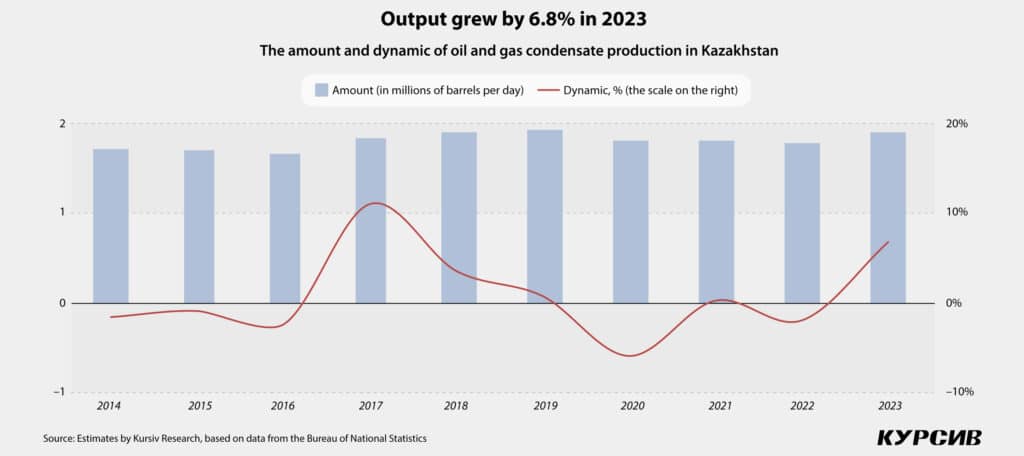

This period was quite successful for Kazakhstan’s oil industry, which returned to a positive trajectory after four consecutive unsuccessful years marked by significant declines and periods of minimal growth (less than 1%). In 2023, Kazakhstani oil companies boosted their output by 6.8% to nearly 90 million tons of crude oil and gas condensate.

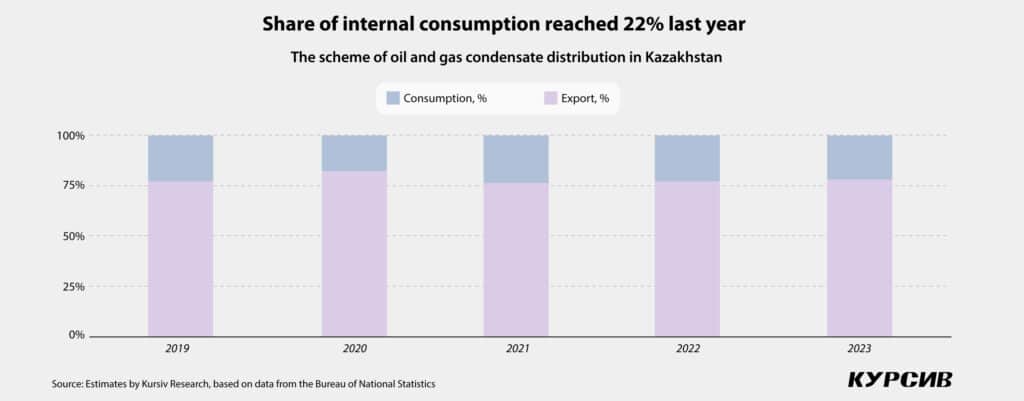

Kazakhstan exported 70.6 million tons of oil or 78.5% of its oil output last year. These exports rose by 8.4% compared to 2022, although export revenue dropped by 9.8% to $42.3 billion due to the correction in global oil prices.

