President Kassym-Jomart Tokayev has directed the Ministry of Tourism and Sports to finalize a development plan for the Almaty Mountain Cluster by April 2025. This tourist destination is one of the top three with immense potential to attract visitors, but its development will require billions of dollars in investment.

According to Yerzhan Yerkinbayev, vice minister of tourism and sports, a visa-free regime for 82 countries and an «open skies» policy for international airlines has doubled the inbound tourist flow to Kazakhstan in 2024, a trend he described as steady.

«Last year, 9.2 million international tourists visited Kazakhstan, doubling the figure from 2022. Foreign tourist arrivals also experienced a twofold increase year-on-year,» Yerkinbayev said.

On average, each international tourist spends nearly nine times more in Kazakhstan than a domestic tourist ($334 vs. $38 per day). This is why the country’s national development plan through 2029 prioritizes the development of three key tourist destinations, including the Almaty Mountain Cluster (AMC), which has the greatest chance to spark interest from foreign tourists.

«The president has prioritized the development of three destinations and one of them is the Almaty Mountain Cluster, which has the potential to become a major tourist destination both in Kazakhstan and globally,» Yerkinbayev added.

Meanwhile, foreign tourists’ satisfaction with AMC resorts has reached 69 on the Net Promoter Score (NPS, a customer loyalty and satisfaction measurement). While this is a «good enough» rating, it’s far from being exceptional due to high occupancy rates at existing resorts and a shortage of accommodations.

Top destination

One in every four international tourists to Kazakhstan visits Shymbulak, one of AMC’s largest resorts. Over two million international tourists visited the resort last year and demand continues to grow.

«Chinese tour operators are ready to send 250,000 tourists per month, but the region’s accommodation capacity is ten times lower,» said Rinat Abdrakhmanov, CEO of Shymbulak Mountain Resort. «Our mountain resorts are overwhelmed with visitors. Shymbulak was designed for 500,000 visitors annually, but we are seeing up to three times that number of tourists. We’re constrained by infrastructure — there aren’t enough accommodations and the trails are too short. As a result, we’ve had to limit ticket sales.»

The relatively short length of the local ski slopes and their scattered layout also reduce AMC’s appeal to the European market.

«European tourists have high expectations,» explained Andrey Kukushkin, secretary general of the Eurasian Alliance of Mountain Resorts (EAMR). «They won’t come to resorts where each slope is only 25 kilometers long. We need larger ski areas with more than 100 kilometers of slopes.»

Industry experts believe the future of AMC lies in connecting the ski slopes of existing mountain resorts. Several cable cars could connect the resorts, creating a unified skiing zone. There are also long-term plans to build new resorts east and west of Almaty.

