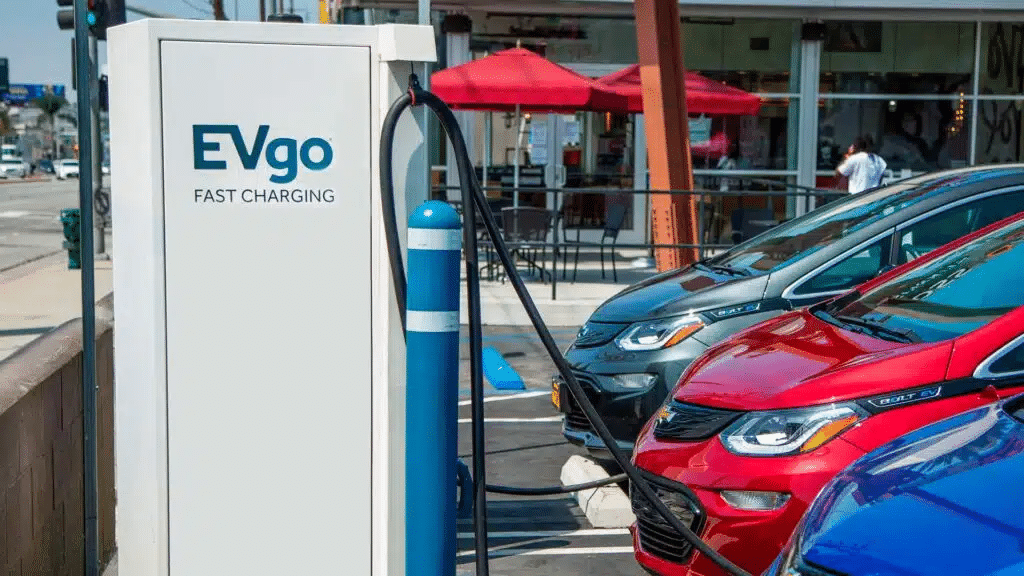

Quotes on EVgo, a small U.S. company that builds charging stations for electric vehicles (EVs), jumped more than 60% on Thursday, October 3. Earlier in the day, the U.S. Department of Energy (DOE) announced a conditional $1.05 billion loan guarantee for the company. The financing should allow EVgo to almost double its charging network and compete with Elon Musk‘s Tesla, Reuters notes.

Details

On Thursday, EVgo stock soared about 61% to $6.32 per share, the largest single-day gain in the last three years, and is now trading at its highest level since May 2023. By the end of Thursday’s trading, the company’s market capitalization had reached $1.9 billion.

Shares of Tesla, which has its own charging network, dipped 3.4%. The name has been sliding after the company’s third-quarter EV deliveries fell short of expectations.

What’s behind Thursday’s surge

The DOE’s Loan Programs Office (LPO) announced a conditional commitment to provide EVgo with a loan guarantee of up to $1.05 billion, which, if finalized, will enable EVgo to deploy approximately 7,500 charging ports at around 1,100 charging stations across the U.S. Currently, the company operates over 1,000 charging stations in the U.S., with plans to build an additional 400 under a recent agreement with General Motors. EVgo posted $66.6 million in revenue for the second quarter of 2024, up 32% year over year, while its net loss of $29.6 million was 37% bigger than a year earlier.

EVgo is set to become the first company in the EV charger industry to receive financial aid under the LPO’s clean energy program, which has about another $70 billion of loan authority, Reuters reports. U.S. President Joe Biden has set a goal to build a network of 500,000 publicly available EV chargers by 2030.

The financing should help EVgo to compete with Tesla, Jigar Shah, who heads the LPO, told Reuters. Note that although the DOE has expressed its intent to finance the EVgo project, both the regulator and the company must satisfy certain conditions, and the DOE must complete an environmental review, the LPO notes. Only then will the final documents be signed.

Analyst highlights

EVgo stock has gained 76% since the start of the year and 100% over the last 12 months. According to MarketWatch, 12 analysts cover the company. Nine recommend buying the stock, two rate it as a “hold,” and one has it as a “sell.” Currently, EVgo is trading about 10% above the analysts’ average target price of $5.75 per share.

On Thursday, JPMorgan upgraded its outlook for EVgo from neutral to overweight, arguing that companies like EVgo that own and operate their own charging infrastructure will outperform peers, Bloomberg reports.