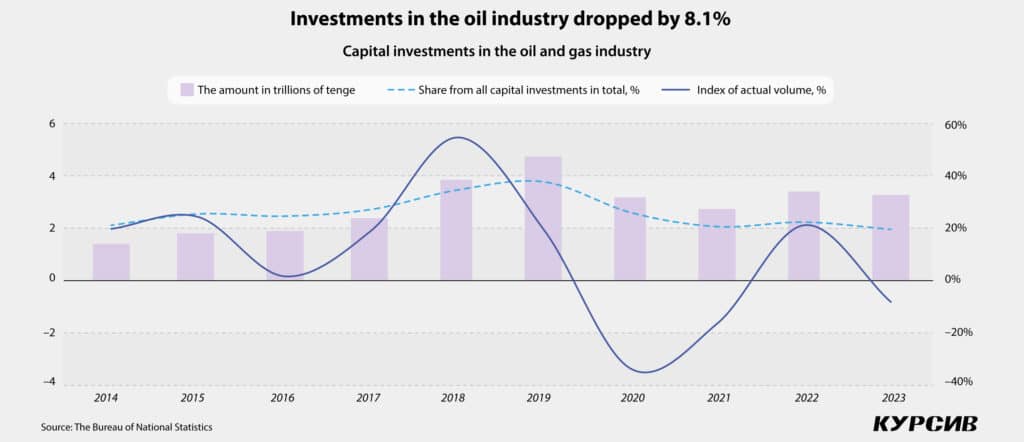

Both fixed asset investments and the gross inflow of foreign direct investment (FDI) are at their lowest levels. Capital investments by oil and gas producers declined to $6.8 billion in 2023, which, in comparable prices, is 8.1% lower than in 2022. This was the lowest value for this indicator over the past ten years in absolute figures.

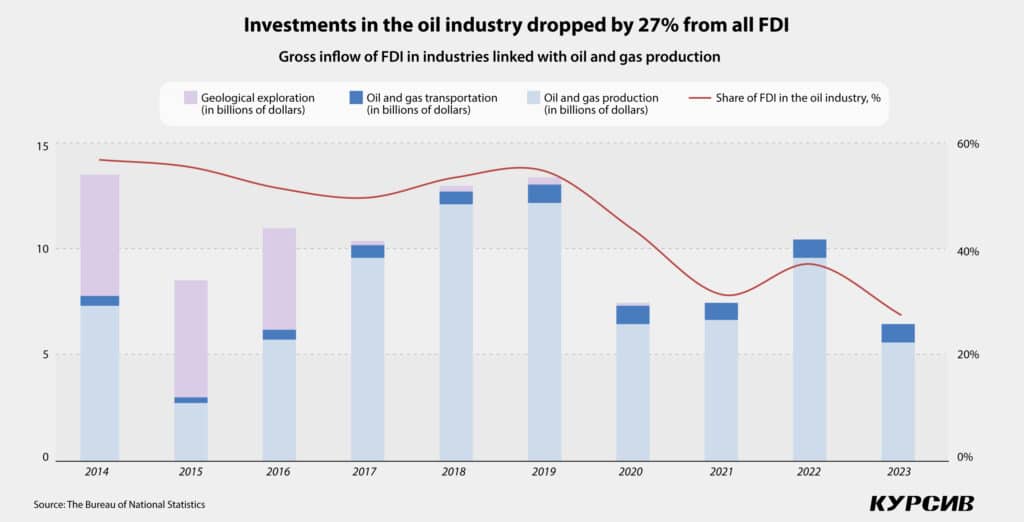

The gross inflow of FDI into the oil and gas industry dropped to $5.6 billion, a 41.5% decline in nominal value compared to 2022. In 2015, the sector reported just $2.7 billion in FDI, the lowest rate over the past ten years, when oil prices plunged by 47% year-on-year. The geological exploration sector is also struggling with a lack of investments, reporting an outflow of FDI for three consecutive years.

Despite various incentives introduced by the government in recent years to stimulate geological exploration, including improved model contracts and online auctions, these measures have yet to have the desired effect. Given that the prime cost of oil projects in Kazakhstan is higher than in other countries, many systemic barriers, such as price discrepancies between foreign and domestic markets, hinder geological exploration. Additionally, due to limited access to export pipelines, some oil companies are forced to supply their oil to the domestic market.

Kazakhstan also faces numerous other risks. According to S&P Global, in the third quarter of 2023, Kazakhstan was ranked 78th out of 110 oil-producing countries (with a lower position indicating higher risks).