Expanding lift capacity

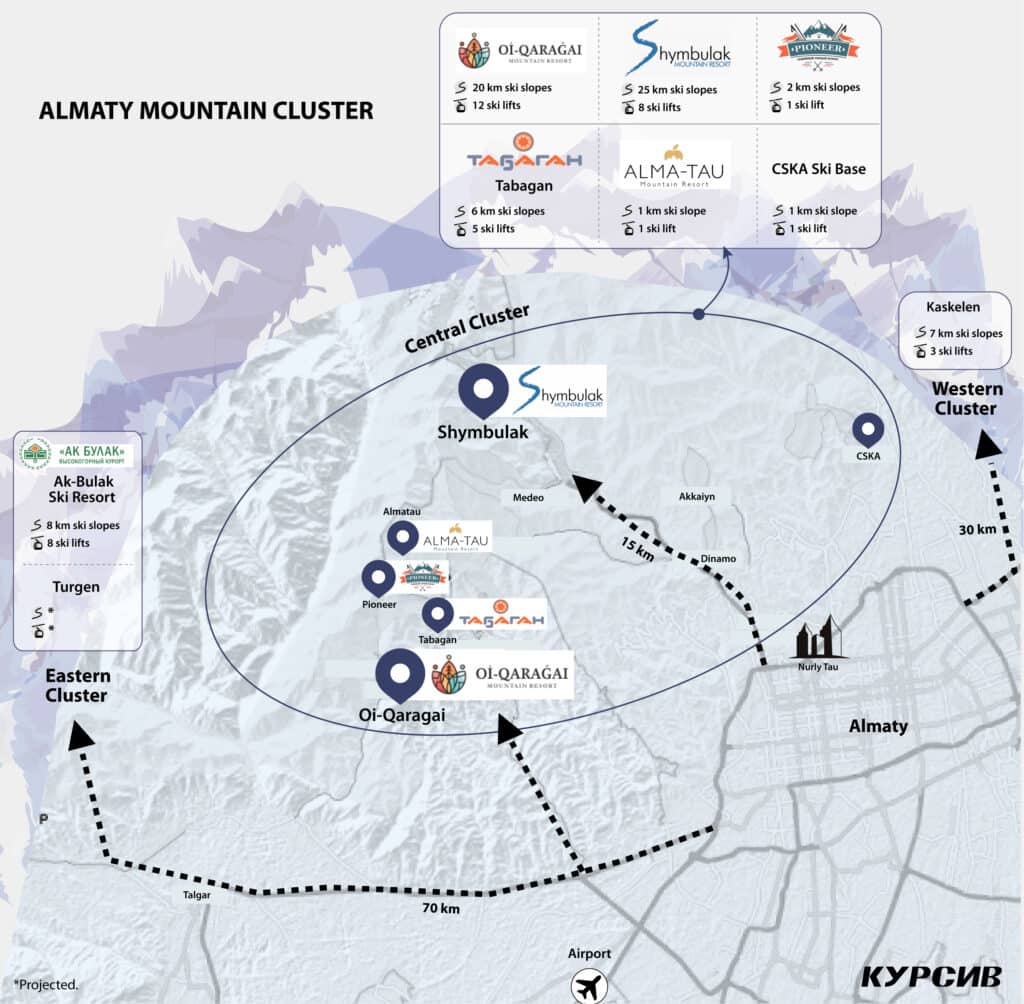

According to Abdrakhmanov, the AMC has the potential to become a major hub for skiing and ecotourism. The area includes the city of Almaty, with a population of two million and a mountainous region within a 100-kilometer radius, divided into three clusters: Eastern, Central and Western.

The Eastern Cluster includes the existing Ak-Bulak resort and the proposed Turgen resort. The Western Cluster features the promising Kaskelen mountain resort. The Central Cluster — currently the focus of development — includes major resorts like Shymbulak and Oi-Qaragai, along with several smaller resorts and ski bases, some of which are no longer operational, such as Tabagan, Talgar, Pioneer, Tau-Park and CSKA (the Russian acronym for «Central Sports Club of the Army»).

«The potential of the AMC mountains was assessed in 2018, resulting in the development of a master plan,» said Askar Valiev, CEO of Master Concept Central Asia. «What makes this cluster unique is that each valley has its entry point, eliminating bottlenecks typical of other locations.»

According to the master plan, integrating the ski slopes in the Central Cluster could significantly increase the total length from 65 kilometers to 106 kilometers and boost the number of daily skiers from 9,000 to 26,000.

«The road between Shymbulak and Oy-Qaragai is 45 kilometers long and takes about an hour and a half due to traffic. However, a direct route through the mountains is only 13 kilometers,» explained Kukushkin. «There are three gorges between the resorts — Kimasar, Butakovka and Kotyrbulak — each with its own resorts. The mountainous terrain allows us to connect them all with a cableway system. In winter, the lifts will serve skiers and in summer, they will be used by hikers.»

Improved access would also provide smaller resorts and ski bases in the gorges with a chance to develop.

«As a rule, small resorts can’t afford the costs of development and equipment,» noted Abdrakhmanov. «They often operate on a residual basis, accommodating overflow from larger resorts. Without significant investment, these smaller facilities risk becoming ghost resorts over time.»

Costly infrastructure

Cableway construction is one of the biggest expenses in developing any mountain resort. In post-Soviet countries, such infrastructure is increasingly built by the state rather than private investors, as governments seek to promote tourism. Experts shared this insight at the Eurasian Alliance of Mountain Resorts (EAMR) Leaders’ Summit, held on Sept. 9 in Oi-Qaragai.

In Georgia, for instance, the government funds major infrastructure projects, including cable cars, artificial snowmaking systems and avalanche control systems.

