Freedom Broker spotlights small-cap stocks to look at

Freedom Broker has highlighted six small caps that investors should consider, with upside reaching 400%. Meanwhile, they caution that portfolios should be diversified to minimize risks.

Acme United Corporation

Acme United Corporation, with a market capitalization of $155.6 million, supplies cutting, measuring, and first aid products worldwide, including knives, scissors, paper cutters, first aid kits, flashlights, and fishing tools. In the second quarter of 2024, Acme’s net sales grew 4% year over year to $53.3 million, while net profit per diluted share rose 14% to $1.09, the company reported. Over the last year, Acme stock has advanced almost 45% to $42.10 per share. Freedom Broker has a target price of $58.00 per share, meaning 38% upside versus the last closing price.

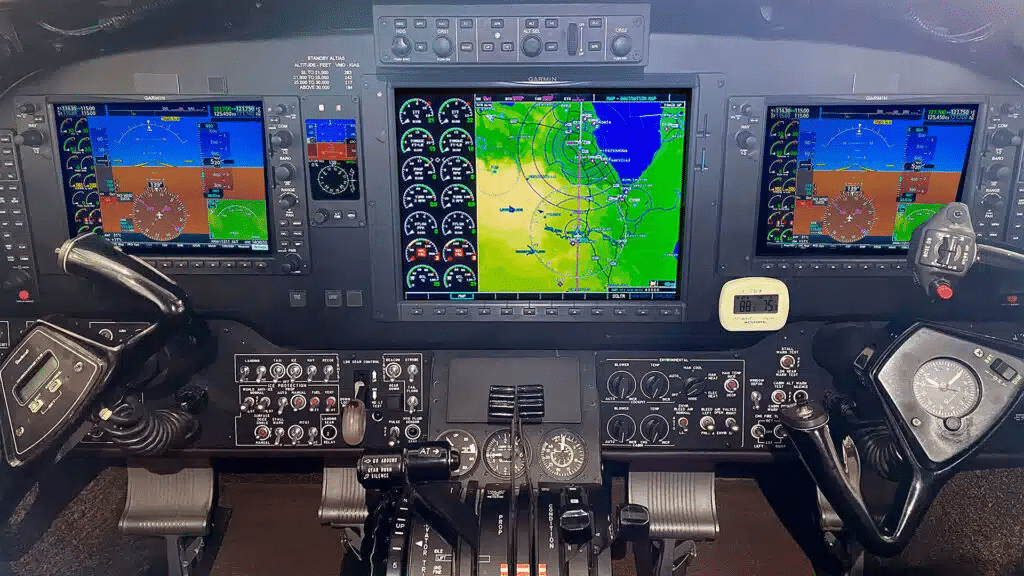

Innovative Solutions and Support

Innovative Solutions, with a market capitalization of $112.35 million, is a system integrator that designs and manufactures navigation systems and equipment for the aerospace industry. Its products include flight control systems, flat panel displays, throttle automation, and integrated backup units. For the fiscal-2024 third quarter (ending June 30), Innovative Solutions posted $11.8 million in net revenue, meaning growth of around 48% year over year. Over the last 12 months, the company’s stock has dropped almost 19% to $6.42 per share. Freedom Broker’s target price is $10.10 per share, implying upside of over 57%.

Ituran Location and Control

Ituran Location and Control is an Israeli company with a market capitalization of $528.8 million, whose shares are traded on the Nasdaq. It offers vehicle tracking services and fleet management solutions. In the second quarter of 2024, revenue grew 4% year over year to $84.87 million. Over the last 12 months, Ituran stock is down around 9% at $26.58 per share. Freedom Broker has a target price of $37.00 per share, for about 39% upside.

Gilat Satellite

Another Nasdaq-traded name, Israel’s Gilat Satellite, with a market capitalization of $270.8 million, aims to be a global leader in in-flight connectivity solutions. Its products include very-small-aperture terminals (VSATs), used widely in marine navigation and by military forces because they allow for a satellite internet connection from virtually anywhere in the world. As a company, Gilat has had a turbulent history, including financial crises and the dot-com bubble. In the second quarter of 2024, revenue increased 13% year over year to $76.6 million. Gilat stock is down around 28% over the last 12 months at $4.75 per share. Freedom Broker’s target price is $7.30 per share, implying upside of about 54%.

CaliberCos

CaliberCos, with a market capitalization of $13.5 million, is an asset manager, focusing on commercial real estate. It thus offers qualified investors an alternative to traditional instruments. CaliberCos says it manages almost $3 billion in assets. In the second quarter of 2024, revenue plunged 60% year over year to $8.2 million amid the deconsolidation of certain assets. Over the last 12 months, CaliberCos has lost almost 59% of its market capitalization, with the current share price at $0.61. This means that at Freedom Broker’s target price of $3.00 per share, there is upside for the stock to grow fivefold from the last closing price.

Riley Exploration Permian

Riley Exploration Permian, with a market capitalization of $588.6 million, acquires, explores, develops, and produces oil and gas in Texas and New Mexico. In the second quarter of 2024, revenue grew 6% year over year to $105.3 million. Over the last 12 months, Riley stock is off around 11% at $27.28 per share currently. Freedom Broker’s target price is $54.00 per share, meaning upside of about 98%.

Risks for investors

Small caps have unique features: low liquidity and high volatility. A single tweet from the CEO can affect their stock prices, points out Georgy Timoshin, a financial analyst at Freedom Finance Global. To minimize risks, he advises investors to diversify their portfolios by mixing small-cap stocks with large caps and other instruments. Another option is to invest in exchange-traded funds (ETFs) tracking indexes like the small-cap Russell 2000 or S&P SmallCap 600.