«Bird-walking weather»

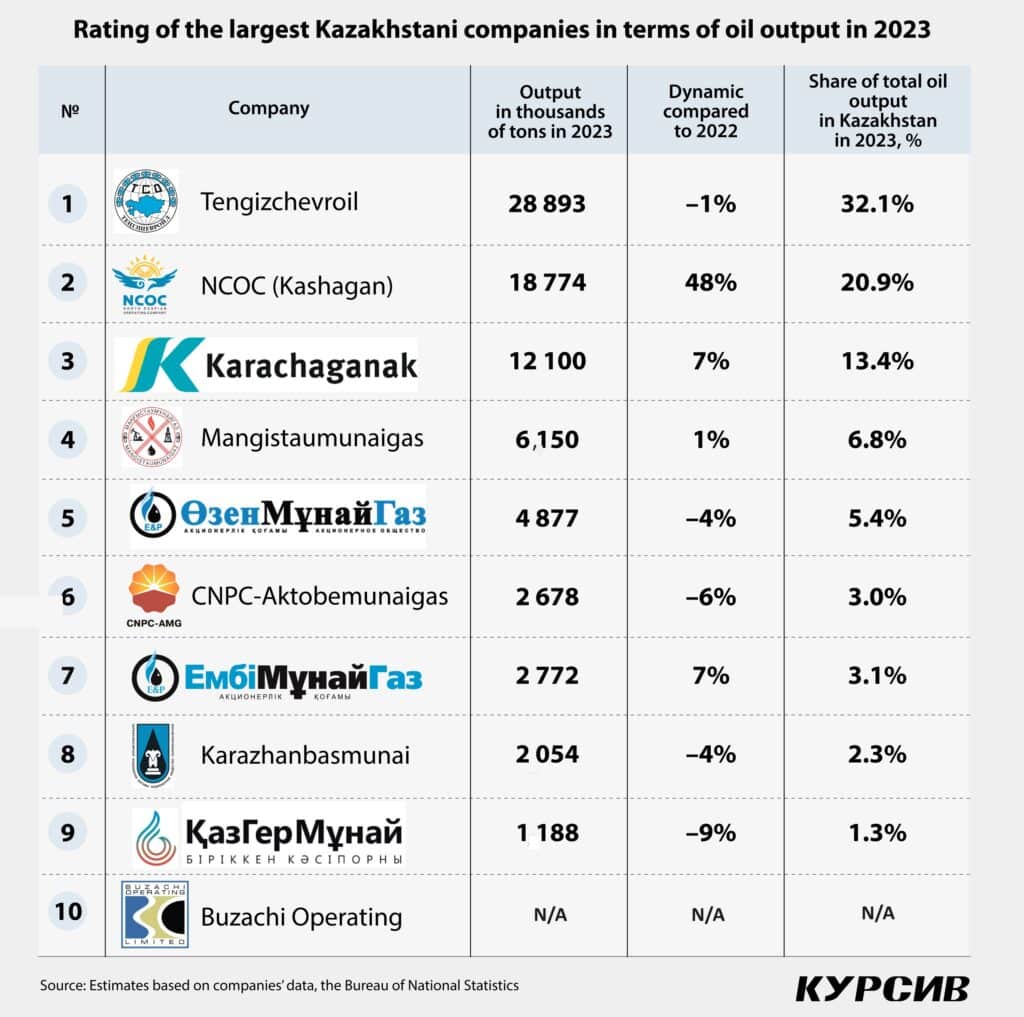

Based on the results of 2023, Kursiv Research has prepared a ranking of the largest oil companies in Kazakhstan, highlighting key corporate events. There were no significant changes in the top ten oil companies. Moreover, over the past ten years, three companies have consistently been the leaders.

These are Tengizchevroil, which develops the Tengiz and Korolevskoye fields; the North Caspian Operating Company (NCOC), responsible for Kashagan, Kairan and Aktoty; and Karachaganak Petroleum Operating (KPO), which operates the Karachaganak field. Over the year, the concentration of these three megaprojects has increased from 63.1% to 66.4%.