«The state consolidated all the resorts and took over management, while private investors enhance the cable cars with additional infrastructure,» said Irakli Burchuladze, head of Georgia’s Mountain Trails Agency. «The public-private partnership works like this: private investors indicate where funds should be directed and the state invests. While resorts aren’t entirely dependent on the government, they still maintain control over their revenues. The plan is to gradually transfer management into private hands.»

The ski infrastructure at Azerbaijan’s Shahdag resort was also fully funded by the state.

«The history of Shahdag began with a presidential order in 2006 and by 2009, construction of the first of four phases was underway,» explained Rustam Najafov, chairman of the board of Shahdag Mountain Resort. «The government funded the construction of a gas-generating station, 12 cable cars and 37 kilometers of highway, with total infrastructure investment reaching $1 billion. A state company was established to oversee the project and after the first phase became operational in 2012, the infrastructure was transferred to this company, which now collaborates with private partners under a public-private partnership model. Over the past decade, the private sector has built 39 hotels and hundreds of restaurants in the area.»

In Kyrgyzstan, the government financed the development of a master plan for the Three Peaks mountain cluster, which includes Jyrgalan, Ak-Bulak and Boz-Uchuk in the Issyk-Kul region. The state is responsible for building roads, engineering structures, communications and ski lifts. Of the $15 million allocated for 2024, three million has already been provided by the Kyrgyz government, according to Kirill Irgistsev, head of the Association of Mountain Resorts of Kyrgyzstan.

«By the end of 2026, the goal is to complete six cable cars, 60 kilometers of slopes and 560 rooms at the Jyrgalan resort,» said Irgistsev. He also noted that even Kyrgyz President Sadyr Japarov highlighted the project’s importance by delivering his New Year’s address on alpine skis. To execute this ambitious plan, the Kyrgyz Courchevel state enterprise was established under the president’s affairs management office.

The state has the precedence

In Kazakhstan, the state has funded the master plan and feasibility studies and will also provide road and engineering infrastructure, but it will not finance the construction of cableways.

«We’re taking a different approach,» said Kukushkin of EAMR. «Instead of using state funds, we are relying on state guarantees to secure financing for major infrastructure projects from international financial institutions.»

According to the feasibility study, the cost of building cableways and preparing slopes, including snowmaking systems, is estimated at around $380 million, accounting for exchange rate fluctuations. Abdrakhmanov estimates the payback period for these investments to be over 50 years, based on current ski pass prices. «There will never be such a long payback because the service life of a cable car is only 20 years,» added Dmitry Matyas, CEO of Oi-Qaragai. «In Europe, where ski passes are more expensive, the payback is typically 10-15 years. A possible solution could be a differentiated rate for locals and foreigners.»

The Eurasian Development Bank (EDB) is willing to finance the development project for the Almaty Mountain Cluster.

«A private investor cannot afford $300 million for cable cars and $80 million for preparation, so we are open to cooperation,» said Sergey Paseko, executive director of the EDB’s Directorate of Transport and Infrastructure. «We haven’t handled projects with a 50-year payback, but 25 years is manageable. The financing structure is 70/30 and as soon as we move into a public-private partnership, the ratio changes to 90/10, with 90% as borrowed funds and 10% as cash from the initiators.»

The government and private sector will need to determine who, from Kazakhstan’s side, will lead this project, as even 10% of $380 million is a significant amount.

«The decision depends on who will manage and operate the infrastructure. If the resorts act as concessionaires, they are likely to be the initiators,» Kukushkin suggested.

«The existing resorts won’t be able to take on the financing,” added Abdrakhmanov. Regarding the management of shared ski lifts and other infrastructure, he presented several options: “We can follow Georgia’s model, where a state-owned company manages and maintains the mountain infrastructure. Another example is Andorra, where two private resorts have united to take turns managing the destination. Every five years, management switches from one company to the other. There could also be a consortium of resorts or a public-private management structure. We are still considering various models.»

A decision on financing and managing the mountain infrastructure will need to be made soon. «We have instructions from the head of state to approve the Almaty Mountain Cluster development plan through a government decree by the end of the first quarter of next year. This document should clearly outline the steps we plan to take and the means we will use,» Yerkinbayev summarized.