Quotes on Crescent Energy jumped 11% on Wednesday, October 2. At the end of the week, the name is set to be added to the S&P SmallCap 600 index, with index inclusion almost always bringing new long-term investors, according to a Nasdaq study.

Details

On Wednesday, Crescent Energy stock gained 11% to $12.40 per share, extending the gains into pre-market trading today, Thursday, October 3. Since the beginning of the year, the share price is now off a little over 6%.

After the close on Tuesday, the news broke that Crescent would join the S&P SmallCap 600 index on October 4, as reported by MarketWatch. It is set to replace Perficient, a digital consultancy that has been acquired by the private equity firm EQT Group, which has EUR246 billion in assets under management. With the deal, Perficient stock is no longer trading on the Nasdaq.

Index inclusion is important for companies, according to a Nasdaq study. Typically, it forces long-term investors to consider “whether they can still afford not to hold the stock.” In addition, some index-tracking ETFs automatically purchase added stocks.

About Crescent Energy

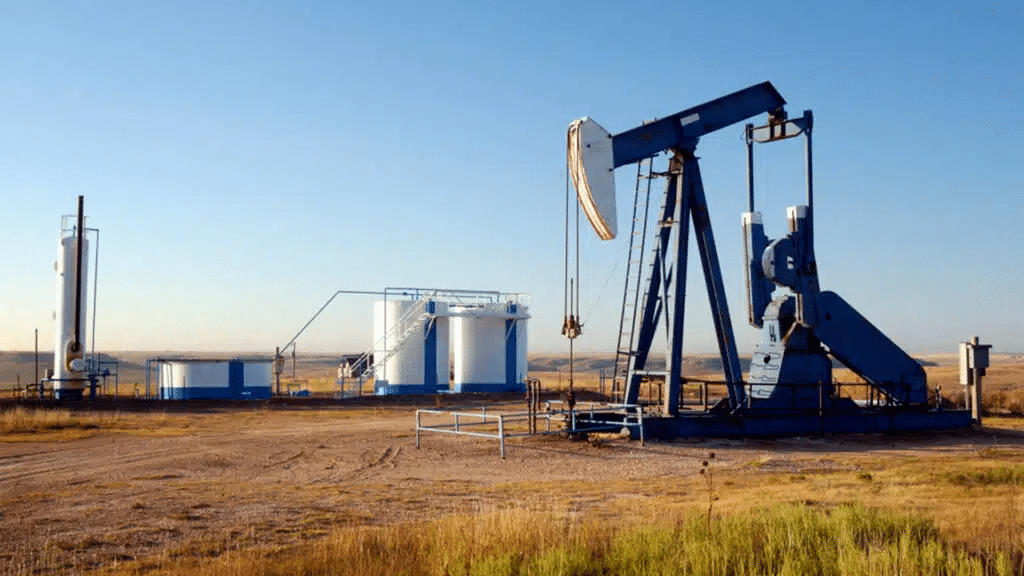

Crescent is an energy company with operations focused in Texas and the Rockies with active development in the Eagle Ford and Uinta basins. It also has two projects in Wyoming, where it employs carbon capture, use and storage. In the summer, it announced the completion of a merger with SilverBow Resources. The combined company, according to its own estimates, thus became the second largest Eagle Ford operator. In the first half of 2024, the company’s top line grew 21% to $1.3 billion.

Analyst recommendations

According to MarketWatch, 12 analysts cover Crescent. Nine recommend buying the stock, while three have it as a hold. The average target price is $15.70 per share, indicating upside of more than 26% versus the last closing price.