Tengiz

In 2023, Tengizchevroil produced approximately 28.9 million tons of oil, marking a 1% decline compared to 2022. This decline was partly due to a short-term stoppage of oil exports through the Caspian Pipeline Consortium (CPC). In June, the CPC conducted a scheduled overhaul of its sea terminal and the company also halted operations on four occasions in December 2023 due to adverse weather conditions in the Black Sea.

The integrated Future Growth Project – Wellhead Pressure Management Project (FGP–WPMP) is in its final stage. Tengizchevroil is expected to boost its oil output by 12 million tons once the project is completed. By the end of 2023, the overall progress on these projects was 99.3%, with all mechanical work completed and commissioning work underway.

From January to June 2024, Tengizchevroil switched its first measuring unit to low pressure and launched the pressure boosting facility (PBF). The company described this move as a key achievement within its WPMP project. Additional PBF compressors are expected to be commissioned by the end of the year, along with upgrades to other measuring units.

Last year, Tengizchevroil revised the key parameters of the FGP–WPMP once again. The expected cost of the project rose to $48.9 billion, with $45.6 billion already spent (93.3%). The launch of the WPMP has been rescheduled from December 2023 to the second half of 2024, while the FGP is now expected to be put into operation in the second quarter of 2025, instead of June 2024 as previously anticipated. Naturally, the Kazakhstani authorities were not pleased with this delay.

Kashagan

In 2023, NCOC increased its oil output by 48% to 18.8 million tons, largely due to the absence of unscheduled overhauls compared to the previous year.

In August 2022, the company experienced a significant decline in daily production due to a slugcatcher failure. The resulting overhaul lasted until November, which reduced annual output by 21.9% and overshadowed the upgrade of the reinjection compressor. However, the $207 million project eventually enabled the company to boost its daily output by 15,000 to 20,000 barrels, improving overall results in 2023.

In 2023, the consortium also completed the installation of a new slugcatcher made from improved materials and anticorrosion coating, which cost $307 million.

According to KazMunayGas’s 2023 annual report, the average daily output at Kashagan was 408,000 barrels. Further increases in production will depend on the implementation of three new projects. One of these projects involves crude gas processing. Although this project, with a capacity of one billion cubic meters of crude gas, began in 2021, it is still yet to be completed.

The launch of the gas processing plant could significantly impact oil output at Kashagan. The consortium currently cannot increase production due to limitations with associated petroleum gas—the Bolashak Integrated Oil and Gas Treatment Unit has no additional capacity for gas processing. Consequently, the company has either injected gas back into wells or processed it into commercial-grade gas. In early 2020, NCOC planned to supply one billion cubic meters of gas to a third-party company, which was supposed to build a new gas processing plant under KazTransGas. This setup was expected to boost Kashagan’s output to 450,000 barrels per day.

In February 2020, KazTransGas was replaced by GPC Investment, a private company that pledged to fund the project with its own and borrowed funds. The Development Bank of Kazakhstan considered supporting the project, which was initially estimated at $860 million.

Following the January 2022 events, QazaqGas (formerly KazTransGas) underwent staff changes, including the departure of former CEO Kairat Sharipbayev, a known ally of Ex-President Nursultan Nazarbayev. Six months after these events, the Kazakhstani government took full control of GPC Investment, which was later integrated into QazaqGaz. In February 2024, UCC Holding from Qatar agreed to finance the construction of the gas processing plant, which has seen its cost increase to $1 billion over the past two years. By June 2024, the foreign partner had acquired a 75% stake in GPC Investment. The new deadline for the commissioning of the gas plant with a capacity of one billion cubic meters is mid-2026.

Under this project, NCOC is expected to build a 14-kilometer gas pipeline from its Bolashak Integrated Oil and Gas Treatment Unit to the new plant. According to KMG’s 2023 annual report, the company is ahead of schedule, having completed 72.5% of the work compared to the planned 68%. The necessary pipes have been delivered, eight kilometers of pipeline have been laid and a fiscal metering unit has been installed. NCOC has estimated this work at $160 million.

