Wells Fargo sees ‘compelling opportunity’ for near-term small-cap trade

Wells Fargo analysts believe that the tight U.S. presidential race, combined with favorable economic conditions, presents an attractive opportunity for a near-term small-cap trade. They expect a 5-10% outperformance by small caps versus the market if Trump wins.

Details

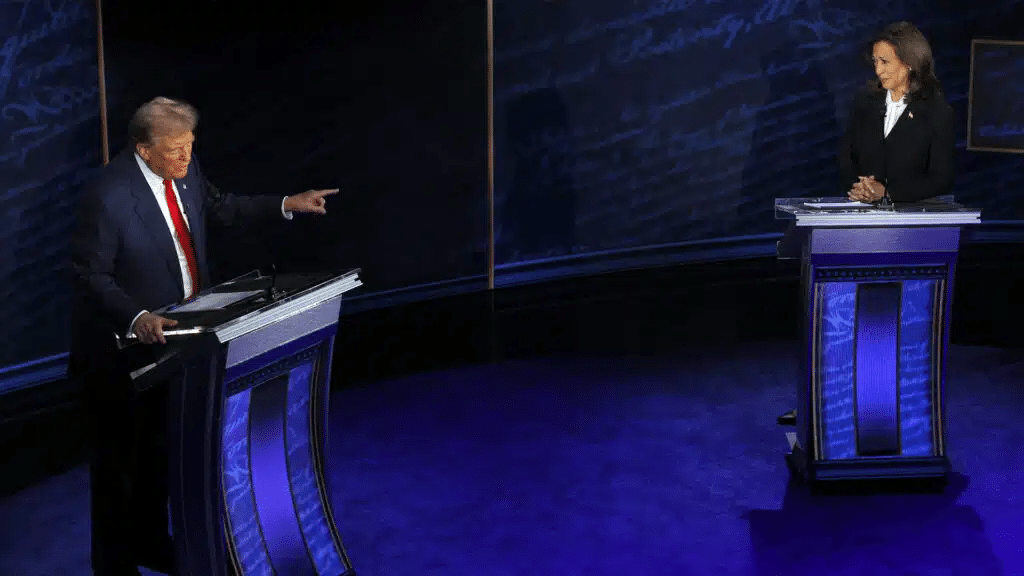

Small caps could outperform the main U.S. market index, the S&P 500, by 5-10% within 1-3 months after the November elections if Republican nominee Donald Trump wins the White House, say Wells Fargo analysts (as cited by Investing.com). Their estimates are based on market behavior following the 2016 election, which Trump won, and the July 13, 2024, assassination attempt targeting him. After the 2016 election, the S&P SmallCap 600 index soared 15.7% by the year end, versus a 5% gain for the S&P 500. After the assassination attempt, the S&P 600 added 6.4% for July, while the S&P 500 dipped 1.6%.

If Democratic nominee Kamala Harris wins, Wells Fargo expects small caps to lag the market slightly, by 2-3%. Harris’s policies are still somewhat unclear, however, which makes precise forecasting more challenging, the analysts caution.

«Expected small-cap returns are favorably skewed, with significant near-term outperformance with a Trump win and limited underperformance with a Harris victory,» they conclude.

Other views on the outlook for small caps

— Small-cap stocks historically shine in U.S. presidential election years, notes Royce Investment Partners, an investment firm founded by small-cap investing pioneer Chuck Royce. The past 10 elections show that by the end of the election year, the Russell 2000 index, which comprises 2,000 small-cap stocks, outperforms the Russell 1000, made up of 1,000 large-cap stocks, extending the outperformance throughout the year following the election as well.

— Bank of America also expects small caps to outperform their large-cap peers, boosted by the recent Fed rate cut. Recall that last month the Fed lowered the fed funds rate for the first time since 2020, and by 50 basis points at that. On average, small caps return a percentage point more than large caps in the six months after a Fed rate cut of 50 basis points and about three percentage points more in the 12 months following such a cut, Bank of America points out.

— Matt Palazzolo, a senior investment analyst at Bernstein Private Wealth Management, also believes that the Fed rate cut could serve as a catalyst to get investors interested in small-cap stocks.

— Sean Gallagher, the global head of Lazard’s small-cap equity platform, has voiced his view that small caps are poised to rally 30-50% in the next 6-12 months.

———————————————

Kursiv is giving away books about the markets and investing! Subscribe to our email newsletter for a chance to win.