SatixFy, an Israeli company with a market capitalization of $60.4 million that develops satellite communication systems, has reported that its net loss more than halved year over year in the first half of 2024. Revenue rose 7% as the company shifted from development and preproduction to product sales. Quotes on SatixFy dipped 1% on the NYSE on Friday, September 6.

Details

SatixFy has reported that its first-half net loss shrank 54% to $21.3 million, or $0.25 per share, while revenue grew 7% to $6.1 million. The revenue mix shifted toward product sales as various development services agreements were completed.

On Friday, SatixFy stock slipped 1% to $0.71 per share on the NYSE. In after-hours trading, it lost another 3%. Still, it is up more than 96% since the beginning of the year.

About SatixFy

SatixFy develops next-generation satellite space and ground communication systems. Its compact Onyx aero terminal, for example, provides broadband connectivity on small and mid-sized aircraft through multi-orbit satellites. It is based on an electronically steerable antenna (ESA) and features a digital beam-forming technology, built around in-house-developed chipsets.

In May, SatixFy announced an agreement with SCOTTY Group to supply in-flight connectivity terminals and provide associated product support, with SCOTTY Group to integrate them into its communication solutions for aircraft. Before, the Austrian company could not connect some aircraft to satellites because existing terminals were too large.

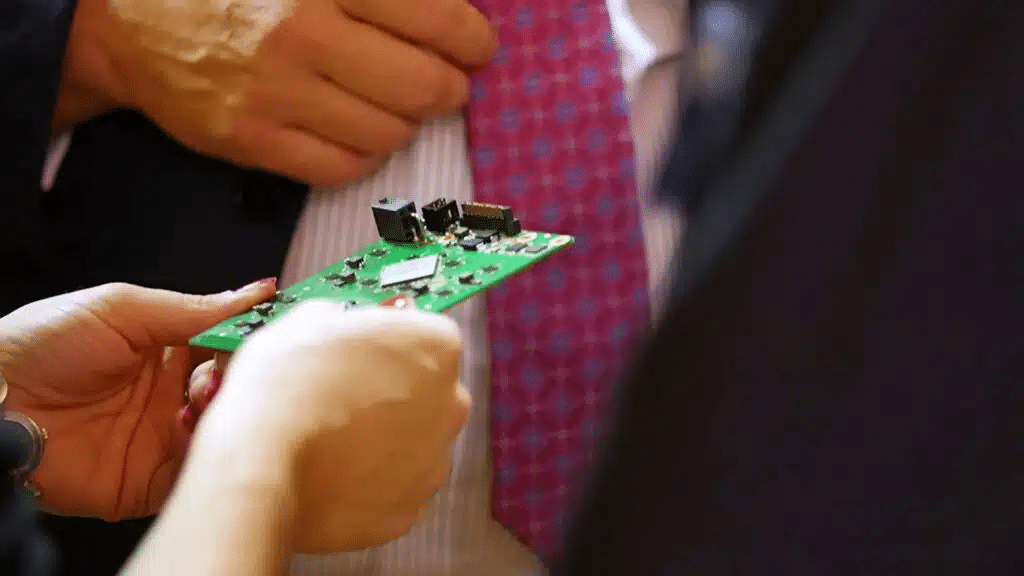

Another product of SatixFy is the Prime2 space-grade chip, an application-specific integrated circuit (ASIC) for complex satellite communication systems. The company describes it as a game-changer for multi-beam low Earth orbit (LEO) or geostationary Earth orbit (GEO) aeronautical antennas thanks to its “unprecedented scalability, flexibility, and performance.”

In June, SatixFy announced that it would supply chips and software for $20 million over the following five quarters to an undisclosed customer — a tech company building its global LEO satellite network. Note that around 50,000 satellites are expected to be launched into LEO within a decade, according to an investor presentation of another Israeli provider of satellite communication technology, Gilat Satellite, which has a market capitalization of $254.9 million on the Nasdaq. The main players in this segment include Telesat, Iris2, OneWeb, Elon Musk‘s Starlink, and Jeff Bezos‘s Amazon.

SatixFy CEO Nir Barkan attributed the improved financial performance in the first half to shipments of engineering samples of ASICs, said. “We are on track towards commercialization, which we expect by mid-2025,” he added.