Qatari investors are also prepared to finance the construction of a second gas processing plant near Kashagan. If implemented, this project, which will handle 2.5 billion cubic meters of crude gas, could increase the company’s oil output to 500,000 barrels per day. According to QazaqGas CEO Sanzhar Zharkeshov, the cost of these projects may range between $2 billion and $2.5 billion. A feasibility study for this project is currently underway and is expected to be completed between 2028 and 2029.

The gas processing plant with a capacity of 2.5 billion cubic meters is the first part of the second phase of the expansion project, referred to as Stage 2A in KMG’s annual statements. The document indicates that the crude gas will be supplied to the company’s gas processing plant, not to a third party, unlike the gas processing plant with a capacity of one billion cubic meters, which is still in the preliminary design stage.

However, based on the current configuration, it seems more likely that the gas will be supplied to a third party. For example, in July 2024, QazaqGas acquired a 25% stake in Kashagan Gas Treatment Plant 2.5 BCMA Ltd., which is expected to oversee the construction of the gas processing plant.

Karachaganak

Last year, Karachaganak reported a 7.5% increase in its output to 12.1 million tons, boosting its supplies of crude gas to the Orenburg gas processing plant. Earlier in 2022, the amount of gas being reprocessed at the plant sharply declined due to an overhaul of its technological facilities.

Karachaganak Petroleum Operating (KPO) is completing the first stage of the Karachaganak Expansion Project (KEP-1A), which involves the construction of a fifth compressor for the reinjection of crude gas. According to KMG’s 2023 annual report, the new facility is expected to be commissioned in the fourth quarter of 2024.

Two years ago, KPO shareholders and PSA, the entity authorized to represent Kazakhstan’s interests under the Production Sharing Agreement (PSA), agreed to launch KEP-1B and successfully made the final investment decision for the project. The KEP-1B project involves the installation of a sixth reinjection compressor and other relevant equipment. Work scheduled for 2023 was completed with actual progress at 35.3%, compared to the planned 12.9%. Both the KEP-1A and KEP-1B projects are designed to support the current level of oil production in the field.

No power for mature fields

Many smaller enterprises, compared to the larger oil companies mentioned earlier, are engaged in developing mature oil fields where output naturally declines. This negative trend was exacerbated by power failures and reduced capacity of the Mangystau Nuclear Energy Plant.

In 2023, there were 347 power failures affecting the operations of at least four of the top ten enterprises: Mangistaumunaigas (#4), Ozenmunaigas (#5), Embamunaigas (#6) and Karazhanbasmunai (#7). These companies reported a total of 511,000 tons of underproduced oil.

Mangistaumunaigas fared the best among the affected entities, managing to produce 6.2 million tons, just 0.9% less than in 2022. The company also signed a new collective agreement for the next three years, marking a significant corporate milestone.

Ozenmunaigas reduced its output by 219,000 tons, producing 4.9 million tons in 2023. The company attributed the decline to power shortages; according to KMG’s 2023 annual report, Ozenmunaigas underproduced 294,000 tons of oil due to power failures or limited power supply.

Although power outages did not impact CNPC-Aktobemunaigas, the company still reduced its oil output by 6.5% to 2.7 million tons. However, it increased the extractable amount of oil by 705,000 tons. The 2023 annual report highlighted CNPC-Aktobemunaigas as one of the few oil and gas operators in Kazakhstan that has systematically explored oil on land for decades. Last year, the company implemented a comprehensive exploration program at its Teresken-1 and Teresken-2 blocks in the Baigany district of the Aktobe region.

Embamunaigas (EMG) significantly increased its oil production despite being affected by power outages, with the least reported losses of about 14,400 tons. EMG boosted its output to 2.8 million tons, a 7.4% increase over 2022, thanks to successful geological and engineering operations at mature deposits and the development of two new oil fields: S. Nurzhanov (Eastern part) and Uaz Severnoe.

Karazhanbasmunai reduced its output by 4.1% to 2.1 million tons, reporting a decline of 88,000 tons and losses of 105,900 tons due to power outages.

