The micro-cap company Sonendo, which makes dental cleaning systems, has lost 65% of its value over four days despite an absence of news. Its market capitalization now stands at $1.34 million. The main short-term challenge for the company is securing new financing, analysts say.

Details

Sonendo stock has dropped more than 65% in over-the-counter trading in New York since last Tuesday, September 10, reaching an all-time low of $0.022 per share. The steepest loss came on Friday, September 13, when half the company’s market capitalization was wiped out. Since the start of the year, the stock is down almost 90%, with the last-12-month decline at more than 97%.

Analyst insights

The losses began on Wednesday, September 11, with trading volumes rising on Thursday and Friday, September 12 and 13, even though Sonendo did not generate any news during those days, points out Ilya Zubkov, a senior analyst at Freedom Finance Global. Zubkov suggests that the reason for the sharp movement may be the low liquidity of the shares, which are traded over the counter.

Several large trades on September 12 and 13 themselves exceeded the average daily trading volume over the last three months, possibly causing the big losses amid a lack of matching orders and the activation of stop-loss orders (i.e., shares were automatically sold at a previously set minimum price to minimize losses), Zubkov notes.

According to MarketWatch, two analysts track Sonendo. Their recommendation is to hold the stock, with an average target price of $0.20 per share. That now implies upside of over 800% versus the last closing price.

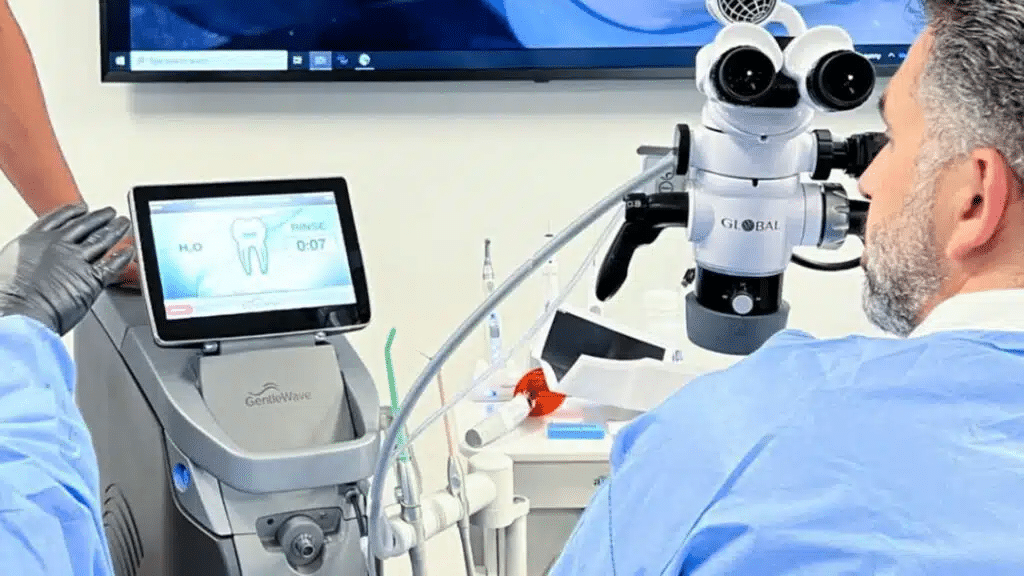

What Sonendo does

Sonendo describes itself as a medical technology company focused on saving teeth from tooth decay. Its main product is a system for cleaning and disinfecting microscopic spaces within root canals, allowing dentists to preserve more of the natural tooth structure.

Zubkov says the main risk for Sonendo through the end of the year remains raising new financing, which, given the company’s debt and low market value, looks set to be rather challenging. At the end of the 2024 second quarter, Sonendo had $20.5 million of principal payments outstanding under its term loan facility, as reported in its second-quarter earnings. The company’s revenue in the period was $8.3 million, with the net loss reaching $7.4 million.

Management has not disclosed how it plans to raise new financing, noting only that work is underway, Zubkov says.