Kazgermunai, which develops mature oil fields in the Kyzylorda region, did not face power cut issues. However, due to the natural decline in production, its output dropped by 8.8% to 1.2 million tons. On the positive side, the company extended its subsoil use contract for the Aksay field until March 2032 and for the deposits of Nuraly, Eastern Akshabulak, Southern Akshabulak, Central Akshabulak and Southern Aksay until March 2034. Additionally, Kazgermunai reported a 6% increase in its C1 oil reserves for three oil fields: Nuraly, Aksay and Southern Akshabulak.

The battle of Kashagan

The launch of the second phase of the Kashagan expansion project (Stage 2B) is widely seen as a potential game-changer. It is expected to boost accompanying gas production by six billion cubic meters, which would allow NCOC to increase its oil output to 710,000 barrels per day.

Kazakhstani authorities have a strong interest in the successful launch of Stage 2B, as the government’s share in Kashagan oil is currently quite small relative to production levels. Under the existing Production Sharing Agreement (PSA), 80% of the oil produced at Kashagan is allocated to shareholders to reimburse their historical expenditures, which total approximately $60 billion. The remaining 20% is profit oil, of which Kazakhstan receives only half or 2% of the total crude produced at the field, according to Nurlan Zhumagulov, Executive Director of the Energy Monitor Fund. Kazakhstan’s share will not increase until investors recover all their investments. If production levels remain unchanged, Kazakhstan’s share will stay the same until the PSA expires in 2041. Moreover, Kazakhstani authorities are unlikely to achieve the declared 6% economic growth without additional oil from Kashagan.

In contrast to the two gas processing plants expected to be built in Kazakhstan, Stage 2B requires significantly more funds. In late 2021, NCOC executives presented a preliminary concept for the project at a conference organized by Kazneftegazservice. The concept involves constructing several large facilities simultaneously: an offshore drilling island, new wells and a pipeline to transport fluids to a new onshore oil and gas treatment plant. The company has already built five artificial islands and is expected to construct a sixth. However, no official cost estimates for the project have been released. In an interview with Newshub.kz, Zhumagulov estimated the project’s cost at around $10 billion, though this figure could increase as large projects often experience cost overruns.

In early March 2023, several oil and gas experts, including Zhumagulov, reported that negotiations between the government and NCOC shareholders regarding Stage 2B had stalled, as shareholders sought an expansion of the PSA due to their substantial investments.

Following the deadlock, Kazakhstani authorities initiated legal actions against the Kashagan operator. The first move came from ecology officials. In late March 2023, the Ecology Department of the Atyrau region announced ten violations of environmental legislation at Kashagan, including the unauthorized storage of sulfur, a byproduct of oil treatment. Kazakhstani officials imposed a $5.2 billion fine on the company for these violations. The consortium contested the accusation and took the case to court. The specialized interdistrict court of Astana partially ruled in favor of the plaintiff, agreeing that the amount of sulfur stored at the Bolashak site was within limits because annual quotas can be accumulated.

The Department of Ecology filed a cassational appeal and in February 2024, the Astana Court of Appeal upheld the department’s findings, ruling that annual quotas for sulfur storage should not be accumulated. Despite this, there have been no media reports confirming that NCOC paid the $5.2 billion fine. The company’s shareholders still have the option to appeal to an international court. Meanwhile, NCOC paid other fines for environmental violations, including a $25.8 million fine in March 2024 for burning sulfur dioxide gas without authorization and discharging untreated wastewater into the Caspian Sea.

In April 2023, the PSA filed a case at an international arbitration court against the operators of Kashagan and Karachaganak. The case accuses investors of artificially inflating their expenditures and reducing Kazakhstan’s profit. The country is seeking $13 billion from Kashagan (for the period from 2010 to 2018) and $3.5 billion from Karachaganak (from 2010 to 2019).

In April 2024, Bloomberg reported that Kazakhstan’s claims against Kashagan had risen to $138 billion, reflecting losses due to delays in the project’s launch. The claim was further increased by $10 billion due to allegations of corruption during project implementation. Some experts believe that this pressure is intended to persuade NCOC shareholders to expedite the launch of Stage 2B. Another potential resolution is increasing Kazakhstan’s share in the Kashagan project, similar to what the government has successfully negotiated with shareholders of the Karachaganak operator.